SHANGHAI, Nov 4 (SMM) - Shengxin Lithium announced that its subsidiary, Shengyi International, intends to purchase a 51% stake in MaxMind Hong Kong for US$76.5 million. The subsidiary of MaxMind Hong Kong owns the mining rights for altogether 40 rare metal blocks with a total area of 2,637 hectares at the Sabi Star lithium-tantalum project in Zimbabwe.

At present, Shengxin Lithium has explored five of the mining right blocks (covering an area of 116 hectares), with a cumulative total of 6.883 million mts of ore resources identified, including 1.231 million mts of proven resources, 2.534 million mts of controlled resources and 2.918 million mts of inferred resources.

It is reported that the main mineral products within the scope of the above mining blocks is spodumene, which is mainly used for the production of lithium hydroxide and lithium carbonate. The Company believes that the lithium resources in the above mining areas have the potential for further growth, which is also beneficial to further securing the supply of raw materials.

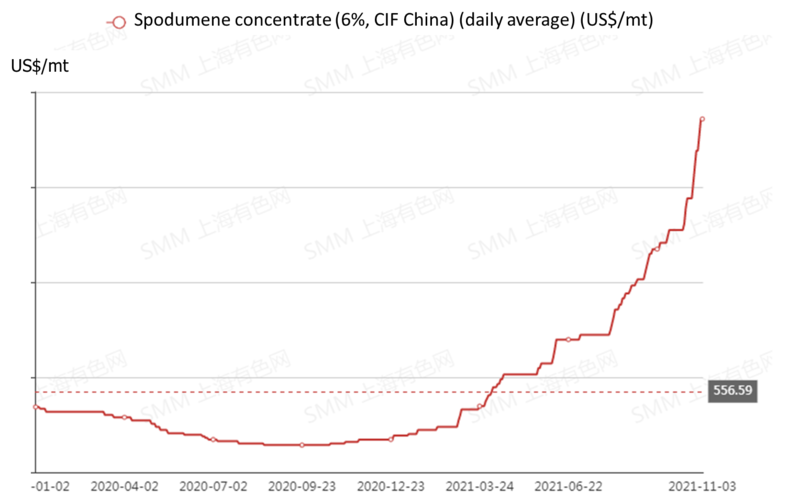

It is worth mentioning that, according to SMM historical prices, the spot prices of spodumene concentrate (6%, CIF) has climbed all the way up since the fourth quarter of 2020. As of November 3, the average spot price of spodumene concentrate (6%,CIF) was US$1,415/mt, up US$997.5/mt or 238.92% from the beginning of the year.