SHANGHAI, Feb 2 (SMM) – SHFE nonferrous metals broadly fell on Tuesday February 2 following an overnight jump on Wall Street.

Tin led the losses and slumped 1.85%, copper slipped 1.04%, zinc eased 0.96%, aluminium lost 1.68%, nickel went down 0.88% and lead decreased 1.42%.

The ferrous complex fell across the board. Hot-rolled coil went down 1.76%, iron ore shed 5.61%, and rebar fell 2.21%.

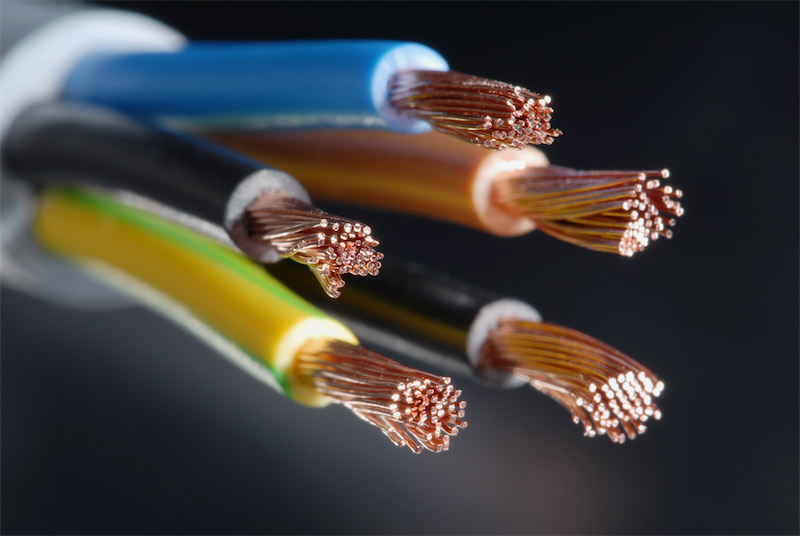

Copper: The most-traded SHFE 2103 copper contract finished the day 1.04% lower at 57,300 yuan/mt. Open interest rose 35 lots to 117,673 lots.

Biden's $1.9 trillion stimulus plan is also controversial in the White House, and aides worry that the high cash-out scale will make other priority issues face insufficient funds. While waiting for the stimulus bill to be implemented, the market is also paying attention to the data guidance of various countries. The US dollar index moved up at night and returned to above 91, which suppressed the copper prices obviously. The sharp increase in China's capital interest rate promoted the demand for RMB Standing Loan Facility (SLF) in January, and the overnight operation volume was obvious, which caused A shares to rise for two consecutive days.

Eurozone seasonally-adjusted GDR for Q4 and the trend of LME copper will come under scrutiny tonight.

Aluminium: The most-liquid SHFE 2103 aluminium contract finished the day 1.68% lower at 14,945 yuan/mt. Open interest fell 8,815 lots to 165,232 lots.

Zinc: The most-active SHFE 2103 zinc contract rose to an intraday high of 19,600 yuan/mt and closed down 0.96% at 19,505 yuan/mt. Open interest rose 1,909 lots to 96,112 lots. As the Spring Festival is approaching, the market consumption weakened amid tepid trade. The overall zinc fundamentals still provide support. The refinery production will be monitored. The supporting position of the lower edge of BALL line will continue to come under scrutiny tonight.

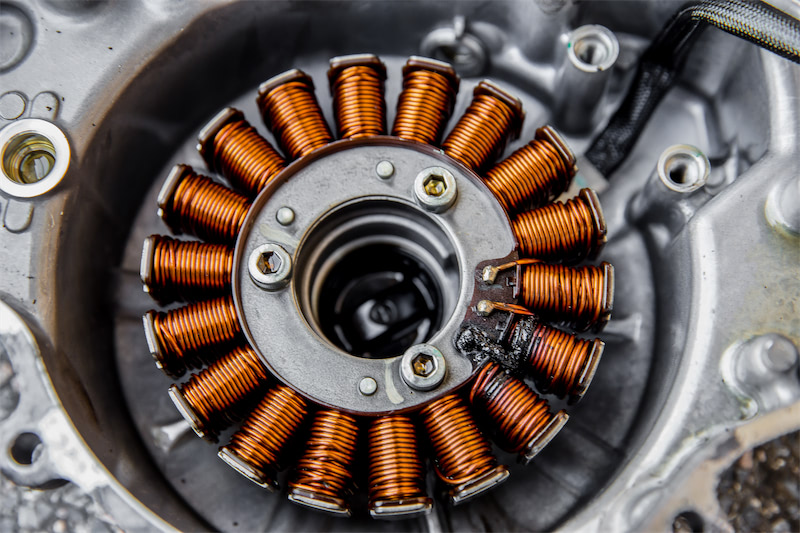

Nickel: The most-traded SHFE 2104 nickel contract ended the day 0.88% lower at 131,010 yuan/mt today. Open interest rose 2,984 lots to 143,289 lots. SMM data showed that the purchasing manager's index (PMI) for downstream nickel industries, including stainless steel, electroplating, alloy and battery, stood at 50.61 in January, down 0.49 points from December. A reading above 50 indicates expansion, while a reading below 50 indicates contraction.

Lead: The most-traded SHFE 2103 lead contract slid to a session low of 14,880 yuan/mt and ended the day 1.42% lower at 14,910 yuan/mt. Open interest fell 1,957 lots to 35,314 lots. The supply and demand of lead market are weak recently, and the enterprises of secondary lead and battery took a holiday at the same time, so it is difficult for the fundamentals to provide upward momentum for SHFE lead. The contract will test support from 14,900 yuan/mt tonight.

Tin: The most-liquid SHFE 2103 tin contract rose to an intraday high of 170,300 yuan/mt and finished the day 1.85% lower at 166,720 yuan/mt today. Open interest fell 2,640 lots to 15,033 lots.