SMM9 March 1: the LME metal market was all red this morning. As of 09:35, Lunni rose nearly 1.2%, Lunxi rose nearly 1.1%, Lunzn Zinc rose nearly 0.9%, Lunn Copper rose nearly 0.8%, Lunn lead rose nearly 0.5%, Lun Aluminum rose nearly 0.5%. Domestically, Shanghai lead rose nearly 1.2%, Shanghai Zinc rose nearly 1.1%, Shanghai Nickel rose nearly 0.7%, and Shanghai Copper rose nearly 0.6%, respectively, on the domestic front, Shanghai lead rose nearly 1.2%, Shanghai Zinc rose nearly 1.1%, Shanghai Nickel rose nearly 0.7%, and Shanghai Copper rose nearly 0.6%. Shanghai tin rose nearly 0.2%, while Shanghai Aluminum fell nearly 0.1%.

With regard to zinc, the second round of central eco-environmental protection inspectors will be launched in an all-round way recently. Seven central eco-environmental protection inspection teams have been set up and the inspectors have been stationed for about one month, of which Tianjin is also among them. Consumption in Tianjin is weaker than expected due to the inspection and suspension of production by acid-related enterprises, which weakens the boost of consumption expectations anchored in the early stage of the market. Short-term environmental protection in the lower reaches of Tianjin has an impact on consumption, or limits the rise of domestic zinc prices. Looking forward to September: the macro mood is still optimistic and zinc prices can still be expected, but in the short term, environmental protection in the lower reaches of Tianjin has an impact on consumption, or limit the height of domestic zinc prices, the follow-up should pay attention to the impact of environmental protection and inventory changes.

[SMM monthly Outlook] Zinc prices in Shanghai are limited by environmental factors, but zinc prices can still be expected in September.

In terms of tin, in the short term, in terms of macro, fundamental and technical aspects, the price of tin is more favorable. In the medium term, we should always pay attention to Sino-US relations and foreign epidemic control, which will eventually affect the source and export volume of tin mines, and loose relief will support tin prices to a certain extent; fundamentals within 2-3 months, there is a certain supply support below tin prices. On the supply side, the reduction in tin production in Myanmar is expected to last until October, with a reduction of about 1000 metal tons per month. In addition, about 2700 tons of tin were imported in July, which was almost consumed in July and August. The domestic silver mine is under construction, and the supply of tin ore is expected to return to about 600 tons of metal in the normal plant in September. Taken together, it is expected that tin supply will be reduced by about 2000 tons in September compared with August, which may support tin prices. On the demand side, preliminary research shows that the output of the solder industry increased slightly in August compared with July, which is related to the traditional peak season of the industry.

[SMM monthly Outlook] tight supply, small increase in demand, short-term tin price is expected to be high.

In terms of black series, the thread rose nearly 0.3%, the hot coil rose nearly 1.3%, stainless steel fell nearly 0.7%, coke rose nearly 1.3%, coking coal rose nearly 0.9%, iron ore was flat, thread, boosted by the news of production restrictions and the weekend billet strong pull up 50 yuan / ton, today's threaded market performance is strong-the snail closed up 1.67% to 3779. The mainstream spot markets have risen 20-70 yuan per ton since the weekend. The overall market trading atmosphere is also very active, in addition to the terminal "routine" replenishment, speculative demand is also actively released.

A brief comment on the spot Thread on August 31: is it expected to soar in an all-round way, and the demand has already been "seen in the clouds"?

Last-issue crude oil fell nearly 0.6%. NYMEX crude oil futures fell on Monday, while Brent crude fell from a five-month high as global demand remained below pre-novel coronavirus levels and US production rose slightly. Us oil production rose 420000 b / d to 10.44 million b / d in June, according to a monthly report released by the (EIA) on Monday. The news put further pressure on oil prices. Oil production has fallen along the Gulf Coast as energy companies continue their efforts to restore drilling rigs and refineries that were shut down before last week's two storms.

In terms of precious metals, Shanghai gold rose nearly 0.5%, while Shanghai silver rose nearly 1.8%. Comex futures rose on Monday, as the US Federal Reserve (Federal Reserve / FED) dovish policy shift dragged the dollar to its lowest level in two years, but gold prices will fall for the first time in five months. Analysts point out that there is less risk aversion in global markets right now, with some restrictions on the rise of gold, which is used as a safe haven. There is great concern that the market may rise too much and there may be some profit-taking, which could lead to a shift to gold.

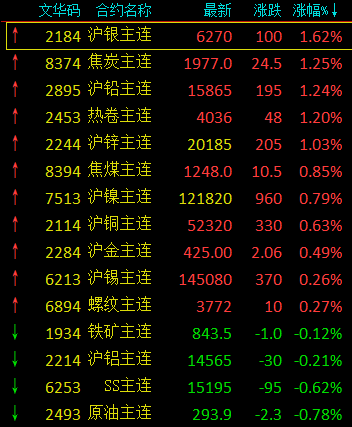

As of 09:30, the status of contracts in the metals and crude oil markets:

Click to understand and sign up for the 2020 China Automotive New Materials Application Summit Forum.

Please fill in your personal information on the last page and the meeting staff will contact you later!