SHANGHAI, Mar 15 (SMM)—SHFE copper contract prices are expected to move rangebound between 65,800-67,800 yuan/mt this week, and LME copper prices will fluctuate between $8,850-9,150/mt.

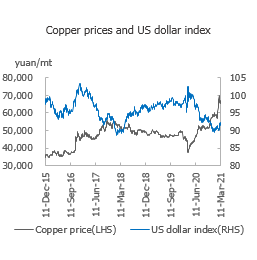

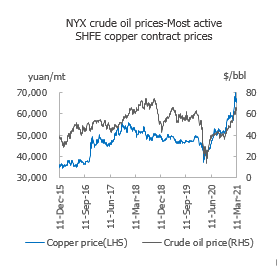

The US initial jobless claims two weeks ago hit the lowest level since November, a larger than expected decline. However, the rise of US bond yields and a weaker risk appetite of the market suppressed the enthusiasm in speculation of equity assets and commodity futures, leaving copper prices rangebound at high levels in the short term.

The Federal Reserve's interest rate decision meeting will take place early this week. Housing starts and retail sales in the United States will have a significant impact on market sentiment. Economic data is expected to exceed expectations on the back of continued easy monetary policy by the Fed, bolstering market bullish sentiment.

On fundamentals, weaker end-user demand amid high copper prices has impacted upstream industries. According to the SMM survey, finished product inventory at domestic copper smelters in the survey sample reached a record high of 83,400 mt at the end of February. Smelters have lowered prices significantly in the spot market. In addition, increased domestic copper scrap supply amid high copper prices and the continued inflow of overseas copper scrap is likely to result in the substitution of copper cathode by copper scrap, weakening consumption of copper cathode. Therefore, it should be difficult for the supply side to digest the finished product inventory, and weak downstream procurement is likely to extend stock accumulation, weighing on copper price.

In the Shanghai spot market, sellers held back cargoes last week as the contango of the SHFE next-month contract expanded from 100-150 yuan/mt to 220-250 yuan/mt over the SHFE front-month contract. After the completion of delivery on Monday, spot discounts are expected to return to around 100 yuan/mt. However, spot discounts are expected to turn into premiums due to trades under long-term contracts and scarce supply of high-quality copper. spot copper is likely to be quoted with discounts of 80 yuan/mt to premiums of 20 yuan/mt this week.