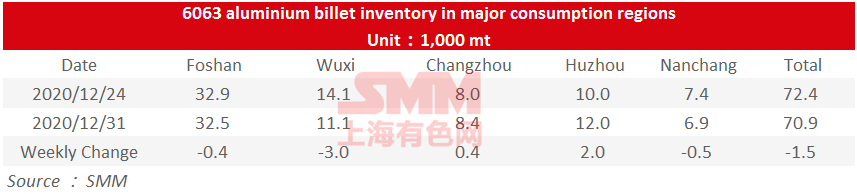

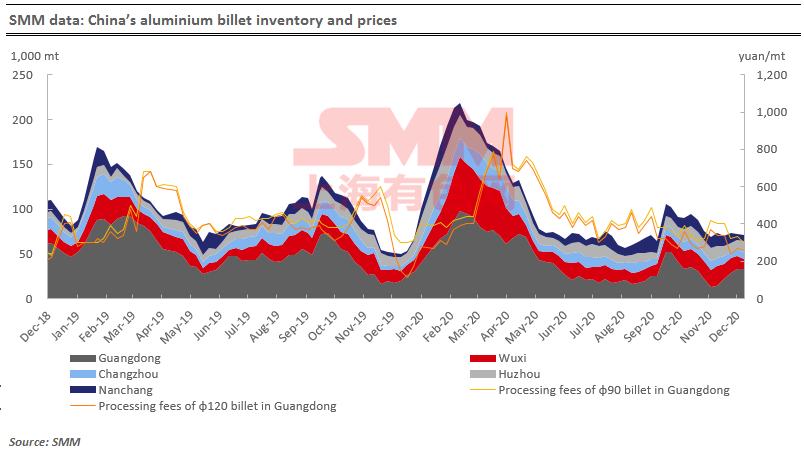

SHANGHAI, Dec 31 (SMM) – Inventories of aluminium billet in China decreased this week due to a decline in arrivals at warehouses.

SMM data showed that aluminium billet stocks across the five major consumption areas — Foshan, Wuxi, Huzhou, Changzhou and Nanchang — in China fell 1,500 mt from a week ago to 70,900 mt as of Thursday November 31.

Inventories in Changzhou, and Huzhou increased week on week. Stocks in Huzhou rose the most by 2,000 mt. Inventories in Foshan, Wuxi and Nanchang all decreased mainly due to smaller arrivals. Among them, stocks in Wuxi fell the most by 3,000 mt, and inventories in Nanchang and Foshan had a small decline.

![Qatar Production-Cut News Boosts Prices; Overnight LME Aluminum and SHFE Aluminum Both Close Higher [SMM Aluminum Morning Meeting Minutes]](https://imgqn.smm.cn/usercenter/HVmVi20251217171654.jpg)

![Overnight, cast aluminum alloy futures fluctuated and closed higher; spot cargo held up well [SMM Cast Aluminum Alloy Morning Comment]](https://imgqn.smm.cn/usercenter/BCdNp20251217171653.jpg)