SHANGHAI, Aug 25 (SMM) – Shanghai nonferrous metals market largely closed in the positive territory as the market awaits the Fed’s annual central banking event this Friday.

Shanghai copper gained 0.88%, aluminium climbed 0.93%, lead edged down 0.19%, zinc advanced 1.41%, tin surged 2.08%, and nickel jumped 1.54%.

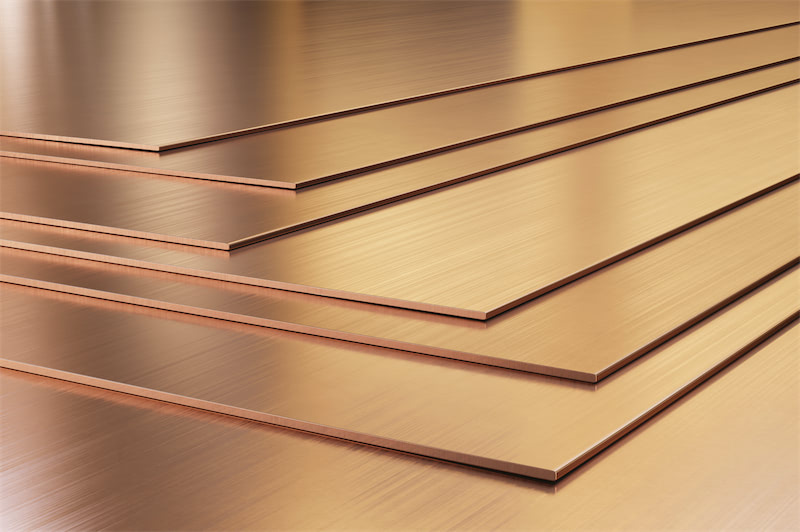

Copper: The most-traded SHFE 10 copper contract closed up 0.88% or 600 yuan/mt to 69100 yuan/mt, with open interest up 3610 lots to 129000 lots.

On the macro front, US House of Representatives approved President Joe Biden’s $3.5 trillion spending blueprint; and House speaker Nancy Pelosi has committed herself to advancing the budget plan and another $550 billion bipartisan infrastructure bill. US stocks soared upon the news while US dollars pulled back. Meanwhile, performance of overnight US economic data diverged. And the market’s expectation over the Fed’s tapering QE decision was also ambiguous. The annual central banking meeting this Friday remains as the market focus.

On the fundamentals, mines were frequently disrupted. Last Thursday, majority of the five labour unions under El Teniente copper mine, owned by Codelco, rejected the new labour contract offered ahead of official negotiation. On the other hand, domestic inventories continued to fall, and consumption was basically stable. SHFE copper is expected to see wild fluctuations due to combined impacts from the macro front and fundamentals.

Tonight, the market shall pay attention to the initial MoM growth rate of new orders for durable goods in July in the US (estimated at -0.3% and finalised at 0.9% in the previous session). The initial data is expected to fall based on the jobs report, but unlikely to reverse the general market rebounding as intraday LME copper has increased by more than $9400/mt.

Aluminium: The most-traded SHFE 2110 aluminium closed up 0.93% or 190 yuan/mt to 20600 yuan/mt, with open interest up 18043 lots to 313000 lots.

In spot market, transactions were largely made around 20560-20580 yuan/mt in Shanghai and Wuxi. Discounts in Gongyi winded further to 150 yuan/mt against east China in light of slower price increases due to congested arrivals. On the fundamentals, the supply side was influenced by various factors, while domestic consumption fell simultaneously, resulting in slight increase in domestic aluminium ingots inventory. SHFE aluminium prices are expected to stay high in the short term on the back of unbalanced supply and demand.

Lead: The most-traded SHFE 2110 lead closed down 0.19% or 30 yuan/mt to 15470 yuan/mt, with open interest up 3861 lots to 49754 lots. In spot market, lead prices corrected down after increases for two consecutive days. Quotes of primary lead by smelters were firm, maintaining premiums at 50-200 yuan/mt over SMM1# lead. Downstream purchase was not active, and some has turned to secondary lead. For secondary lead, smelters mostly held back from selling in view of falling lead prices and unchanged purchasing costs of battery scrap. Mainstream quotes maintained premiums at 250-375 yuan/mt. Market transactions were thin as battery companies delivered mainly under previously executed orders approaching month-end. Some secondary lead smelters are likely to cut output owning to the environmental protection inspections led by the central government, thus potentially driving down social inventories. Changes have not been detected among primary lead smelters for now.

Zinc: The most-traded SHFE 2110 zinc closed up 1.41% or 315 yuan/mt at 22590 yuan/mt, with open interest up 8671 lots to 91351 lots. On the fundamentals, long-orders have mostly been fulfilled, and premiums fell by around 50 yuan/mt from the past few trading days as social inventories continued to rise. Among them, 0# standard zinc premiums and Shuangyan zinc premiums against SHFE 2109 contract stood between 155~165 yuan/mt and 160~180 yuan/mt respectively. However, market transactions were scarce as high season is still on the way.

Tin: The most-traded SHFE 2109 tin closed up 2.08% at 240440 yuan/mt, with open interest down 521 lots. On the fundamentals, spot cargos available in the market were tight with some brands being totally sold out, and smelters held quotes firm due to low in-plant inventories. Overall supply tightened as inventories in Shanghai and London both fell again. The market shall watch if long capital will enhance its advantages in the chart by taking advantage of the logic that prices will become firm when cargos available in the market decrease due to tightened supply on the fundamentals.

Nickel: The most-traded SHFE 2109 nickel closed up 1.54% or 2190 yuan/mt at 144430 yuan/mt, with open interest down 4556 lots to 68353 lots. SHFE nickel closely followed LME chart which trended up in the trading day. Demand on the fundamentals performed favourably, and there is no obvious downward pressure on SHFE nickel.