SHANGHAI, Jun 28 (SMM) – SHFE nonferrous metals broadly fell on Monday June 28 as investors monitored rising Covid-19 around the globe.

Shanghai nonferrous metals, except for aluminium, traded lower on Monday June 28. Lead shed 1.57% to lead the losses, copper decreased 0.44%, zinc declined 0.73%, tin went down 0.35% and nickel fell 0.04%, while aluminium advanced 0.37%.

The ferrous complex rose across the board. Iron ore advanced 2.09%, rebar rose 0.98%, and hot-rolled coil climbed 1.06%.

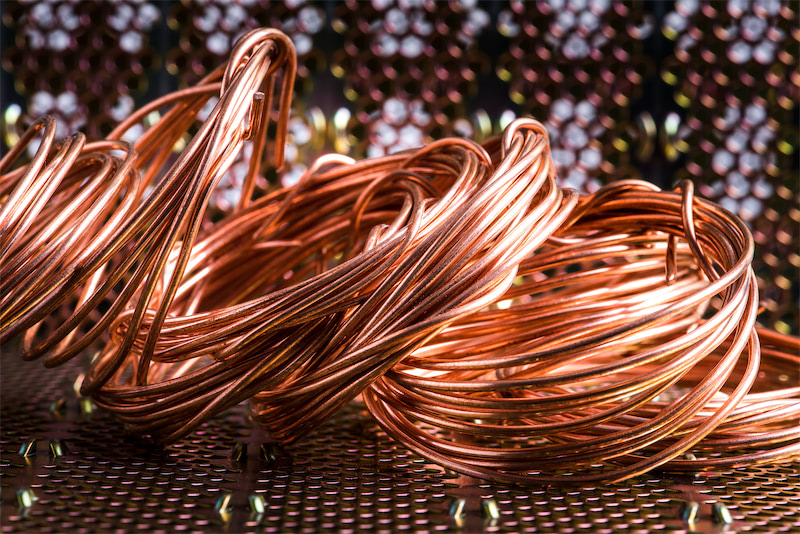

Copper: The most-traded SHFE 2108 copper contract finished the day 0.44% lower at 68,630 yuan/mt. Open interest rose 2,220 lots to 120,000 lots.

Boston Fed President said that it is expected that employment and inflation may reach the Fed's target before the end of next year, and then it may consider raising interest rates once. European Central Bank President urges EU countries to maintain loose fiscal policy. The macro expectation of tightening liquidity is opposed to the reality of loose liquidity, which brings about market sentiment fluctuation. The University of Michigan consumer confidence index rose lower than expected in June. Personal expenditure for May stagnated due to rising prices. The profit growth of industrial enterprises for May in China slowed down, and the market was not optimistic about the subsequent liquidity expectations.

The actual monthly retail sales rate in Germany in May, and the directional guidance to the market from the PMI of various countries at the end of the week and the nonfarm data of the US will continue to be monitored.

Aluminium: The most-liquid SHFE 2108 aluminium contract finished the day 0.37% higher at 18,895 yuan/mt. Open interest rose 873 lots to 227,843 lots.

Zinc: The most-active SHFE 2108 zinc contract closed down 0.73% at 21,745 yuan/mt. Open interest rose 5,027 lots to 100,829 lots.

The US core PCE price index increased by 3.4% year on year in May, the highest since April 1992. Federal Reserve Powell reiterated the dovish stance that inflation will not lead to an advance rate hike. The economic bulletin issued by the European Central Bank predicts that the economic growth of the euro zone will continue to improve significantly in the second half of the year, and the medium-term economic recovery will also be supported by strong demand and continuous monetary and fiscal policies, which will drive LME zinc to strengthen.

On fundamentals, with the relatively loose supply of domestic ore, TCs may still maintain the upward trend in the third quarter. On the other hand, smelters have basically resumed production at present, but there is still no obvious increase in the arrivals in various places, and the arrival time may continue to move backward. Therefore, the impact of arrival on the market may have to be observed in time.

Nickel: The most-traded SHFE 2107 nickel contract ended the day 0.04% lower at 137,580 yuan/mt today. Open interest fell 26,180 lots to 48,482 lots.

Lead: The most-traded SHFE 2108 lead contract ended the day 1.57% lower at 15,350 yuan/mt. Open interest rose 5,376 lots to 63,759 lots. Near the end of the month, the enthusiasm of purchasing in the spot market is still not high, and the circulation of goods in the market is relatively abundant. The smelter premiums keep following the market, and the market has a strong wait-and-see sentiment. The contract will test support from 15,300 yuan/mt tonight.

Tin: The most-liquid SHFE 2108 tin contract fell to a session low of 208,010 yuan/mt and finished the day 0.39% lower at 209,090 yuan/mt today. Open interest fell 2,441 lots to 39,209 lots. Tight domestic supply still supported high tin prices. It is expected that the contract will keep fluctuating at high in the near term. Pressure above will be seen from 213,000 yuan/mt today. Support below will be seen from 207,500 yuan/mt today.

![BC Copper 2604 Closed Lower with a Wide Trading Range, Pressured by Both Geopolitics and Interest Rate Cut Expectations [SMM BC Copper Commentary]](https://imgqn.smm.cn/usercenter/pJSbE20251217171713.jpeg)