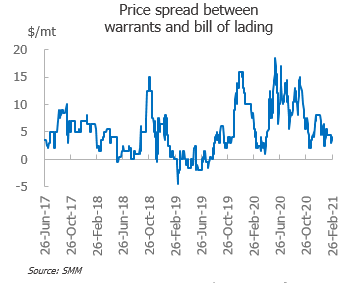

SHANGHAI, Mar 2 (SMM)—Yangshan copper premiums with a quotation period in March stood at $68-84/mt under warrants during February 22-26, and between $65-80/mt under bill of lading. The SHFE/LME copper price ratio stood at 7.35 as of February 26.

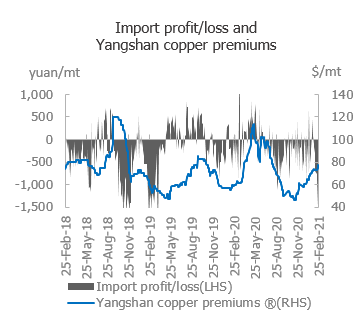

Yangshan copper premiums rose initially then fell last week. Traders quoted $5/mt higher compared to pre-CNY levels. Import losses shrank to around 200 yuan/t in the first half of the week amid a stable SHFE/LME copper price ratio, boosting financing demand. As such, quotes trended higher. The two high-quality brands under bill of lading slated to arrive in March were quoted over $80/mt, and trades occurred with import premiums of around $80/mt. ILO that slated to arrive in March was traded with import premiums of around $77/mt. Quotes for mainstream pyro-copper under warrants exceeded $80/mt.

However, higher copper prices combined with lower quotes in the domestic spot market have depressed downstream demand noticeably. Some of the traders under cash flow pressure offered cargoes for sale.

Import premiums for warrants currently stand at $70-82/mt, with the average premium up $3/mt from February 22; import premiums for bill of lading are quoted at $66-78/mt, and the average premium rose $3.5/mt. Many trades occurred under warrants and buyers plan to deliver cargoes into the INE. Copper inventories on the INE proliferated by 57,000 mt last week.

Traded import premiums for high-quality pyro-copper currently stand around $82/mt under warrants, $78/mt for mainstream pyro-copper, and $70/mt for hydro-copper. On the bill of lading front, premiums are $78/mt for high-quality copper, $73/mt for mainstream pyro-copper, and $66/mt for hydro-copper. The quotation period is in March.

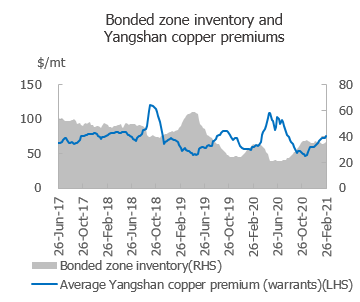

As of Friday February 26, copper inventories in the Shanghai bonded zone increased 13,300 mt from February 18 to 358,600 mt. Warehouses resumed operations post-CNY holidays and some cargoes under bill of lading arrived in the warehouses. Some exported domestic copper entered the bonded warehouses. This combined with weaker import demand resulting from a lower SHFE/LME copper price ratio and lower quotes in the domestic spot market increased bonded zone inventories last week.