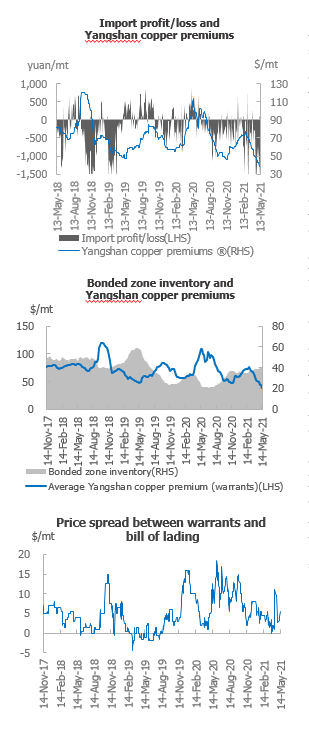

SHANGHAI, May 19 (SMM)—Yangshan copper premiums with a quotation period in June stood at $30-45/mt under warrants during May 10-14, and between $20-35/mt under bill of lading. The SHFE/LME copper price ratio stood at 7.26 as of May 14.

Trades remained muted as the SHFE/LME copper price ratio weakened further. Import losses stood at around 700 yuan/mt for the June contract. Quotes are currently concentrated on bill of lading slated to arrive in late May to early June. Some traders were forced to sell at lower prices amid the approach of delivery. Quotes for the two high-quality brands slid to $35/mt at the week's end, with room for price declines. Quotes for mainstream pyro-copper stood at around $30/mt.

Trades of ILO occurred with import premiums of $25/mt. Quotes for warrants continued to slide without any advantage. purchases were subdued. Weak demand resulted in continued growth in bonded zone inventories. However, traders refrained from lowering prices sharply in view of warrants costs and the contango structure on LME copper. Import premiums under warrants are currently quoted at $30-44/mt, down $6/mt from a week earlier on average, and quotes for bill of lading stand at $20-32/mt, a decline of $9/mt. Buyers have strong negotiation power over pricing and Yangshan copper premiums will have downward room amid oversupply.

Traded import premiums for high-quality pyro-copper currently stand around $44/mt under warrants, $38/mt for mainstream pyro-copper, and $30/mt for hydro-copper. On the bill of lading front, premiums are $32/mt for high-quality copper, $27/mt for mainstream pyro-copper, and $20/mt for hydro-copper.

Copper inventories in the Shanghai bonded zone increased 4,300 mt from May 7 to 401,900 mt as of May 14, growing for the fourth consecutive week. Domestic smelters moved copper cathode into the bonded zone amid severe import losses. Demand for cargoes arriving recently was weak. Yangshan copper premiums under bill of lading dropped to the lowest level since its first publication by SMM in April 2017. The absence of purchases for arriving shipments drove some cargoes into the bonded zone, growing bonded zone inventories.