SHANGHAI, Oct 28 (SMM)—At the 2020 China International Silver Industry Chain Summit Forum and China Silver Market Application Seminar, precious metals senior analyst Xue Na at Nanhua Futures gave a speech on "Silver Price Analysis and Forecast ahead of the US Presidential Election".

Silver demand-supply and commodity attributes

Xue Na said, silver prices were not highly correlated to its fundamentals, as historical data showed. Silver inventories at Exchange warehouses stands near its highest level since 1970s, but its prices have not fallen to the lowest.

In addition, production costs of silver were extremely low. In 2019, the cash cost of primary silver stood at $7.1/oz. The amount of primary silver accounted for 23% of total supply at mines, while associated silver was generally a by-product.

Silver investment demand and gold

The trading volume of gold and silver futures and options is much larger than that of physical gold and silver, Xue said, and on a longer term basis, ETF holdings are highly correlated with gold prices.

The large increase in silver ETF holdings was one of the recent price drivers. In the long run, the correlation between silver ETF holdings and price is not high.

However, it can be found from historical data that silver has a strong correlation with CRB index and gold. The correlation coefficient between spot silver price and the weekly closing price of CRB comprehensive spot price has been 0.90 since 2000, and 0.88 between spot silver price and the weekly closing price of gold. In addition, silver price trend is also related to economic cycles of China and the United States, especially China’s.

How will the US presidential election affect silver prices?

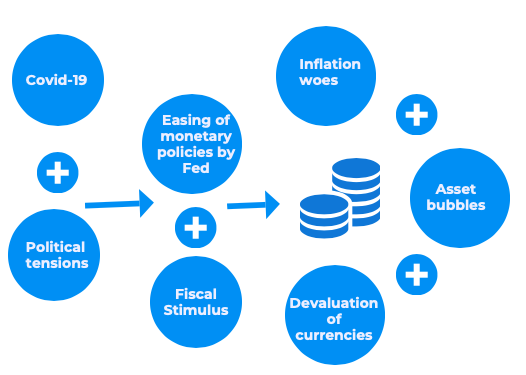

Xue Na believed that the US currency, fiscal and diplomatic policies have a greater impact on gold and silver. The US presidential election due on November 3 deserves investors’ attention.

Silver price forecast

Gold/silver price ratio

There have been a slew of macro events affecting silver prices recently, with COVID-19 cases surging in the United States and Europe. Moreover, the law of gold/silver price ratio has changed a lot, and the old one can no longer be used for arbitrage. The exchange rate of the Chinese yuan also has a certain effect on domestic gold and silver.

![This Week, Platinum and Palladium Experienced Significant Pullbacks, End-Use Demand Recovered, and Spot Market Trading Was Normal [SMM Platinum and Palladium Weekly Review]](https://imgqn.smm.cn/usercenter/obeMy20251217171735.jpg)

![Silver Prices Continue to Pull Back, Suppliers Remain Reluctant to Sell, Spot Market Premiums Hard to Decline [SMM Daily Review]](https://imgqn.smm.cn/usercenter/LVqfJ20251217171736.jpg)