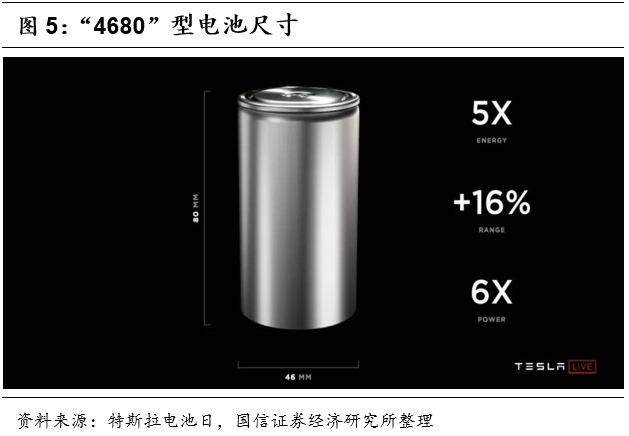

SMM News: Tesla held the annual shareholders' meeting and Battery Day at 04:30 on September 23, 2020 at the Fremont factory in California. The company released a new "4680" battery, with a 16% increase in mileage and a six-fold increase in power output. If innovations in battery, process and design become a reality, Tesla's lithium battery mileage will increase by 54 per cent, cost will fall by 56 per cent, and investment quota will fall by 69 per cent.

Guoxin Automobile View

Overall, the 56% cost reduction of Tesla lithium battery is mainly due to the upgrading and optimization of physical assembly, electrochemical system and manufacturing process. In terms of physical equipment, 1) the design scheme of the cell was upgraded from "2170" to "4680", and the cost was reduced by 14% by using non-polar ear design at the same time; in terms of manufacturing process, 2) through the innovation of dry electrode process and volumetric process, the production line efficiency was improved, the investment was reduced and the cost was reduced by 18%; in the aspect of electrochemical system, 3) the negative electrode material was improved, silicon material was introduced, and the cost was reduced by 5%. 4) cathode material improvement, hope to achieve high nickel and low cobalt, cathode processing process and resource extraction process simplification, recovery process improvement, reduce cost by 12%. 5) body process optimization, battery packaging optimization, cost reduction by 7%. It will take 12-18 months to achieve some of these goals and about 3 years to fully achieve them.

In addition, in terms of market performance, Tesla's car delivery volume will grow by 50% in 2019 and may still grow by 30% to 40% in 2020. According to Musk's above forecast, it will deliver 47.75-514500 vehicles this year, roughly in line with Tesla's previous forecast of 500000. In terms of battery capacity, the company aims to achieve 100 GWh, in 2022 and 3000 GWh, in 2030 and is expected to produce batteries in Germany. The company expects to produce 10 TW, of batteries a year in the future, including 3500 GWh for compact and medium-sized cars, 900 GWh for luxury cars and SUV,1100 GWh's Cyber Truck,3000 GWh Semi Truck, and 1500 GWh for small cars and Robotaxi. On the launch of the new model, the company expects to launch a low-cost fully self-driving model with a price of $25000 and a range of more than 520 km in three years' time. Based on the bottom-up carding and research of Tesla industrial chain, we recommend 1) Tier 1 suppliers with large bicycle value or revenue elasticity in Tesla industrial chain, 2) core parts suppliers with high technical barriers to products, 3) new energy parts suppliers with continuous new products and room for ASP improvement. Based on the above logic, the order we recommend is: 1) Ningde Times, the supplier of battery assembly, which is the core power technology of Tesla; 2) Sanhua Intelligent Control, the leading global supplier of thermal management system for new energy vehicles; 3) Top Group and Huayu Automobile with high bicycle value.

Comment

Electrochemical system: positive and negative materials are improved, and the cost is reduced by 17%.

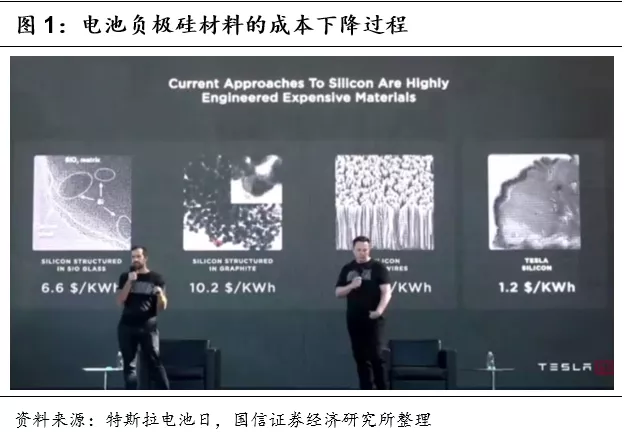

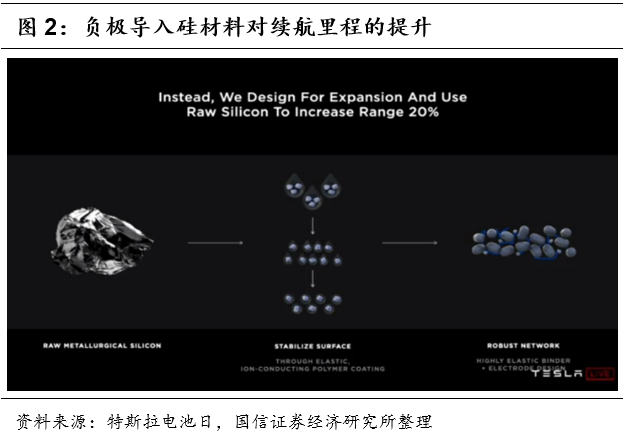

Upgrade the negative electrode material, introduce silicon material, reduce the cost by 5%; the company will gradually use silicon material to replace graphite in the negative electrode of the battery. Silicon is one of the most abundant elements in nature, and its energy storage performance is better than that of graphite. Theoretically, the energy density of using silicon as negative electrode can be increased by about 50%. In recent years, many battery manufacturers have begun to focus on the development of silicon negative electrode technology. However, silicon-based materials as negative electrodes will have a volume expansion rate of 400%, which will condense with the diaphragm, which is easy to cause rupture. The company solves this problem by redesigning high elastic materials and coating materials. The final cost is only US $1.20 / KWh, and increases the life range by 20%. The negative extreme contributes to the 5% cost reduction of the battery, and the investment is reduced by 4%.

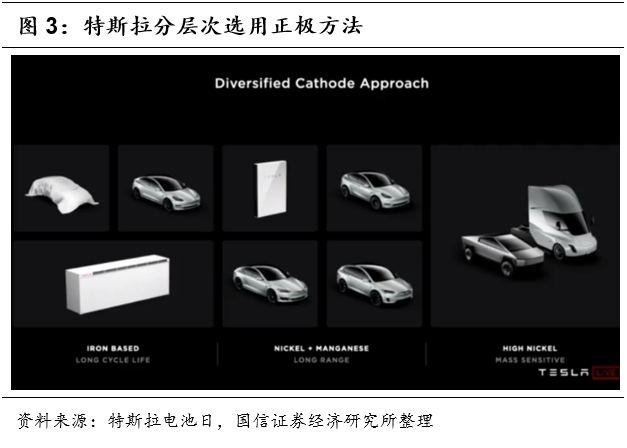

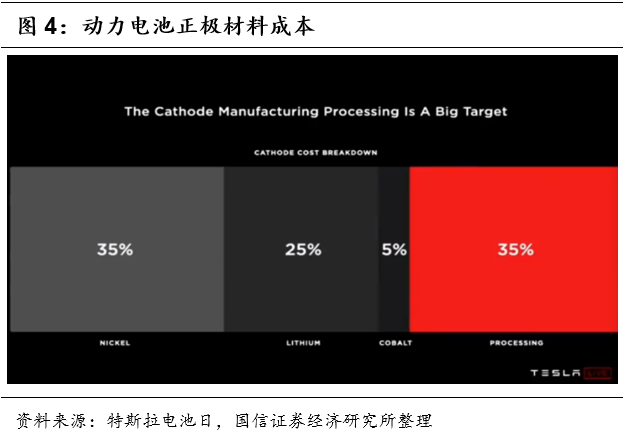

Cathode materials are upgraded to achieve high nickel and low cobalt, cathode processing and resource extraction processes are simplified, and recovery processes are improved, reducing costs by 12%. At present, batteries account for a large proportion of the cost of new energy vehicles, while among the existing lithium-ion power batteries, the cost of cathode materials accounts for a large proportion, of which cobalt accounts for as high as 30%. The cost of cobalt is high and resources are scarce. 66% of the world's cobalt production comes from the politically unstable Democratic Republic of the Congo (DRC). Cobalt is expected to be in short supply in 2026. And the content of cobalt has a great influence on the performance of the battery, cobalt partly participates in the electrochemical reaction, and its main function is to ensure the regularity of the layered structure of the material, reduce the electrochemical polarization of the material and improve its rate performance. However, too high cobalt content will reduce the actual capacity of the battery, while too low cobalt content will reduce the cyclicity of nickel-lithium ion mixed discharge, and its dosage is relatively difficult to control. The energy density of nickel metal is the highest and the cost is the lowest among the positive elements of the battery.

Therefore, increasing nickel content while reducing cobalt content is a good way to increase battery energy density and reduce cost. It is in line with our prediction of the future development path of battery technology in "Guoxin Securities-Automotive Industry Special topic-Tesla Series XII: Tesla electrification Technology Source Analysis". At present, Panasonic, LG, Ningde era and other international mainstream power battery companies are taking low-cobalt and cobalt-free battery as the next generation power battery research and development direction. On this battery day, Musk said that in the future, positive electrodes will be selected in different levels: iron batteries for medium and low battery life or energy storage; nickel manganese batteries for long battery life; and high nickel batteries for long range and high energy density. In the Cyber truck/Semi Truck, the company will use 100% nickel support, while other models will use a combination of nickel and other chemicals.

In addition to materials, Tesla will also take a series of measures to reduce battery costs, including establishing a cathode material production base in the United States to reduce 80% of the production process; publishing the preparation method of "Tesla cathode", which greatly reduces the process, simplifies the complex production process of traditional battery cathode, reduces 66% capital expenditure and 76% process cost, and achieves zero water waste. To achieve local acquisition of nickel and lithium, it has been granted the right to exploit a 10,000-acre lithium mine in Nevada; the battery recycling pilot will begin next quarter.

Physical assembly: the introduction of electrodeless ear "4680" battery, the cost is reduced by 14%

The company launched a new type of electrodeless ear "4680" battery, which is 80mm in height and 46mm in diameter, and adopts laser engraved electrodeless ear technology. Compared with the "2170" cylindrical batteries currently used in Model 3 and Model Y models, the "4680" battery has a six-fold increase in power, a 16% increase in mileage and a 14% reduction in cost per kilowatt-hour. In the process of further increasing the diameter of the battery, in addition to the expansion of capacity, but also need to consider the problem of heat dissipation, the company believes that the diameter of 64mm is a good choice.

In addition, the most important feature of this battery is the use of non-polar ear design. The polar ear is a kind of raw material of lithium-ion polymer battery, which is a metal conductor that leads the positive and negative electrode from the battery. It is needed in mobile phone battery, Bluetooth battery, notebook battery and so on in daily life. The polar ear battery has its limitations. The current battery is to laminate the multi-layer material into a thin sheet, then roll it up and stuff it into a cylindrical miniature container. The cathode, anode, and separator are rolled together and connected to the positive and negative terminals of the battery container through the cathode and anode ears, so the current must flow through the electrode ear to reach the connector outside the battery unit. However, when the current must flow along the cathode or anode to the electrode ear and out of the battery unit, the resistance will increase with the increase of distance, which also leads to the problem of charging heating. In addition, because the polar ear is an additional part, it increases the cost and makes it difficult to manufacture. In contrast, batteries designed with electrodeless ears can simplify the manufacturing process, remove the main heating components and reduce resistance. The core design idea is to directly connect the positive and negative current collector to the cover plate or shell, multiply the current conduction area, shorten the current conduction distance, reduce the charging time, greatly reduce the internal resistance of the battery, reduce the calorific value, and prolong the battery life. make high-density cells possible.

The company disclosed a new patent application for electrodeless ear battery in May 2020 and plans to mass-produce the new battery at its power battery plant in Fremont, with annual production expected to reach 10GWh by the end of 2021. Musk said that whatever battery is produced at the Fremont plant will be a complement to the 100GWh battery purchased from suppliers, and the company plans to increase the number of batteries purchased from partners such as Panasonic, LG Chemical and Ningde Times.

Manufacturing process: dry battery and other process innovation, car body and other process optimization, cost reduction of 25%

First, through the innovation of dry electrode process and chemical volumetric process, the company can improve the efficiency of production line, reduce the amount of investment and reduce the cost by 18%.

First of all, the company started from the electrode design innovation, using dry electrode process; this process comes from the previous acquisition of Maxwell, in line with our prediction in "Guoxin Securities-Automotive Industry Special topic-Tesla Series XII: Tesla electrified Technology Source Analysis".

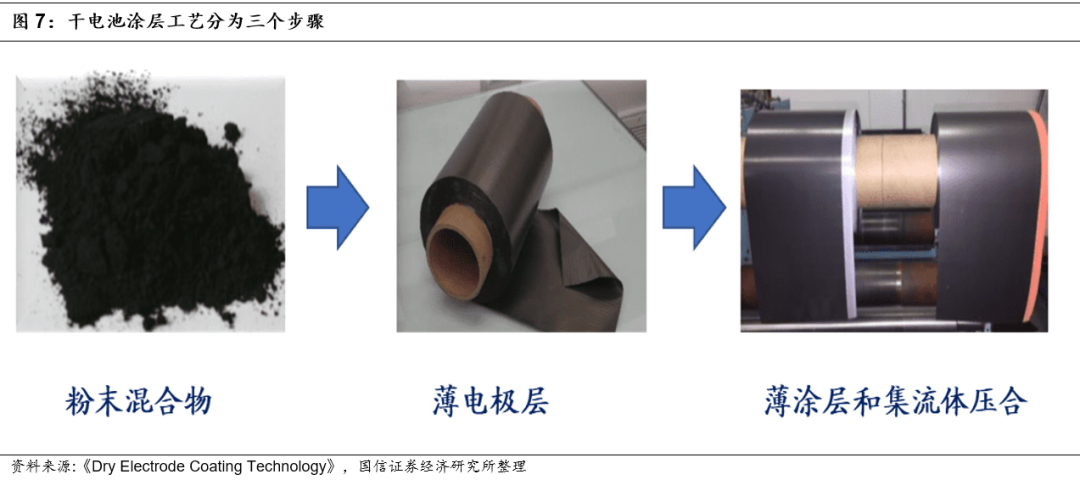

The dry cell coating process (that is, solvent-free coating process) includes three main steps: dry powder mixing, powder forming into thin coating and thin coating pressing with current collector. Specifically, when coating, the electrode particles, adhesives and conductive agents are first composed of a powder mixture, and then extruded into a continuous initial electrode material belt, wound and pressed on the metal foil collector to form an electrode. In the "Dry Electrode Coating Technology" paper published by Maxwell laboratory, it is shown that dry electrodes can be used for the manufacture of thick electrodes, as well as positive electrodes (NCM/NCA/LFP and other positive materials and aluminum foil) and negative electrodes (silicon-based materials / LTO and copper foil).

The dry electrode process is more compatible with the current mainstream high nickel battery (high nickel positive electrode + carbon silicon negative electrode) system. For positive electrode, dry electrode can effectively alleviate the problems of poor thermal stability of high nickel and easy to absorb water; for negative electrode, pre-lithiation can greatly reduce the difficulty of pre-lithiation (pre-lithiation can effectively alleviate the loss of active material caused by the formation of SEI film caused by the first charge and discharge of carbon-silicon negative electrode), and accelerate the introduction of silicon-carbon negative electrode.

The core technology of dry cell process lies in the desolvation of electrode formula and extrusion technology. The key technology of Maxwell is that in the electrode formula, a small amount of (5%-8%) PTFE powder original fibrosis is used as an adhesive, so that the positive / negative electrode materials can be self-supported to form film and roll during extrusion, so as to realize desolvation and avoid the shortcomings of traditional slurry wet method, such as toxic solvent, easy to form bonding layer to reduce electrical conductivity, electrode physical and chemical properties are changeable and so on. Compared with the wet process using solvent (the negative / positive powder is mixed with the solvent with binder and the paste is coated on the electrode collector), the dry cell process has two advantages: one is to greatly improve the efficiency, due to the dry forming process, the presence of binder in the fiber state makes lithium ion enter the active material particles better, and the battery has better conductivity. The Discharge magnification test results of the "Dry Electrode Coating Technology" paper show that under the same conditions, the dry-coated electrode has higher output power, longer cycle life, better high-temperature stability and higher charging / Discharge efficiency than the wet-coated electrode. The second is to effectively reduce the cost, the wet process needs to use a relatively more complex electrode coating machine, and the toxic solvent needs to be dried and recovered in the oven, so the simplified dry process has certain advantages in equipment investment, material cost and worker cost.

According to Maxwell research, the dry cell process developed by it has the following advantages:

(1) High energy density: at present, the dry electrode technology has achieved an energy density breakthrough of 300 Wh/kg (10% of the ultra-wet process), and is expected to exceed 500 WhCompkg in the future;

(2) long cycle life: the life of the wet process is about 2 times that of the wet process;

(3) lower cost: compared with the wet process, the cost is reduced by 10%, 20%, and the cost per bike is reduced by nearly US $20-1000;

(4) Environmental protection and technology extension: no toxic solvent, it is expected to be used in new materials / cobalt-free batteries / solid-state batteries, etc.

In addition to the above advantages, the company's dry motor process optimizes the previous dry motor scheme, which achieves 10 times the process simplification of the traditional scheme and achieves the best output rate.

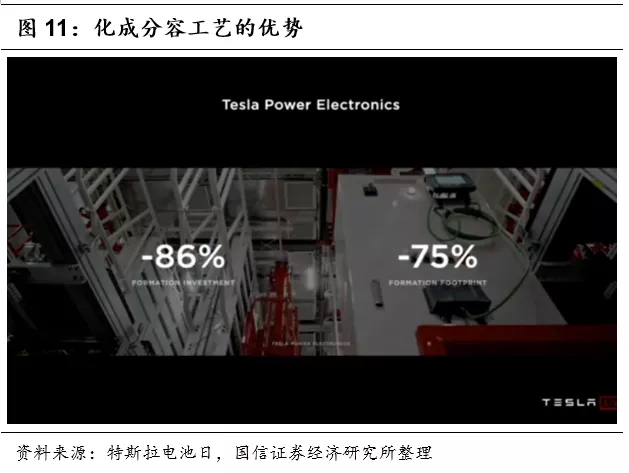

Secondly, the innovation of the formation and separation process also contributes to the cost reduction; the formation can not only convert the active material in the battery into a substance with normal electrochemical effect by means of the first charge, but also form an effective passivation film or SEI film on the negative surface of the battery. The purpose of capacity separation is to sort and classify the capacity and performance of the battery. The company hopes to reduce complex processes by 75% and cost savings by 86% through the management of electronic systems.

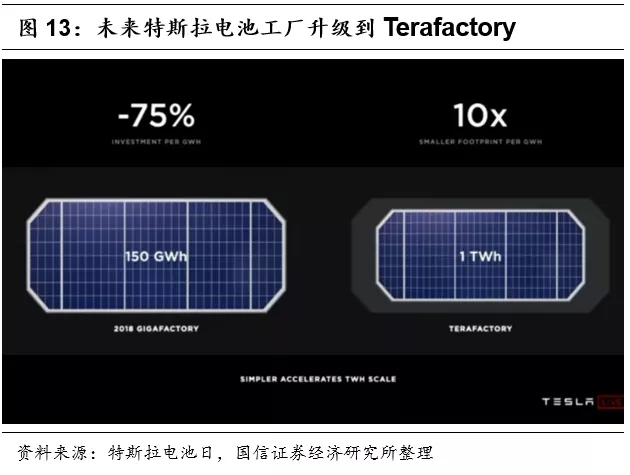

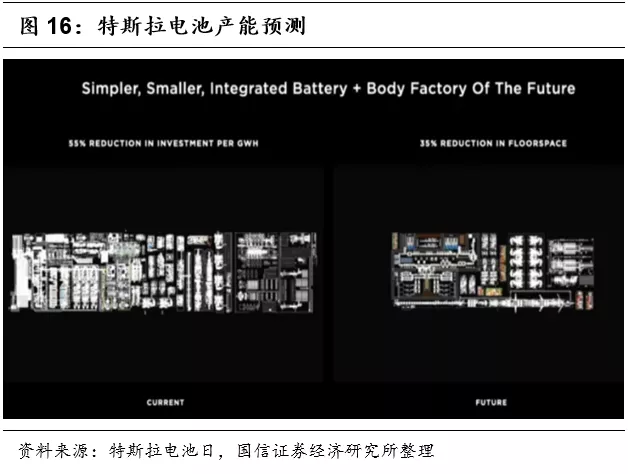

Finally, the company plans to set up a high-performance battery assembly line, hoping to achieve continuous assembly processing; the company plans to achieve 20GWh output on a single assembly line, and the single-line output will be increased seven times. In addition, the company hopes to form integrated production to replace independent production, and eventually all factories have to form automated, intelligent and efficient production lines. Through the improvement of the process, the company expects the final battery plant to reduce investment by 75% and achieve output per unit area of 10x. In addition, the battery factory will move from Gigafactory to Terafactory, that is, a single plant with a production capacity of 1TWh. the company plans to achieve a total battery capacity of 100GWhh in 2022 and 3TWhin 2030. The company also plans to produce batteries at a factory in Germany, which is currently under construction. The company hopes to produce 10 MW of batteries a year in the future, including battery requirements for 3500GWh compact and medium-sized cars, 900GWh luxury cars and SUV,1100GWh 's Cyber Truck,3000GWh Semi Truck, and 1500GWh small cars and Robotaxi.

Second, the company reduces the cost by 7% through body process optimization and battery packaging optimization.

First of all, the company optimizes the processing of the whole car body; the front and tail of the car can be designed by alloy casting and other methods.

Secondly, the company optimizes the structure of the battery outside the cell; by optimizing the battery package, the company hopes that the battery structure can be more compact, the battery can be bonded in a better way, and has stronger stability. The internal space of the battery is more structural. In addition, the company will build the battery directly into the car structure to achieve a better combination of the battery and the car body, which will reduce the production of 370 parts, speed up production while reducing the overall weight of the vehicle by 10%, and increase the mileage by 14%. The company also wants the battery to be installed closer to the center of the body, making the model more controllable.

Delivery is expected to reach 500000 vehicles in 2020, and the Shanghai factory will produce 1 million vehicles a year in the future.

In terms of car production capacity, Tesla's car delivery will grow by 50% in 2019 and may still grow by 30% to 40% in 2020. According to Musk's forecast, it will deliver 47.75-514500 vehicles this year, roughly in line with the company's previous forecast of 500000. Musk also mentioned that the company is the only 100% foreign-funded car company in China, setting an annual production target of 1 million vehicles at the subsequent Shanghai plant. In addition, for the company, the cycle from procurement to vehicle delivery is getting shorter and shorter, and it is expected to set up at least one factory on every continent in the world, which will ensure the company's mobility and shorten the delivery cycle. At present, there are factories in China, the United States and Europe, and we hope to set up factories in Australia in the future.

On autopilot, Musk said that the average level of self-driving industry in North America is 2.1 accidents per million miles. Tesla's accident probability of Autopilot has been reduced to 0.3 per million miles. He believes that Tesla's self-driving vehicles are 10 times safer than humans, and he hopes to use 3D to enable Autopilot in the future.

On the launch of the new model, the company expects to launch a low-cost fully self-driving model with a price of $25000 and a range of more than the 520km in three years' time. The company also launched Model S Plaid,Model S Plaid to achieve the new highest performance based on the flagship model Model S. In terms of performance parameters, the new three-motor all-wheel drive car will have a range of more than 520mph, a top speed of 200mph and a horsepower of more than 1100 horsepower. Due to the EPA standard used by Tesla, the test results are closer to the actual operating conditions. In addition, the zero acceleration time of the, Model S Plaid is less than 2 seconds, and the acceleration of 1/4 miles is less than 9 seconds. The Model S Plaid is available in five body colors, namely, pearl white, pure black, metallic silver, dark blue and red. Tire models are available with 19-inch Tempest tires and 21-inch Sonic Carbon twin-turbine tires. Tesla is already taking orders from Model S Plaid, and the new car is expected to be delivered later in 2021, with prices starting at $139990.

Risk hint

First, Tesla's delivery in 2020 fell short of expectations.

Second, health incidents broke out again in autumn and winter, resulting in less-than-expected recovery of factory capacity.

Investment suggestion: continue to recommend Tesla's domestic industrial chain

Overall, the 56% cost reduction of Tesla lithium battery is mainly due to the upgrading and optimization of physical assembly, electrochemical system and manufacturing process. In terms of physical equipment, 1) the design scheme of the cell was upgraded from "2170" to "4680", and the cost was reduced by 14% by using non-polar ear design at the same time; in terms of manufacturing process, 2) through the innovation of dry electrode process and volumetric process, the production line efficiency was improved, the investment was reduced and the cost was reduced by 18%; in the aspect of electrochemical system, 3) the negative electrode material was improved, silicon material was introduced, and the cost was reduced by 5%. 4) cathode material improvement, hope to achieve high nickel and low cobalt, cathode processing process and resource extraction process simplification, recovery process improvement, reduce cost by 12%. 5) body process optimization, battery packaging optimization, cost reduction by 7%. It will take 12-18 months to achieve some of these goals and about 3 years to fully achieve them.

In addition, in terms of market performance, Tesla's car delivery volume will grow by 50% in 2019 and may still grow by 30% to 40% in 2020. According to Musk's above forecast, it will deliver 47.75-514500 vehicles this year, roughly in line with Tesla's previous forecast of 500000. In terms of battery capacity, the company aims to achieve 100 GWh, in 2022 and 3000 GWh, in 2030 and is expected to produce batteries in Germany. The company expects to produce 10 TW, of batteries a year in the future, including 3500 GWh for compact and medium-sized cars, 900 GWh for luxury cars and SUV,1100 GWh's Cyber Truck,3000 GWh Semi Truck, and 1500 GWh for small cars and Robotaxi. On the launch of the new model, the company expects to launch a low-cost fully self-driving model with a price of $25000 and a range of more than the 520km in three years' time. Based on the bottom-up carding and research of Tesla industrial chain, we recommend 1) Tier 1 suppliers with large bicycle value or revenue elasticity in Tesla industrial chain, 2) core parts suppliers with high technical barriers to products, 3) new energy parts suppliers with continuous new products and room for ASP improvement. Based on the above logic, the order we recommend is: 1) Ningde Times, the supplier of battery assembly, which is the core power technology of Tesla; 2) Sanhua Intelligent Control, the leading global supplier of thermal management system for new energy vehicles; 3) Top Group and Huayu Automobile with high bicycle value.