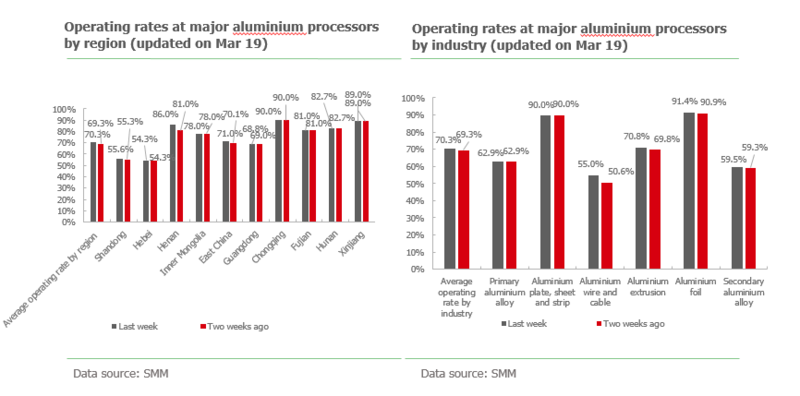

SHANGHAI, Mar 23 (SMM)—Operating rates across major aluminium processors rose slightly last week as they had to accept high aluminium prices to deliver orders. End-users find it difficult to accept current high aluminium prices. As some end-users adopt quarterly or semi-annual pricing, high aluminium prices will not pass through to end-users until they complete Q2 pricing.

Primary aluminium alloy: Operating rates at major primary aluminium alloy enterprises were flat from the previous week at 62.9%. aluminium wheel plants kept raw material stocks at safe levels and avoided excessive stockpiling amid high aluminium prices. Alloy producers have basically resumed normal operations, except for a large factory in Shandong, whose operating rates were below levels before CNY due to relocation. Operating rates will remain stable this week as the fact that car makers make purchase under long-term orders will continue to constrain alloy consumption.

Aluminium plate and strip: Major aluminium plate and strip enterprises maintained full capacity due to heavy backlog orders. Some producers even rejected orders from clients with slow payment. Despite volatile and high aluminium price, large producers did not reduce purchases, but had stricter control over inventory. Operating rates will remain high this week on the back of backlog orders.

Aluminium wire and cable: Operating rates of major aluminium wire and cable producers increased significantly, mostly driven by producers in Henan, due to approaching delivery of orders. However, the outlook for future new orders is not optimistic. Orders from State Grid decreased on a year-on-year basis due to high aluminium prices. Prices under overseas orders were lower than those under domestic orders, inhibiting enthusiasm for taking overseas orders. Operating rates at major producers may remain stable, but are likely to decline at small and medium-scale producers due to the lack of new orders after previous orders were delivered.

Aluminium extrusion: Operating rates at major aluminium extrusion enterprises rose slightly, but remained below normal level. Some end-users are beginning to accept high aluminium prices, but most remain cautious amid high and volatile aluminium prices. Demand for industrial extrusion outperformed demand from other sectors. Demand of construction extrusion remained weak. Downstream procurement will continue to be driven by rigid demand before aluminium price see significant downward corrections, and operating rate may remain little changed this week.

Aluminium foil: Operating rates at major aluminium foil enterprises continued to rise. Domestic orders for automotive foil, battery foil and air-conditioning foil are full. Operating rates will continue to rise this week with continued recovery of consumption. Many producers have begun to control export orders as high aluminium prices have eroded export profits, but this had little impact on the overall operating rate. Some small and medium-sized enterprises who did not lock in prices and are short of cash still showed low willingness to take orders, purchase and produce.

Secondary aluminium alloy: Operating rate of secondary aluminium alloy enterprises climbed 0.2 percentage point from a week ago to 59.5%. At present, production is normal. Secondary aluminium prices failed to follow primary aluminium up. Orders remained weak due to high aluminium prices, but improved slightly from the previous two weeks as die-casting plants have basically run out of inventory and gradually accepted high prices. Raw material supply remained tight with limited imports of aluminium scrap. Secondary aluminium companies are facing high costs. Operating rate is expected to stabilise this week.