SHANGHAI, Jul 1 (SMM) - The outbound volume of the aluminium billet rose by 12,800 mt to 51,100 mt last week, an increase of 33.5%. The transportation was severely restricted in some regions with the approaching of the 100th anniversary of the founding of CPC last week, and the downstream willingness to restock slightly recovered.

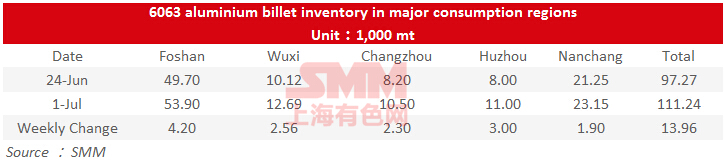

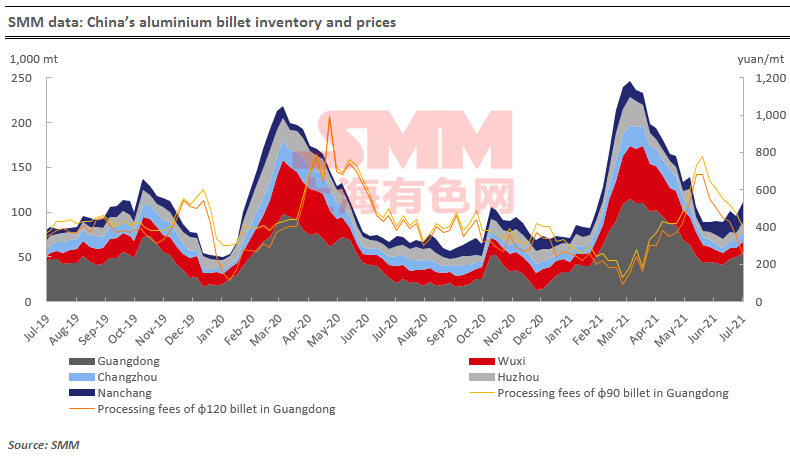

The stocks of aluminium billet in five major consumption increased by 1,400 mt to 111,200 mt from the previous week, an increase of 14.35%. Foshan saw the largest increase volume by 4,200 mt, and Huzhou registered the highest growth rate by 37.5%. Aluminium prices fluctuated widely under the impact of policies, macroeconomics, and fundamentals. The overall market trade was flat amid the strong downstream wait-and-see sentiment.

According to SMM survey, aluminium downstream orders will decline in July. The first batch of national reserve will be released next Monday and Tuesday, which will lead to the looser liquidity in the spot market, and the holders may had difficulties in sales. The outbound volume of aluminium billet is expected to drop next week, and the inventories may increase.