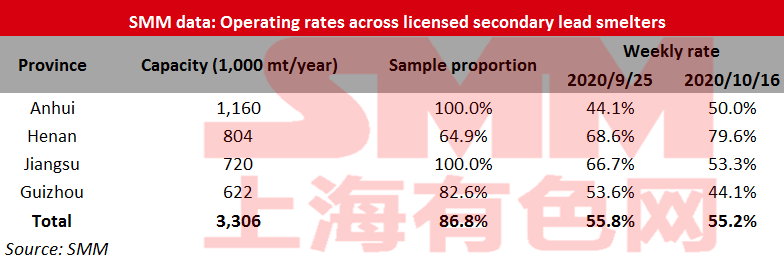

SHANGHAI, Oct 16 (SMM) – Operating rates across licensed smelters of secondary lead in Jiangsu, Anhui, Henan and Guizhou averaged 55.2% in the week ended October 16, down slightly by 0.6 percentage point from the previous week, showed an SMM survey.

Anhui Dahua and Henan Jinli’s recovery from maintenance lifted the average operating rates in the two provinces by 5.9 and 11 percentage points to 50% and 79.6% respectively.

The average operating rate in Jiangsu dropped 13.4 percentage points on the week to 53.3% as Jiangsu New Chunxing trimmed production due to shortage of battery scrap.

The average operating rate in Guizhou lost 9.5 percentage points to 44.1% as Guizhou Sanhe suspended production for maintenance.

Operating rates are expected to rise next week as Guizhou Jinlong will complete technology upgrading and Sanhe will complete maintenance, and Jiangsu New Chunxing is likely to increase output by using other scrap materials.

![SMM March 3 EV Battery Market Overview [SMM Evening News]](https://imgqn.smm.cn/usercenter/PKFMX20251217171721.jpg)

![The Most-Traded SHFE Lead 2604 Contract Closed With a Small Bearish Candlestick; It Is Expected to Maintain a Fluctuating Trend in the Short Term [Lead Futures Brief Commentary]](https://imgqn.smm.cn/usercenter/lIHfM20251217171721.jpeg)