SHANGHAI, Nov 29 (SMM) - As the supply of thermal coal is always tight in winter, the Ministry of Industry and Information Technology recently issued the Motor Energy Efficiency Improvement Plan to encourage the development of energy-saving rare-earth motors to replace traditional industrial motors, in response to the call for energy conservation and emission reduction. And it also plans to improve the recycling system of motor scrap.

The upstream supply of the rare earth industry chain consist of three parts, naming the domestic mining of light and heavy rare earth ore, ore import and recycling of NdFeB scrap.

In 2021, domestic mining of light and heavy rare earth ore accounts for 44% of the total upstream supply of PrNd oxide. The mining quota for light rare earth is 149,000 mt in the same year, an increase of 20% year-on-year; and the quota for medium and heavy rare earth ore totals 19,000 mt. As the mining of rare earth ore brings greater pressure on environmental protection, the annual mining quota of medium and heavy rare earth ore has not increased in the past few years.

In 2021, China’s ore imports stood at 80,000 mt, including 56,000 mt of rare earth metal ore from the United States, and 24,000 mt of mixed rare earth carbonate and unlisted rare earth oxide from Myanmar. Currently, the production of the MP mine in the United States is close to full capacity, thus there is limited room for growth in imports. Meanwhile, the imports from Myanmar in 2021 dropped by 30% year-on-year, and domestic supply was also unable to meet market demand. In the second half of the year, some manufacturers have reduced their operating rates due to short ore supply.

In other words, there is unlikely to be significant growth from the mine side, which is difficult to match the increasing downstream demand for rare earth products.

The NdFeB scrap recycling market accounts for 30%-40% of the upstream PrNd oxide supply, and the supply will amount to 24,000 mt throughout 2021. However, magnetic material companies reduced their production in autumn and winter, and the NdFeB scrap inventory decreased as well. The prices have then rose to 740,000-750,000 yuan/mt. Furthermore, the costs of auxiliary materials such as hydrochloric acid, oxalic acid, and liquid caustic soda remained high. The NdFeB scrap recycling market is still facing Problems such as difficult in collecting scrap and high cost.

The dismantling and recycling domestic motor scrap seems to be more advantageous in terms of techniques and costs by comparison. The recycling of motor scrap has an additional course of dismantling and smashing when compared to NdFeB scrap recycling. Therefore, the technical barriers to be overcome by domestic recycling companies to transform and upgrade to a motor scrap recycler are relatively low. Due to the immature scrap recycling technology and strict environmental protection supervision in foreign countries, motor scrap is mostly treated as waste, and the prices are low. The recycling of imported motor scrap is more cost efficient.

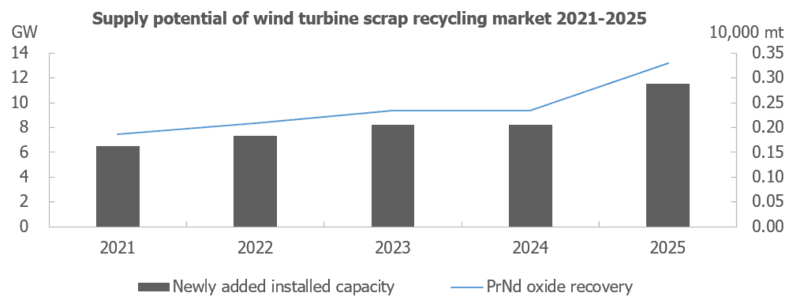

The service life of wind turbines is usually 15-20 years. The first batch of wind turbines installed around the world in 2001 is about to be dismantled and recycled. It is expected that the scrap dismantling market will produce at least 29,000 mt of high-performance NdFeB in 2021-2025, which is equal to 11,900 mt of PrNd oxide. According to the supply and demand balance of PrNd oxide in the next five years, if the wind turbine scraps are fully utilised, it will make up for the supply shortage in the next two to three years. The recycling of permanent magnet motor scrap is mainly found in China. At present, the amount of NdFeB recovered from imported wind turbine scrap stands at 2,000 mt per month, which is equivalent to 732 mt of PrNd oxide. The recycling market for imported motor scrap is still a blue ocean with broad prospects as only a few large recyclers are planning to expand their business to this sector.