In the first half of 2020, the novel coronavirus epidemic had a serious impact on the global economy, and the automobile industry experienced a large-scale suspension of production and sales, resulting in a sharp decline in car sales. In the second half of the year, however, the global auto industry began to recover and sales rebounded.

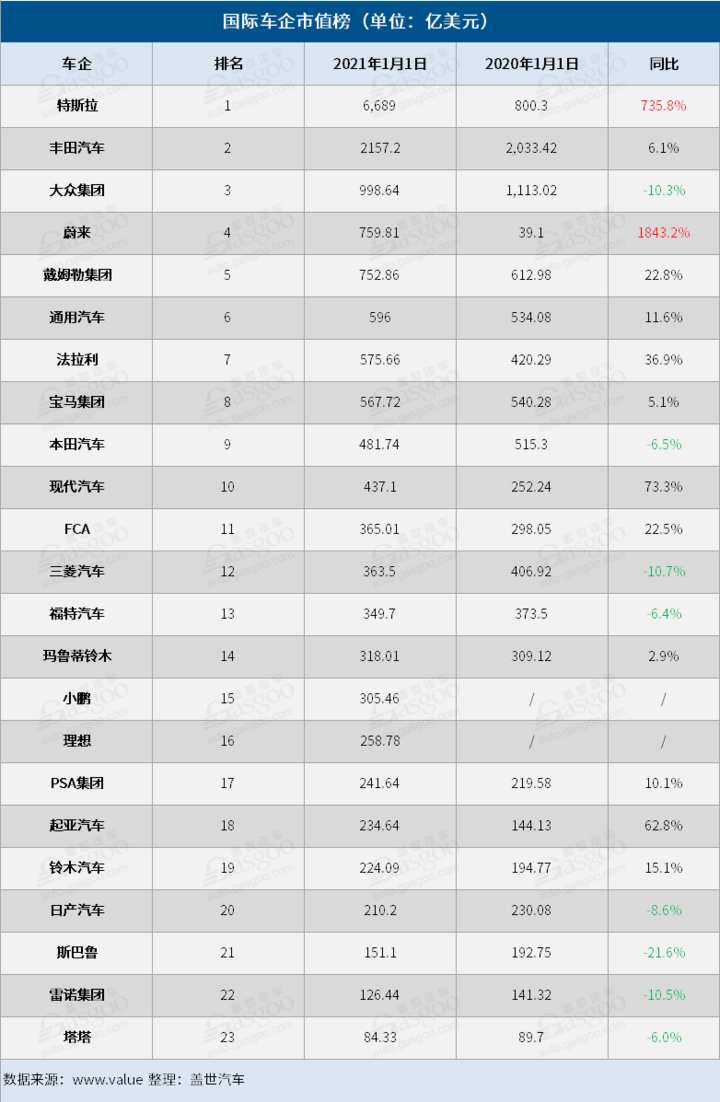

Sales performance also has a direct impact on the share prices and market capitalization of car companies. After sorting out the changes in the market value of 23 international car companies (January 1, 2020 and January 1, 2021), Geshi found that the market capitalization of 8 of the 23 car companies decreased to varying degrees, while among the rising enterprises, Tesla, Lulai and other electric cars led the increase, of which Tesla's market value increased more than 7 times, while the market value of Lulai increased more than 10 times. At the same time, some traditional carmakers that have invested heavily in electric cars and self-driving technology and made good progress, such as Daimler and General Motors, have also achieved a rise in market capitalization. on the other hand, car companies that have lagged behind in the process of transformation have performed less prominently in the stock market.

Tesla leads new energy car companies to soar in market capitalization.

The automobile industry is undergoing profound changes. As countries around the world have issued laws banning the sale of fuel vehicles and increasing incentives for electric vehicles, automakers are scrambling to launch new electric vehicle products. In the process of transition to electric vehicles, new energy vehicle companies have received more attention and favor in the capital market.

Tesla is a typical example. Tesla shares have been challenging short sellers in 2020, peaking 848% from their March low, one of Wall Street's most impressive gains. As of January 1, 2021, Tesla had a market capitalization of $668.9 billion, making it the world's largest car company, up more than sevenfold from less than $100 billion ($80.03 billion) in the same period last year.

Behind the soaring market value of Tesla is the blessing of many factors. The first is the sharp increase in production and sales. According to Tesla's official data, Tesla produced a total of 509737 electric vehicles and delivered 499550 in 2020, completing 99.91 percent of the annual delivery target of 500000 vehicles and reaching a new milestone in annual delivery. Second, Tesla is constantly expanding its product lineup, and the company will launch an all-electric truck Cybertruck and a new Roadster, and plans to launch an entry-level electric car priced at $25000 in the future. Investors are excited that the mass production of, Model Y has been launched in the Shanghai super factory and delivery has begun. Third, Tesla is developing his own battery technology to cut cell costs by 14% while increasing battery mileage by 16%. In addition, Tesla is building new super factories in Berlin, Germany and Texas in the United States to further increase car production capacity.

Tesla was officially included in the S & P 500 in December, triggering a surge in share prices. Five consecutive quarters of profits make it the only pure electric car manufacturer that is making a profit, establishing a leading position in the electric vehicle market and helping the company stand out in the global automotive industry.

Last year, China's electric car leader Ulai was also one of the best-performing auto stocks. It should be pointed out that the share price of Xilai Motor has soared by 1843.2% in the past year. As of January 1, 2021, the market capitalization of Lulai Automobile reached US $75.981 billion, ranking fourth in the market capitalization list of auto companies.

The soaring share price of Weilai is inseparable from the support of the Hefei government. On February 25, 2020, Weilai signed a cooperation framework agreement with Hefei and headquartered China in Hefei. After that, Li Bin, CEO of the company, acted frequently and was successively exposed to self-research on automotive chips, going to Copenhagen and so on. In addition, in August last year, Xilai issued a battery rental plan, and then Li Bin began to brew the used car business, and officially launched the official used car NIO Certified, on January 3 this year, realizing the service closed loop of the whole life cycle of Lulai products.

Wall Street analyst John Murphy said there is still a lot of room for the high-growth stock to rise. Ming Hsun Lee, a securities analyst, also believes that the fundamentals of Xilai are good, and the company's revenue is expected to more than double to more than $32 billion in 2021. Bank of America has a "buy" rating on Xilai, with a target price of $54.7.

Among the three new car-building enterprises listed on the stock market in the United States, Xiaopeng and ideal's performance is also relatively satisfactory. As of January 1, 2021, Xiaopeng has a market capitalization of US $30.546 billion, while the ideal car has a market capitalization of US $25.878 billion, ranking 15th and 16th respectively. Bank of America has a "buy" rating on Xiaopeng, with a target share price of $43.

The share prices and market capitalization of China's three new car makers have risen in part because investors prefer to see them as technology stocks rather than typical carmakers, with Tesla as a case in point. "Tesla's overvaluation has raised expectations of the growth potential of his Chinese competitors, especially at a time when these start-ups are still from a small base and China is vigorously promoting electric vehicles," Steve Man, an analyst at (Bloomberg Intelligence), a Bloomberg industry research, wrote in a report.

Nearly 60% of the market capitalization of traditional car companies leads Toyota.

The market capitalization of traditional car companies is not on a par with that of electric car companies, but most of them continue to maintain an upward trend.

Tesla is the world's most valuable carmaker by market capitalization, while Toyota ranks second with a market capitalization of $215.72 billion, but the world's largest carmaker by revenue. In 2019, Toyota had revenue of $280.6 billion, compared with $24.6 billion for Tesla.

Toyota shares were roughly flat in 2020, with a 6.1% increase in market capitalization at the end of the year compared with the beginning of the year. Kei Nihonyanagi, an analyst, believes that Toyota's business has been stable, and the company is paying more attention to the research and development of electric vehicle battery technology.

Toyota plans to launch solid-state battery technology in 2021, which can be fully charged in 10 minutes and travel 500km on a single charge, minimizing safety risks, which can be described as "revolutionary" in the auto industry. In addition, Toyota plans to launch an electric SUV, in Europe and then in the United States, and while some critics say Toyota lags behind in electrification, the company is clearly trying to make up for it. Bank of America has a "buy" rating on Toyota shares, with a target price of $180.04.

GM is also doing relatively well. In 2020, the company outperformed the s & p 500, rising 17%; it has almost doubled in the past six months. As of January 1, 2021, GM's market capitalization was $59.6 billion, up 11.6% from a year earlier and ranked sixth on the market capitalization list.

GM announced plans to invest up to $27 billion in electric and self-driving cars by 2025, including the launch of 30 new electric vehicles. Analysts seem to agree that GM has enough resources and a good team to successfully implement its ambitious electric vehicle strategy.

Wall Street analyst John Murphy believes that investors are not fully aware of GM's profitability. In the third quarter of last year, the company made a net profit of $4 billion, making GM more profitable than other electric car companies that are struggling to achieve sustainable profitability. Bank of America has a "buy" rating on GM shares, with a target price of $72.

Ferrari also performed very strongly in 2020, rising more than 37% during the year, also outperforming the s & p 500. As of January 1, 2021, the company's market capitalization was $57.566 billion, up 36.9% from a year earlier.

The growth of Ferrari's share price is driven by its strong pricing power. In 2019, the average price of a Ferrari luxury sports car was $324000, while wealthy customers seem to be more immune to the global recession caused by the pandemic. In addition, Ferrari has done a very good job of restricting the supply of cars to maintain high demand. Currently, the company's new chief executive also plans to dabble in electric cars. Bank of America has a "buy" rating on the stock, with a target price of $270.

In addition to the above-mentioned car companies, the market capitalization of traditional car companies such as Daimler, BMW, Hyundai, FCA, Kia, PSA and Suzuki have all risen to varying degrees, of which Hyundai Kia has the highest increase, with 62.8% and 73.3% respectively. In December last year, Hyundai Automobile Group officially launched its new electric global modular platform Emure GMP, which is used in Hyundai Kia's next generation pure electric vehicles. This also led to a rise in the share prices of the two companies.

The market capitalization of 8 car companies has declined, mostly in Japan.

Although Tesla's total sales are less than half of Ford's truck sales, Tesla's market capitalization is about 19 times that of Ford. As of January 1, 2021, Ford's market capitalization was $34.97 billion, down 6.4 per cent from a year earlier. The main difference between Tesla and Ford is not the type of power, but that Tesla is seen as a future-oriented brand, while Ford stays in the rearview mirror. Ford faces a huge challenge in how to transform itself from a traditional manufacturer to a flexible electric car maker.

However, Murphy pointed out that Ford may be in the early stages of rising earnings growth, thanks to global restructuring measures and an upcoming range of models. Bank of America has a "buy" rating on the stock, with a target price of $10.50.

As the best-selling carmaker in Europe and china, Volkswagen's market capitalization fell 10.3% year-on-year to $99.864 billion in 2020, still ranking third on the market capitalization list, but the company needs to be wary of being overtaken by the dark horse.

Honda's market capitalization as of January 1, 2021 was $48.174 billion, down 6.5% from a year earlier, but Nihonyanagi believes the stock has performed well given its strong balance sheet and attractive valuations. Honda trades at just 10 times forward earnings and 0.42 times sales earnings. Nihonyanagi said Honda had "considerable investment value". 'The company has a leading competitive position in the motorcycle industry, which is a long-term growth opportunity,'he said. Honda said on a recent earnings call that its top priority is to adjust costs, increase its electric vehicle sales portfolio and raise its dividend by 2.45%. Bank of America rated the stock as a "buy" with a target share price of $36.96.

In addition, car companies whose market capitalization has declined include Mitsubishi, Nissan, Subaru, Renault and Tata, while most Japanese car companies have seen their market capitalization decline. The reason may be that these car companies lag behind in the electrification competition and do not have the models that investors want to see in their product portfolio. At present, because electric vehicles are more expensive, there is a lack of corresponding charging infrastructure in Japan, and the market share of electric vehicles in Japan is even less than 1%.

However, the market capitalization is constantly changing, and the above market capitalization list does not represent the future. In order to make the market capitalization continue to jump, car companies must not only have "hard power", but also have the ability to invest "what capital likes".