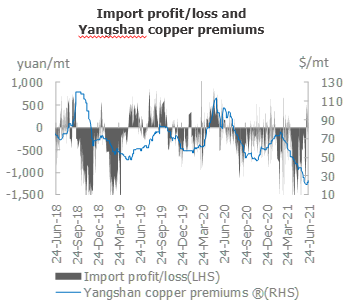

SHANGHAI, Jun 30 (SMM) - Yangshan copper premiums with a quotation period in July stood at $15-32/mt under warrants during June 21-25, and between $10-28/mt under bill of lading (B/L). The SHFE/LME copper price ratio stood at 7.26 as of June 25.

Trades continued to pick up as the improved SHFE/LME copper price ratio boosted import demand. Recent deliveries increased LME copper inventory by 25% last week, while cancelled warrants stood below 4%. The contango structure of LME cash to the three-month contract stood at around $30/mt. The SHFE/LME copper price ratio improved amid accelerated stock declines. As such, import losses shrank to below 100 yuan/mt. Inquiries were brisk and demand was concentrated on warrants and B/L slated to arrive before mid-July. However, many traders have already sold their goods at low prices previously, limiting offers of cargoes slated to arrive in late June and early July. Sellers raised their quotes.

Import premiums for warrants are currently quoted at $19-32/mt, up $4.5/mt from a week earlier on average, and quotes for B/L stand at $15-28/mt, a rise of $5/mt. Quotes for cargo due to arrive in the second half of July and in August increased, with quotes of around $30/mt for the two high quality brands. Buying interest was subdued at the end of the week as the copper price ratio fell, limiting trades. This will pressure Yangshan copper premiums.

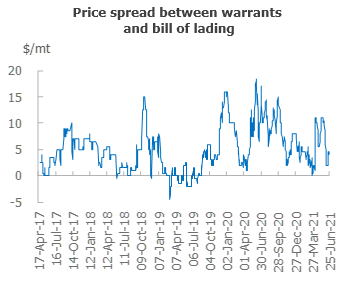

Traded import premiums for high-quality pyro-copper currently stand at around $32/mt under warrants, $27/mt for mainstream pyro-copper, and $19/mt for hydro-copper. On the B/L front, premiums stand at $28/mt for high-quality copper, $23/mt for mainstream pyro-copper, and $15/mt for hydro-copper. The quotation period is in July.

Copper inventories in the Shanghai bonded zone increased 500 mt from June 18 to 429,800 mt on June 25.