SHANGHAI, Feb 8 (SMM) – On February 4, Inner Mongolia Ministry of Industry and Information Technology implemented a differential electricity price policy in accordance with national regulations on the industries of aluminium, iron alloy, calcium carbide, sodium hydroxide, cement, steel, yellow phosphorus and zinc smelting. The power rate is 0.1 yuan/kWh for the restricted production and 0.3 yuan/kWh for the closure production (0.4 yuan/kWh for cement and 0,5 yuan/kWh for iron and steel). The price will be increased by 30% and 50% in 2022 and 2023 respectively.

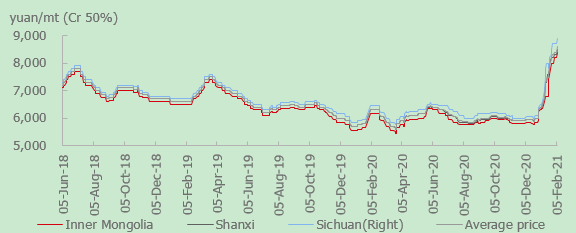

High-carbon ferrochrome prices rose by 1,000 yuan/mt (Cr 50%) weekly

Source: SMM

The local ministry will filter out the enterprises with the production capacity to be restricted or closed from Q2 2021, and power grid enterprises will adjust the power rates for the filtered companies based on the government's standards according to the enterprises' production facilities and power consumption (including market trading electricity). According to policy requirements, in the alloy production, power rates will increase 0.1 yuan/kWh for the restricted capacity, and 0.3 yuan/kWh for eliminated capacity, which is converted to 400 yuan and 1200 yuan for silico-manganese producers, 500 yuan and 1,250 yuan for high-carbon ferrochrome companies, and 800 yuan and 2,400 yuan for ferrosilicon companies.

Source: SMM

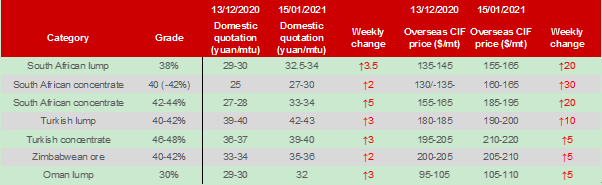

South Africa 40-42% chromium concentrate stood at $175-200/mt (bulk cargo), and $170/mt (in container). Prices of 42-44% concentrate were between $190-220/mt (bulk cargo). South Africa 38% chromium lump ore quoted $180-190/mt, 40-42% crude ore were quoted with $190-200/mt(bulk cargo). Turkey 46-48% chromium powder was at $230-240/mt, and Turkey 40-42% lump ore quoted $230-245/mt. The price of Iran 38-40% lump ore was $210/mt, Pakistan 40-42% lump ore was $210-220/mt. Zimbabwe 48-50% concentrate price moved between $210-220/mt (bulk cargo), and Oman 30% lump ore prices stood at $120/mt. The average growth price gain of overseas chrome ore futures was around $10/mt.

For more information and updates on the China nickel sector, please subscribe to China Nickel Weekly.

![[NPI Daily Review] The High-Grade NPI Market Came Under Brief Pressure; the Cost-Support Rationale Remained Unchanged](https://imgqn.smm.cn/usercenter/CWsEw20251217171732.jpeg)

![[SMM Nickel Sulphate Daily Review] March 10: Raw Material Uncertainty Continued, Nickel Salt Prices Rose Slightly](https://imgqn.smm.cn/usercenter/PFIti20251217171734.jpg)