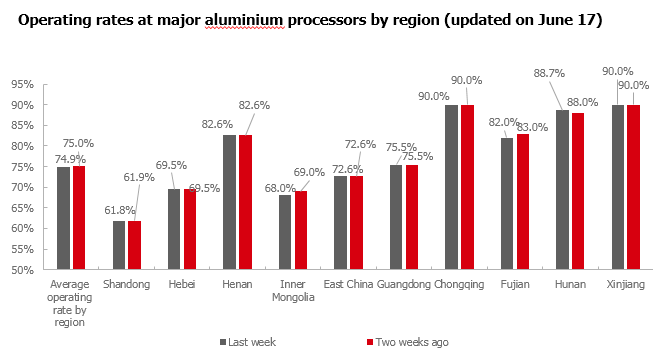

SHANGHAI, Jun 21 (SMM) — Operating rates across major aluminium processors was largely unchanged, down 0.1% last week. The decline is mainly due to primary alloy industry, which is affected by weaker car consumption. New orders in other downstream sectors weakened slightly due to approaching off-season, but this had limited impact on current operating rate. Demand from food packaging and consumer electronics sectors remains strong. Operating rate will remain stable this week as end-users will become more active in picking up goods amid less volatile aluminium price.

Primary aluminium alloy: The weekly operating rate of major primary aluminium alloy enterprises dropped to 60.5%. Car chip shortage, car maker shutdowns due to high temperature and pandemic in Guangdong severely hurt sales at primary aluminium alloy enterprises. Operating rate is expected to continue to decline slowly with more car makers stopping production due to high temperature.

Aluminium plate and strip: The operating rate of major aluminium plate and strip enterprises remained at 87%. The official announcement of SRB to sell aluminium ingots had little impact on the market as market players had anticipated this earlier. Now is still the peak season for aluminium plate and strip. Some producers have increased production as aluminium price volatility has been relatively small since June. Operating rates are expected to remain stable or rise slightly this week.

Aluminium wire and cable: The operating rate of major aluminium wire and cable enterprises remained stable. Although new orders decreased year-on-year, backlog orders allowed producers to maintain stable production. Production was stable in Jiangsu and Zhejiang, but increased slightly in Shandong and Henan. Producers restocked as needed while waiting for the details of sale by the SRB. Operating rate is expected to remain flat this week. Market needs to pay attention to bid invitation by the State Grid in the future.

Aluminium extrusion: Operating rates at major aluminium extrusion producers were little changed. Large producers reported abundant orders on hand and most of them maintained full production, but new orders showed signs of falling and some reduced production. Large-scale construction extrusion companies reported a slight decline in demand from the real estate and infrastructure sectors, while small and medium-sized companies received few orders. For industrial extrusion, demand from the electronics, rail transport and aerospace sectors remains strong. Operating rate in the photovoltaic industry remains low due to high price of silicon materials. Downstream customers were still not enthusiastic about picking up goods, causing finished product inventory to accumulate. Exports were affected by the pandemic in Guangdong and overseas. Operating rate is expected to drop slightly this week.

Aluminium foil: Operating rates at major aluminium foil enterprises remained flat last week. Most of the major aluminium foil manufacturers have two months of backlog orders. New orders for air-conditioning foil are gradually shrinking, demand for brazing foil has remained sluggish due to the impact of the automotive sector, and food foil has become a new driver of overall demand. The peak consumption season is still there, the fluctuation of aluminium prices has eased, the dumping of reserves has already landed, and the National Development and Reform Commission has once again spoken out about stabilizing prices. Operating rate is expected to remain stable this week, with support from the peak season, less volatile aluminium prices and efforts by the National Development and Reform Commission to stabilise consumer prices.

Secondary aluminium alloy: Operating rate of major secondary aluminium enterprises was largely stable last week. The price of secondary aluminium followed aluminium price down. Die-casting companies still restocked as needed due to bearish sentiment amid falling aluminium prices. Die-casting companies have gradually entered the off-season since June, with fewer orders from automobile and home appliance sectors, having ripple effect to secondary aluminium producers. Prices of secondary aluminium is expected to fall. Operating rates are likely to stabilise or fall slightly this week.