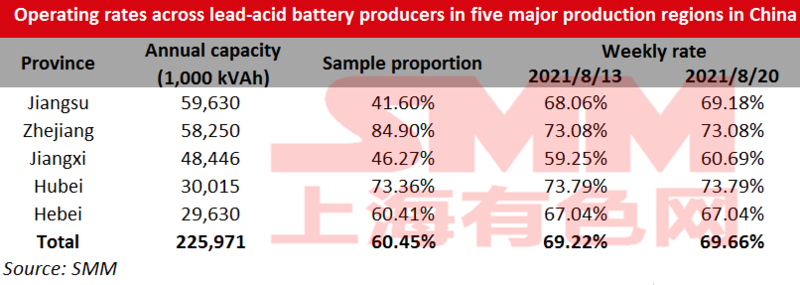

SHANGHAI, Aug 20 (SMM) - Operating rates across lead-acid battery producers in Jiangsu, Zhejiang, Jiangxi, Hubei and Hebei provinces gained 0.44 percentage point from August 13 to 69.66% as of August 20.

Replacement demand in the lead-acid battery market gradually improved, ad the orders for electric bicycle batteries increased. Operating rates mainly rose in Jiangsu and Jiangxi. The rebound in the consumption of car batteries was limited, and most car battery companies maintained the operating rates between 70-90%. Whether the lead-acid battery companies in Jiangsu will resume production after the pandemic control is loosened will be monitored.