SHANGHAI, Feb 3 (SMM) – SHFE nonferrous metals broadly fell on Thursday February 3 as a private survey showed China's services sector activity growth slowing sharply in January.

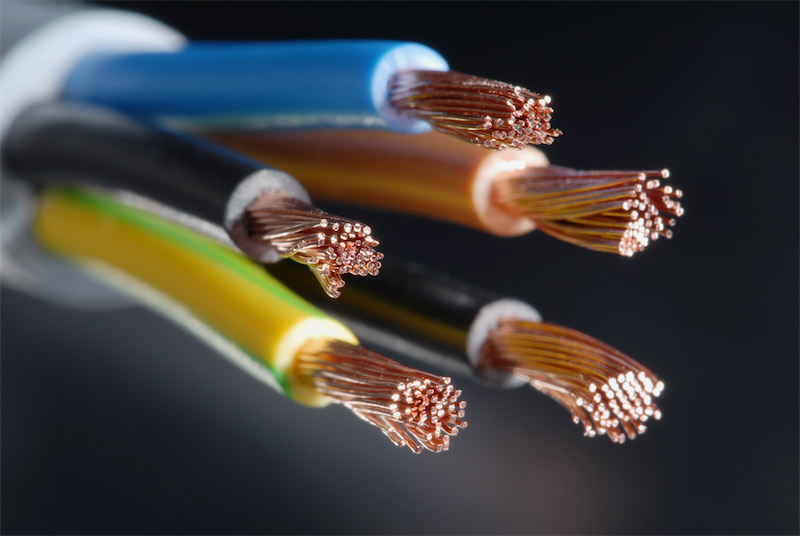

Shanghai nonferrous metals, except for zinc, traded lower on Thursday February 3. Tin dropped 2.51% to lead the losses, aluminium shed 0.86%, lead declined 1.47%, copper went down 1.06% and nickel fell 1.75%, while zinc advanced 0.69%.

The ferrous complex closed mixed. Iron ore decreased 0.89%, rebar slipped 0.22%, while hot-rolled coil rose 0.02%.

Copper: The most-traded SHFE 2103 copper contract finished the day 1.06% lower at 57,000 yuan/mt. Open interest fell 4,110 lots to 113,563 lots.

The US Senate initiated special procedures to pass the $1.9 trillion stimulus plan without Republicans. GameStop, AMC and silver fell sharply across the board, and the speculative upsurge of retail investors retreated. GameStop closed below $100 for the first time in a week, its market value evaporated by more than $27 billion, and the proportion of short positions in tradable shares plummeted to 51%. Last night, Shanghai Futures Exchange and China Securities Regulatory Commission issued a document to raise the risk of margin warning and improve the supervision of silver trading. China Caixin/Markit services Purchasing Managers’ Index for January weakened month on month, which led to more cautious market sentiment and suppressed long positions radical sentiment.

US ADP employment data, the trend of US dollar index and whether the contract could stop falling will come under scrutiny tonight.

Aluminium: The most-liquid SHFE 2103 aluminium contract finished the day 0.86% lower at 14,965 yuan/mt. Open interest rose 1,982 lots to 167,214 lots. Support from the fundamentals was insufficient, and the participation of speculative funds declined. It is estimated that the contract will fluctuate between 14,700-15,100 yuan/mt tonight.

Zinc: The most-active SHFE 2103 zinc contract slid to a session low of 19,465 yuan/mt and closed up 0.69% at 19,650 yuan/mt. Open interest fell 2,256 lots to 93,857 lots. On the fundamentals, TCs for imported ore under long-term contracts were still in a downward trend, and the performance of domestic zinc ingot inventory in January is better than the market expectation, which provided a driving force for the rise of zinc prices. Whether the five-day moving average could form support will be monitored tonight.

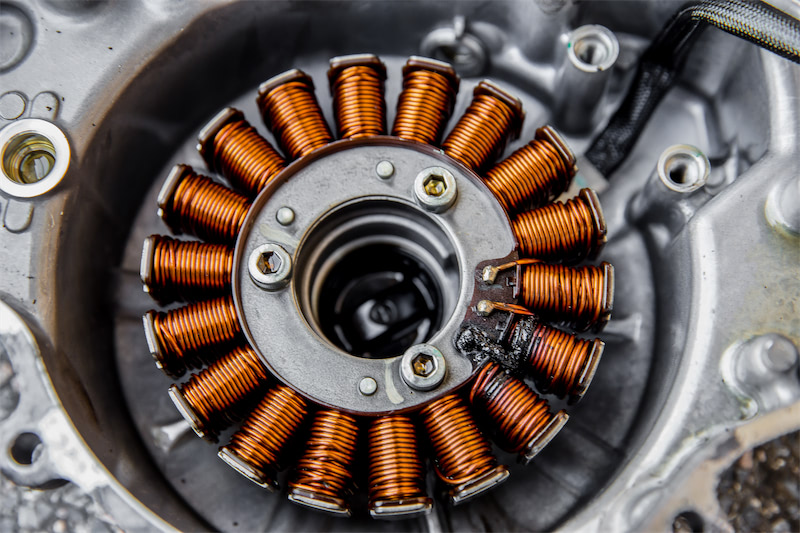

Nickel: The most-traded SHFE 2104 nickel contract ended the day 1.75% lower at 129,630 yuan/mt today. Open interest rose 11,084 lots to 154,373 lots.

Lead: The most-traded SHFE 2103 lead contract rose to an intraday high of 15,050 yuan/mt and ended the day 1.47% lower at 14,765 yuan/mt. Open interest fell 67 lots to 35,247 lots. Near the delivery date of the February contract, spot trading is getting more and more tepid, and some cargo holders have certain selling delivery intentions due to the demand for funds to be returned before the holiday. The contract will test support from 14,800 yuan/mt tonight.

Tin: The most-liquid SHFE 2103 tin contract rose to an intraday high of 168,400 yuan/mt and finished the day 2.51% lower at 164,180 yuan/mt today. Open interest fell 2,963 lots to 12,070 lots.