SHANGHAI, Dec 21 (SMM)—Overall supply of copper under long-term contracts for next year has declined compared with last year, and the proportion of orders adopting floating pricing has increased significantly.

Market participants began long-term contract negotiations in early November. Traders quoted at $78-80/mt for the two high-quality brands and around $75/mt for mainstream pyro-copper in the wake of the benchmark of $88/mt finalised by Codelco. However, most of the offers from buyers stood below $70/mt, leading to a gridlock in trades.

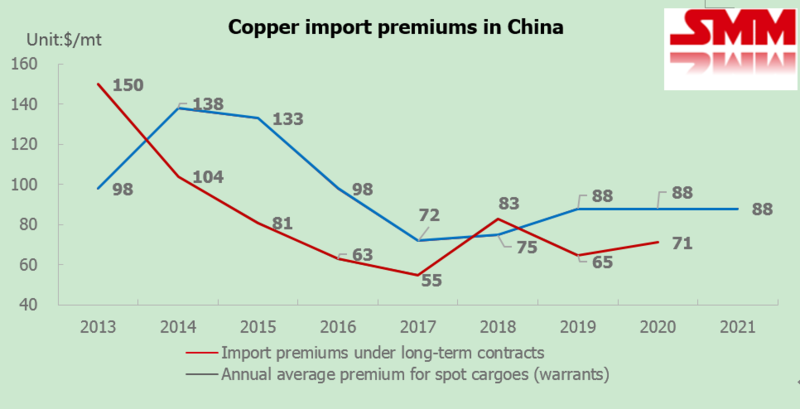

The overall import market was subdued in 2020. Imports saw a lack of opportunities with the exception of Q2 when the import window opened for an extended period. The recovery of domestic demand accelerated in Q2, while supply was tight. Brisk trades pushed up Yangshan copper premiums to the highest since October 2018. However, the SHFE/LME copper price ratio fell as weaker domestic consumption combined with large volumes of copper scrap supply driven by high copper prices lowered copper prices in China. In addition, liquidities also decreased. As such, Yangshan copper premiums fell below $50/mt. As of December 17, the average SMM Yangshan copper premium stood at $71.19/mt under warrants, and at $62.82/mt under bill of lading. The average Yangshan copper premium for high-quality copper stood at $69.92/mt, well below the $88/mt benchmark quoted by Codelco.

The market is also bearish over the import market in 2021. Overseas manufacturing has been affected by COVID-19, improving demand in China. As overseas manufacturing is gradually recovering after COVID-19, domestic demand is likely to weaken in 2021. On top of that, the implementation of new regulations on secondary copper (brass) imports will further depress demand for non-standard, non-registered and some registered hydro-copper brands. The weak market performance, together with expectations of weaker demand for imported copper have hampered signing of long-term contracts for next year.

Codelco insisted on an offer of $88/mt for the two high-quality brands. Some traders reached deals to ensure the stability of supply and maintain trades contacts, but trading volumes were limited. Japanese and South Korean smelters and domestic traders signed long-term contracts with import premiums of $70-75/mt, and the prices with downstream buyers are slightly lower. The acceptance of ISA and OLYDA brands in China has decreased due to China-Australia trade issues, increasing difficulties for Glencore and BHP in signing long-term contracts. Long-term contracts of non-registered A-grade copper imports were signed with discounts of $20/mt.

For more information on the Chinese domestic copper markets, please subscribe to China Copper Weekly.