SHANGHAI, Jan (Feb 1)—The recent coastal wind and waves at northern Chilean ports has caused an extensive delay in copper exports by Chile in January. Of several large and medium-scale ports in northern Chile that transport copper cathode and copper concentrates like Antofagasta, Mejillones, Iquique, Arica and Patache, four ports could not load copper cathode as large-scale vessels failed to call at ports, with the exception of the Antofagasta port.

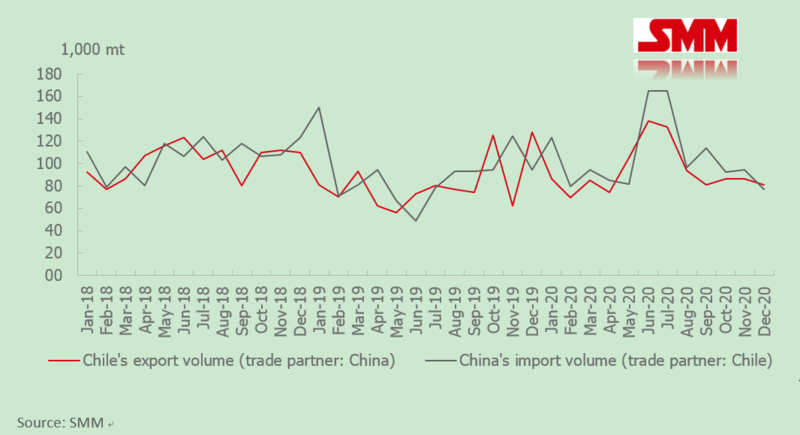

According to Chilean export data, exports of copper cathode to China have declined since the fourth quarter of last year. In December 2020, Chile’s exports of copper cathode to China stood at 81,200 mt, a decrease of 6.1% from the previous month, driving tighter supply of Chilean copper in China in January.

The delay of shipping schedules has affected normal trades in the foreign trade market. Transportation capacity has remained tight for an extended period due to surging exports, affected second wave of overseas COVID-19 and a backlog of cargoes piled up at overseas ports. That combined with container shortages affected arriving shipments of copper cathode. Delays in shipments from Chile have exacerbated market concerns over tighter supply. The shipping issues at Chilean ports in January will lead to lower shipments arrivals of copper cathode in February and March, which has increased pressure for some traders for deliveries of long-term contracts after Chinese New Year.

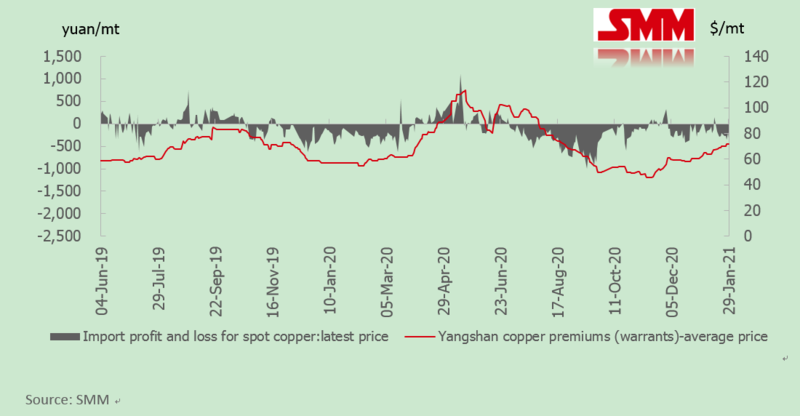

Supply tightness will intensify amid normal production resumptions after CNY should the COVID-19 pandemic be under control. Over the past two weeks, demand in the import market has concentrated on cargoes under bill of lading slated to arrive after CNY. Sellers raised their quotes despite an absence of improvement in the SHFE/LME copper price ratio. Quotes of the two high-quality brands under bill of lading has exceeded $75/mt, and trades occurred with premiums of around $73/mt. Yangshan copper premiums with a quotation period in March stood at $64-80/mt under warrants as of January 28, and between $60-73/mt under bill of lading.

For more information on the Chinese domestic copper markets, please subscribe to China Copper Weekly.