SHANGHAI, Apr 15 (SMM)—At the economic work conference (Two Sessions), China emphasised the "stability" of macroeconomic policies and the strengthening of regulations of raw materials markets to ease the cost pressure of enterprises. That depressed market bullishness. US President Biden officially announced a package of over $2 trillion in infrastructure and economic stimulus, aiming at optimising the development of infrastructure, manufacturing and the Internet. US Treasury yields are expected to surge to high levels amid economic recovery in the US from the COVID-19. The US dollar index is expected to remain in an upward track. Copper prices are expected to meet strong resistance from 68,000 yuan/mt.

Oyu Tolgoi copper-gold mine in Mongolia has declared force majeure due to COVID-19 prevention at the port along the border, stopping shipments of copper concentrate to China. It is unknown when shipments will resume remains uncertain. In addition, the Chilean government has tightened controls on population movements, which has also restricted international transportation. Although copper cathode market has not yet been affected, market concerns linger.

On demand, orders from the State Grid have picked up. The pandemic is expected to continue to plague the market in the high month of April. Meanwhile, smelters will conduct concentrated maintenance in the second quarter, and construction projects such as infrastructure and real estate have gradually started, improving consumption of copper rods produced with copper cathode and copper tubes.

SMM understood that production schedules at major domestic air-conditioning companies in April increased around 33% year-on-year, and operating rates at copper tube plants are expected to continue to rise. Market expectations over the high month of April, concentrated maintenance at smelters and the decline in SHFE copper inventory should support copper prices to move at high levels.

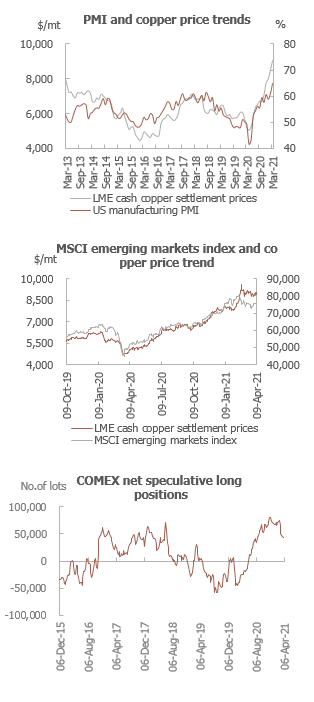

Aggressive market speculative operations were believed to have driven the surge in SHFE copper prices on February 25 and the sharp drop on February 26. Copper prices are expected to move rangebound at high levels in April amid stable macroeconomy and fundamentals in the short term. SHFE copper prices will fluctuate at 65,000-68,000 yuan/mt in April, and LME copper is expected to trade between $8,700-9,150/mt.