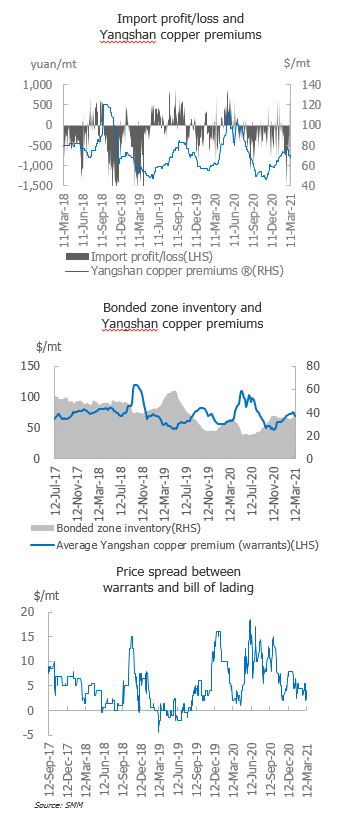

SHANGHAI, Mar 16 (SMM)—Yangshan copper premiums with a quotation period in April stood at $63-76/mt under warrants during March 8-12, and between $60-73/mt under bill of lading. The SHFE/LME copper price ratio stood at 7.38 as of March 12.

Import losses stood at 300-500 yuan/mt last week, weakening demand and muting trades. LME copper maintained the backwardation structure. This combined with a domestic contango structure and depreciation in the yuan led to stronger LME copper compared with SHFE copper. The current supply under bill of lading slated to arrive in late March is ample, driving traders to lower their quotations. But buyers refrained form purchasing. The spread between some counter-offers and quotations stood at $5-10/mt.

Import premiums under warrants are currently quoted at $73-93/mt, down $2.5/mt from a week earlier on average, and quotes for bill of lading stand at $60-70/mt, a decline of $3.5/mt. Quotes for bill of lading are likely to exceed those for warrants should the SHFE/LME copper price ratio fail to improve, weakening demand.

Yangshan copper premiums are expected to fall further amid quiet trades and oversupply.

Traded import premiums for high-quality pyro-copper currently stand around $73/mt under warrants, $69/mt for mainstream pyro-copper, and $63/mt for hydro-copper. On the bill of lading front, premiums are $70/mt for high-quality copper, $65/mt for mainstream pyro-copper, and $60/mt for hydro-copper. The quotation period is in April.

Copper inventories in the Shanghai bonded zone increased 6,400 mt from March 5 to 371,900 mt as of March 12, the fourth consecutive week of increase. Domestic consumption has not fully recovered. This coupled with the substitution of copper cathode by copper scrap driven by a high price spread between copper cathode and copper scrap continued to accumulate stocks. Meanwhile, the closed import window limited customs clearance, growing bonded zone inventories.