SHANGHAI, May 26 (SMM)—Lead prices bottomed out after the settlement as bears sold out positions. Domestic lead concentrate supply remained tight, and the quotations were chaos, but the smelters did not reduce production significantly. The primary lead supply was sufficient. Tianchuan warehouse was full of delivered primary lead, so the inventories may increase at Henan smelters or other social warehouses. Primary lead prices remained at wide discounts. Secondary lead profits were low, but the production was high. Therefore, the overall lead prices will remain low.

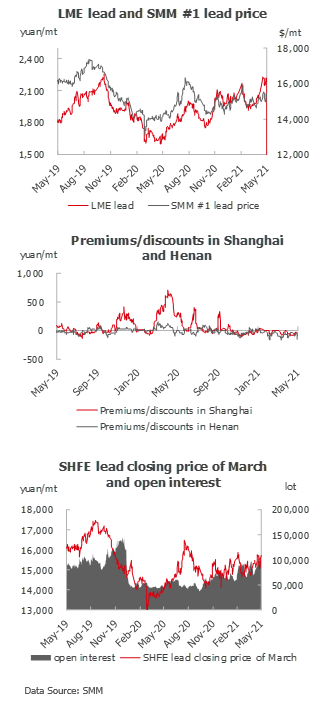

Domestic fundamentals were weak due to the inventory increase last week, while the overseas fundamentals were stable. Domestic market was considering to profit through buying domestic contracts and selling overseas market amid the lower SHFE/LME ratio. The profit room is expected to be large in the peak season after August, when domestic inventories start to decrease and the supply increase is limited. LME lead is expected to move between $2,155-2,255/mt this week, and the most traded lead futures contracts are expected to move between 15,400-15,800 yuan/mt.