SHANGHAI, Feb 9 (SMM) – SHFE nonferrous metals rose for the most part on Tuesday February 9 due to strong earnings and improving data on the Covid-19 and vaccination front.

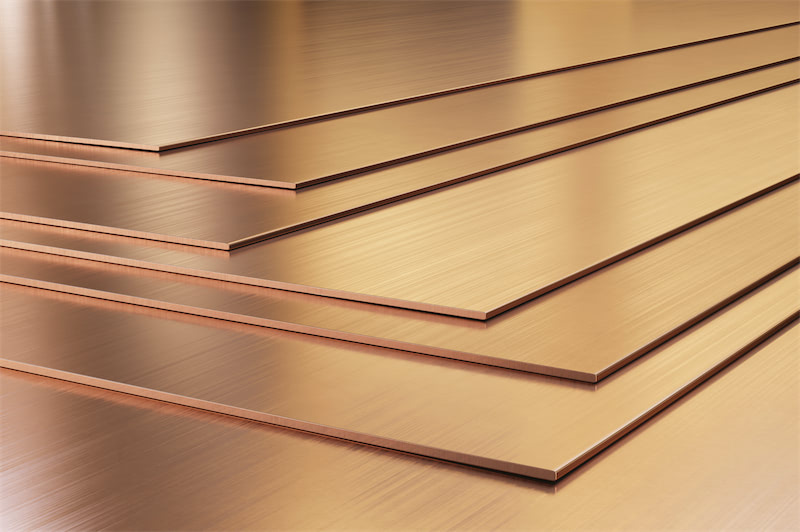

Copper, the best performer, rose 1.67%, zinc advanced 0.62%, lead went up 0.53%, Aluminium climbed 1.21% and nickel gained 1.47%, while tin dropped 1.63%.

The ferrous complex rose across the board. Iron ore surged 4.27%, rebar rose 2.31%, and hot-rolled coil climbed 2.4%.

Copper: The most-traded SHFE 2103 copper contract finished the day 1.67% higher at 59,570 yuan/mt. Open interest fell 3,254 lots to 90,464 lots.

The president of Richmond Fed is not worried about the inflation risk brought by the stimulus plan. Goldman Sachs raised the expected size of the US stimulus bill to US$ 1.5 trillion, and raised the expected growth rate of US GDP to 6.8% and 4.5% this year and next respectively. Cleveland Fed President said that the popularisation of vaccination will accelerate the economic recovery, the market sentiment is unprecedentedly positive, the global capital market is generally rising, and A shares are up by more than 2%.

Germany seasonally-unadjusted trade account in December, the trend of the US stimulus bill and whether the contract can show an upward market trend on the last trading day before the CNY tomorrow will come under scrutiny tonight.

Aluminium: The most-liquid SHFE 2103 aluminium contract finished the day 1.21% higher at 15,865 yuan/mt. Open interest fell 12,830 lots to 158,397 lots. The short-term higher prices were related to the expected change of accumulated stocks. At present, the enthusiasm of long positions to enter the market is ahead of schedule, and the increase of open interest is concentrated in the 2104 and 2105 contract, which reflects the expectation that the supply and demand of aluminum ingots will be high in April-May after the CNY holiday. The basis between the 2103 and 2104 contract has narrowed to 20 yuan/mt, and the 2104 contract strengthened, which once again verifies the expectation of funds on market preference after the holiday. Pre-holiday consumption shrank, and the demand for capital hedging should continue to be monitored.

Zinc: The most-active SHFE 2103 zinc contract closed up 0.62% at 20,180 yuan/mt. Open interest rose 5,172 lots to 76,234 lots.

Nickel: The most-traded SHFE 2104 nickel contract ended the day 1.47% higher at 135,250 yuan/mt today. Open interest rose 11,372 lots to 169,583 lots.

Lead: The most-traded SHFE 2103 lead contract rose to an intraday high of 15,305 yuan/mt and ended the day 0.53% higher at 15,190 yuan/mt. Open interest fell 1,354 lots to 26,626 lots. The market is optimistic about the post-holiday economic recovery and industrial production demand. The contract fluctuated within a narrow range in this atmosphere and stood on the 10-day moving average. Whether the contract could remain above 10-day moving average will be monitored tonight.

Tin: The most-liquid SHFE 2104 tin contract fell to a session low of 162,330 yuan/mt and finished the day 1.68% lower at 163,460 yuan/mt today. Open interest fell 1,563 lots to 34,457 lots. The guidance of LME tin on the trend of the contract will be monitored. It is expected that the contract will keep fluctuating in the near term. Pressure above will be seen from 167,500 yuan/mt today. Support below will be seen from 162,000 yuan/mt today.