SHANGHAI, Nov 5 (SMM) - This is a roundup of China's metals weekly inventory as of November 5.

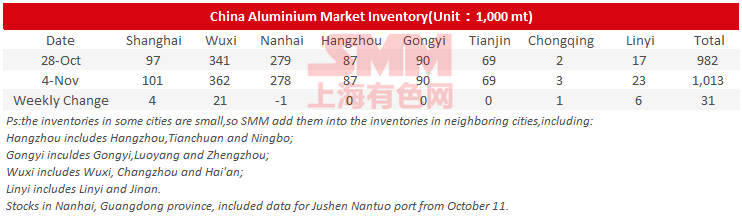

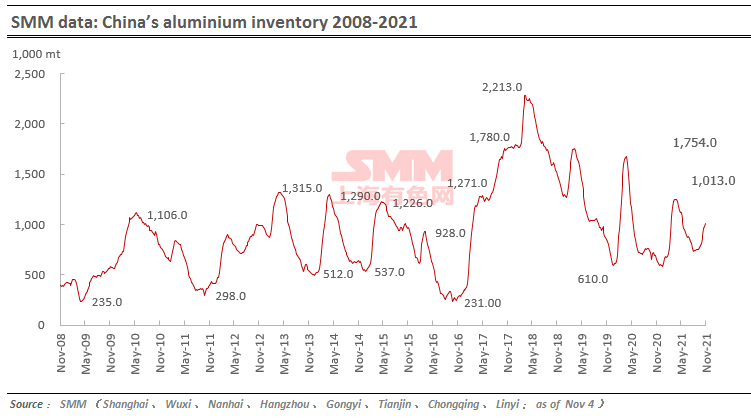

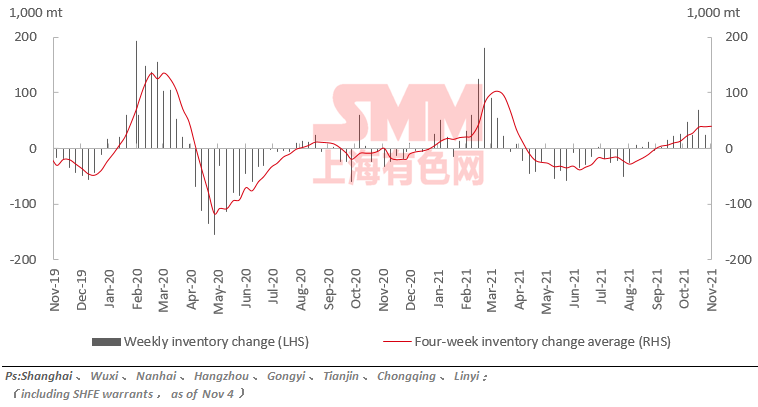

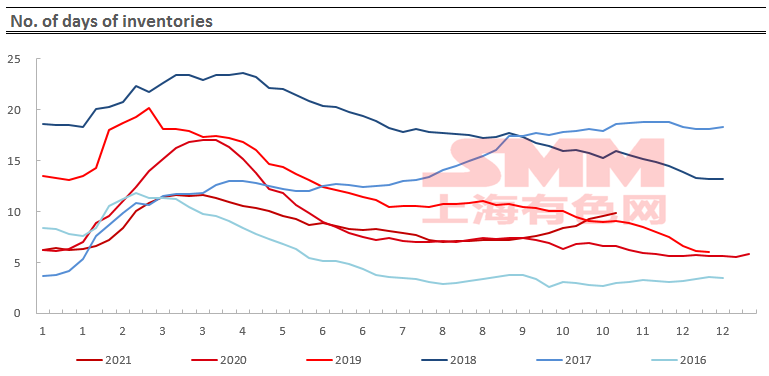

Aluminium Social Inventories Rose 31,000 mt on Week

SMM data showed that China's social inventories of aluminium across eight consumption areas rose 31,000 mt on the week to 1.01 million mt as of November 4, mainly because more arrivals in Wuxi and Shanghai have led to rising local inventories. While the inventory in Nanhai fell slightly on the week due to less arrivals from a week ago, and the shipments have also picked up.

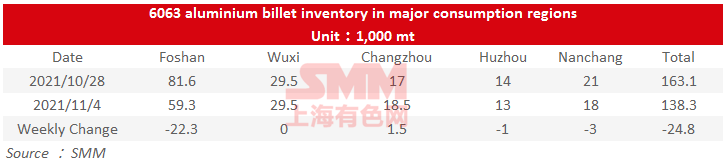

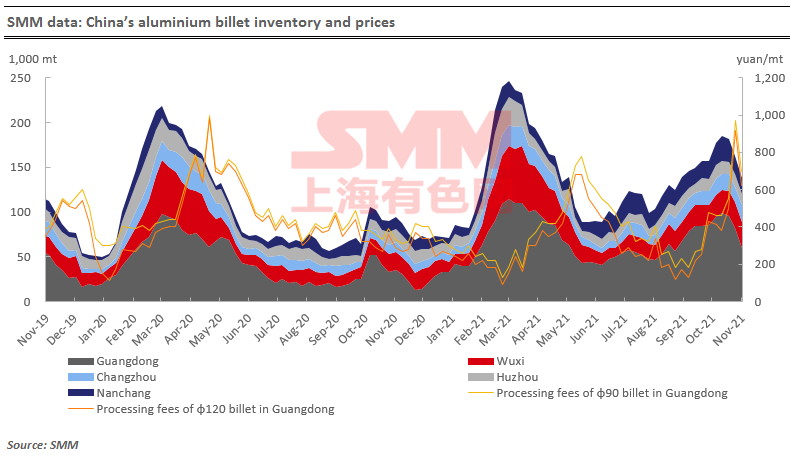

Aluminium Billet Inventories Down 24,800 mt on Week

The stocks of aluminium billet in five major consumption areas dropped 24,500 mt to 138,300 mt on November 4 from a week ago, a decrease of 15.21%. And the inventory has been falling for three straight weeks.

The decline was still mainly contributed by Foshan, whose inventory dropped 22,300 mt or 27.33% on the week, followed by Nanchang as its inventory declined 3,000 mt or 14.29%. The inventory in Changzhou added 1,500 mt or 8.82% from a week ago.

As far as SMM understands, the arrivals of aluminium billet in Foshan has been at a low level, and the downstream was more active in purchasing amid falling aluminium prices. While in Guangdong, the power rationing has eased, which created more demand for raw materials among conversion plants. While the inventory increase in Wuxi was a result of lingering power rationing in Jiangsu, as the local demand was sluggish on the requirement of orderly use of electricity.

Going forward, the orders at aluminium extruders have been moderate according to SMM research. Therefore, the aluminium billet inventory is likely to keep falling in the following week.

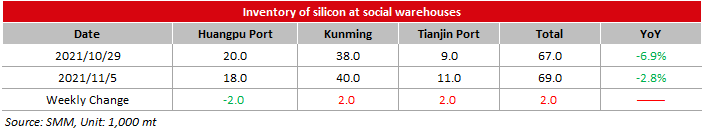

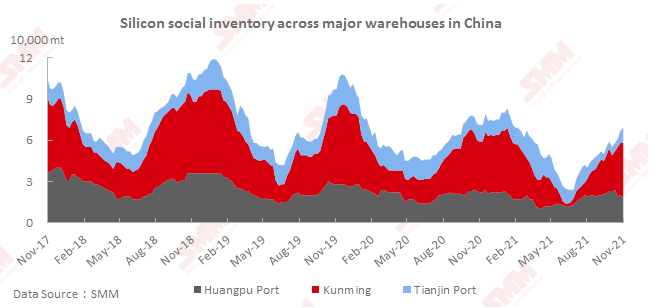

Silicon Metal Inventory Expanded 2,000 mt on Week

The social metal inventory of silicon metal across Huangpu port, Kunming city and Tianjin port increased 2,000 mt from the previous week to 69,000 mt as of Friday November 5.

The inventory at Huangpu port dropped as the shipment volume was higher than the arrivals. The inventory in Kunming and Tianjin port increased as the stocks shipped from Yunnan and Xinjiang arrived. The social inventory of silicon metal is expected to increase further this week.

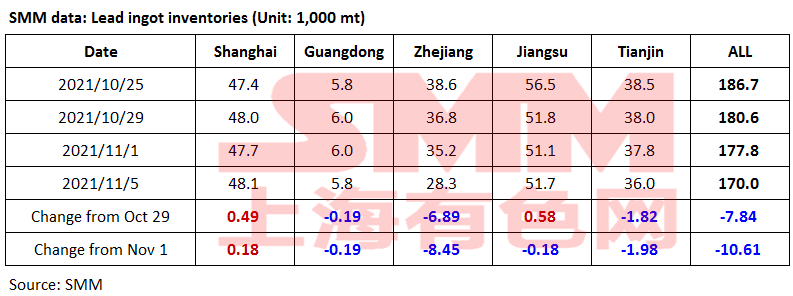

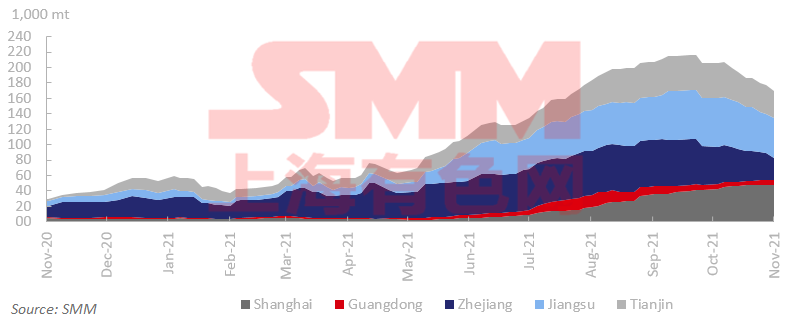

Lead Ingot Social Inventory Down 10,600 mt on Week

Social inventories of lead ingots across Shanghai, Guangdong, Zhejiang, Jiangsu and Tianjin decreased 10,600 mt from October 29 and 7,800 mt from November 1 to 170,000 mt as of November 5.

According to SMM survey, the power rationing in Henan was lifted this week, but major secondary lead smelters in Anhui are forced to suspend production due to the temporary power outage on the line transformation. At the same time, Hebei suspended production due to the air pollution control, reducing lead ingot transportation to surrounding consumption areas. Downstream companies turn to consume social stocks. In addition, the delivery is about to undergo next week. On the one hand, the temporary power outage in Anhui was eased, and the air pollution control in Hebei is about to be lifted. Lead ingot supply is expected to recover. The decline of lead ingots is likely to slow as some to-be-delivered cargoes will arrive at the delivery warehouses approaching the delivery date.

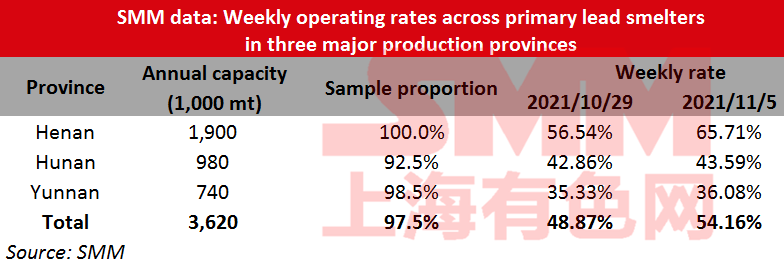

Operating Rate of Primary Lead Smelters Up 5.29% on Week

The average operating rate across primary lead smelters in Henan, Hunan and Yunnan provinces gained 5.29 percentage points from the previous week to 54.16% in the week ended November 5, an SMM survey showed.

In Henan, Jinli, Wanyang, Yuguang, and other smelters in Jiyuan city resumed the production after the power rationing, while the smelters in other regions including Xinling and Yongning did not fully recover the production due to the extended power rationing.

In Hunan, Shuikoushan Jinxin raised the operating rate slightly this week, and it would plan the production based on the crude lead supply next week. Shuikoushan Zhihui had to cut the production for lack of the crude lead.

In Yunnan, Gejiu Tongfu slightly expanded the production after maintenance. Wanyang may postpone the routine maintenance to mid-November, so it will maintain the normal production next week. Jiangxi Jinde and Jiangxi Copper are still under maintenance.

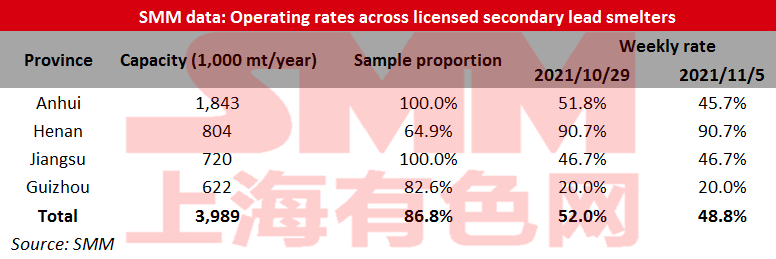

Operating Rate across Secondary Lead Smelters Down 3.12% on week

The operating rates across licensed smelters of secondary lead in Jiangsu, Anhui, Henan and Guizhou averaged 48.84% in the week ended November 5, down 3.12 percentage points from the previous week, an SMM survey showed.

The regional power cut in Anhui restricted the production of some smelters, which dragged down the output and the overall operating rates.

Some smelters in Jiangxi conducted temporary maintenance due to the equipment failure, and some smelters in Hebei curtailed the production under the environmental protection control. The output in the two regions declined as well.

The operating rates are expected to rise this week amid the restored power supply, the alleviated environmental control, and the brisk profits of the secondary lead smelters.

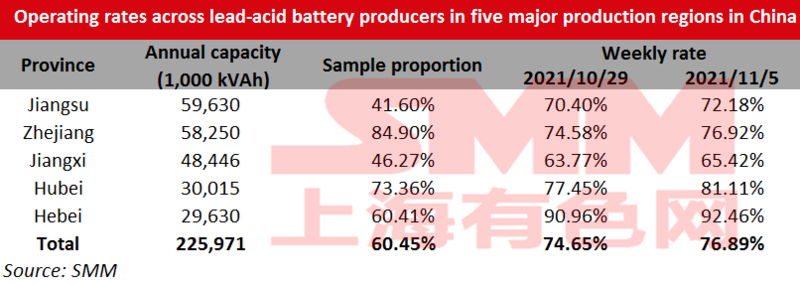

Operating Rate across Lead-Acid Battery Producers Rose 2.23% on Week

The average operating rate across lead-acid battery producers in Jiangsu, Zhejiang, Jiangxi, Hubei and Hebei provinces increased 2.23 percentage points from October 29 to 76.89% as of November 5.

The overall consumption of lead-acid battery improved significantly. The companies generally raised the battery prices as the prices of lead and other raw materials increased, which encouraged the distributors to purchase actively. Some distributors also purchase on demand for the annual sales goal. The operating rates across lead-acid battery producers rose amid more orders.

At the same time, some companies in Jiangsu and Zhejiang continued to cut the production by 10-20% due to the power rationing, most of which mainly produce the batteries for electric bicycle or car.

The finished product inventory of electric bicycle batteries dropped rapidly, and some companies were short of the stocks, while the shipments of car battery was slow.

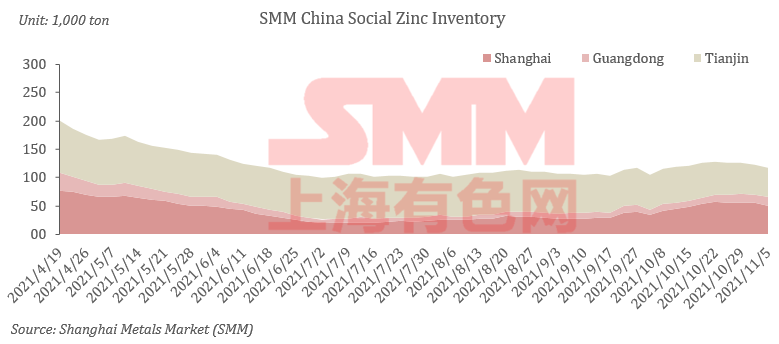

Zinc Social Inventories Down 9,200 mt on Week

Total zinc inventories across seven Chinese markets stood at 134,400 mt as of November 5, down 6,300 mt from November 1 and 9,200 mt from October 29.

The inventory in Shanghai declined as downstream buyers restocked goods on dips. Guangdong saw a slight decrease in stocks as power rationing in Guangxi loosened and the arrivals of cargoes increased.The stocks in Tianjin trended lower amid limited arrivals and rising restocking demand by downstream producers. Inventories in Shanghai, Guangdong and Tianjin fell 8,000 mt, and inventories across seven Chinese markets decreased 9,200 mt.

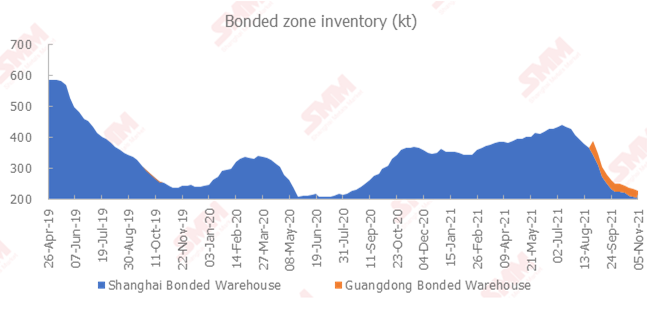

Copper Inventory in China Bonded Zone Dipped 6,400 mt on Week

The copper inventories in the domestic bonded zones declined 6,400 mt from October 29 to 226,900 mt as of Friday November 5, the fourth consecutive week of decline, according to the most recent SMM survey.

The inventory in the Shanghai bonded zone decreased 3,400 mt to 206,400 mt, and the inventory in the Guangdong bonded zone fell 3,000 mt to 20,500 mt.

The shipments out of the bonded zone drove the decline. Some domestic traders continued to declare imports on the back of the high premiums in the domestic spot markets. Domestic smelters' export operations are proceeding in an orderly manner, and some copper cathode has been offshored. The arriving shipments were limited. As such, the bonded zone inventories continued to decline.

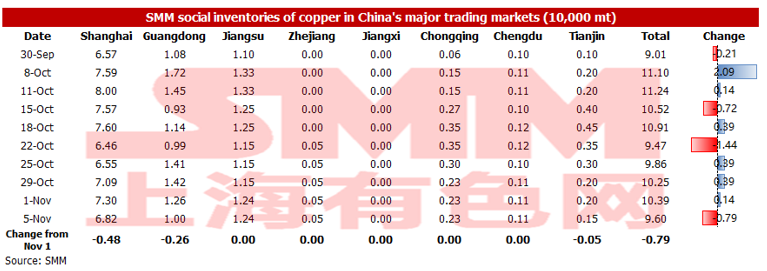

Copper Inventory in Major Chinese Markets Decreased 7,900 mt on Week

The copper inventories across major Chinese markets fell 7,900 mt from a week earlier to 96,000 mt as of Friday November 5, according to SMM data.

The declines were mainly seen in Shanghai, Guangdong and Tianjin. Specifically, the inventory in Shanghai decreased by 4,800 mt to 68,200 mt, and the inventory in Guangdong decreased 2,600 mt to 10,000 mt. The inventory in Tianjin declined 500 mt to 1,500 mt.

The decrease in the customs clearance of imported copper and the decrease in the arriving shipments of domestic copper cathode were the key drivers of the inventory decline across Shanghai and Guangdong.

The adverse weather in Tianjin reduced the shipments arrivals.

The shipments arrivals next week would be limited. And the domestic smelters have exported their cargoes. The total supply will decrease, while the consumption is expected to stablise. In this scenario, the inventory is expected to decrease further next week.

Nickel Ore Inventories at Chinese Ports Surged 60,000 wmt

The nickel ore inventory at Chinese ports grew 60,000 wmt from a week earlier to 9.05 million wmt as of November 5. Total Ni content stood at 71,000 mt. Total inventory at the seven major ports stood at around 4.61 million wmt, a drop of 80,000 wmt from a week earlier.

The inventory increase at the Guangxi port is the most obvious. The number of NPI plants that resumed production is smaller than that of stainless steel mills. The peak shipment period of nickel ore will end as the monsoon season has set in in the Philippines. The port inventory is expected to slide further in the near term.

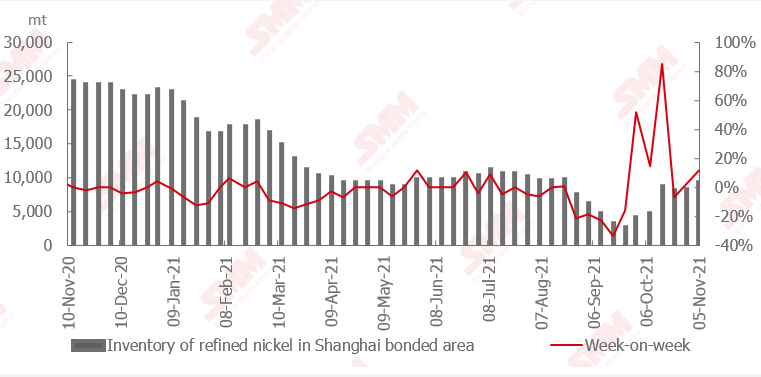

Nickel Inventory in Chinese Bonded Zone Accumulated Slightly

The SHFE/LME nickel price ratio did not provide the opportunity to import cargoes this week. Therefore, the overall shipments from the bonded area was limited.

The cargoes from overseas have arrived. The traders moved them into the bonded zone, and will ship the cargoes into the domestic market after the import window opens.

The total inventories in the domestic bonded zone added 1,000 mt from a week ago.