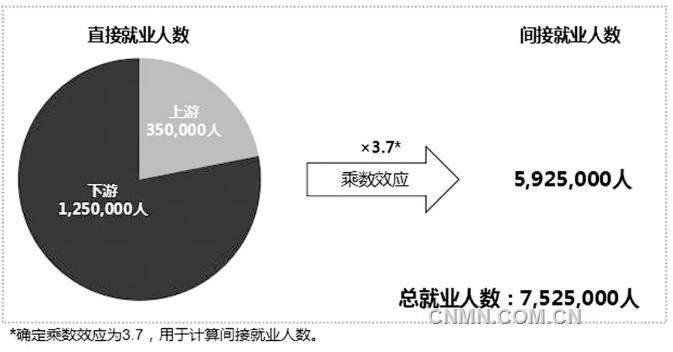

Recently, the International Aluminum Association released a global employment report on the aluminum industry. According to the report, about 7.525 million people were employed in the global aluminum industry in 2019, with about 350000 in upstream (including mining, refining and smelting), 1.25 million in downstream and 5.925 million in indirect employment. According to the report, for every additional direct employment in the aluminum industry, 3.7 indirect jobs will be created.

As the leader in global production and consumption of aluminum products, China's aluminum industry ranks first in the world in 2019, with a total of about 751000, of which upstream employment and downstream employment also rank first, about 130000 and 621000 respectively. Among them, 143000, 189000, 137000 and 152000 people are employed directly in the fields of rolling, extrusion, casting and recycling in China's aluminum industry, respectively.

In terms of global upstream employment, India, Brazil, Russia, the 28 countries of the European Union and the European Free Trade Association, Australia, Guinea, Canada, the United Arab Emirates and Saudi Arabia ranked second to tenth, with employment of about 68000, 27000, 20000, 20000, 15000, 11000, 9000, 7000 and 6000, respectively. In terms of employment in the lower reaches of the world, Asia, North America and Europe, excluding China, ranked second to fourth, with about 187000, 165000 and 75000 respectively.

Chinese aluminum industry enterprises are vigorously implementing the development strategy of "going out". Enterprises such as China Aluminum Group Co., Ltd., Shandong Weiqiao Venture Group Co., Ltd., have cooperation projects with many of the above-mentioned countries and regions.