SHANGHAI, Aug 7 (SMM) – This is a roundup of China's base metals output in July 2020, from an exclusive survey of key producers by SMM analysts.

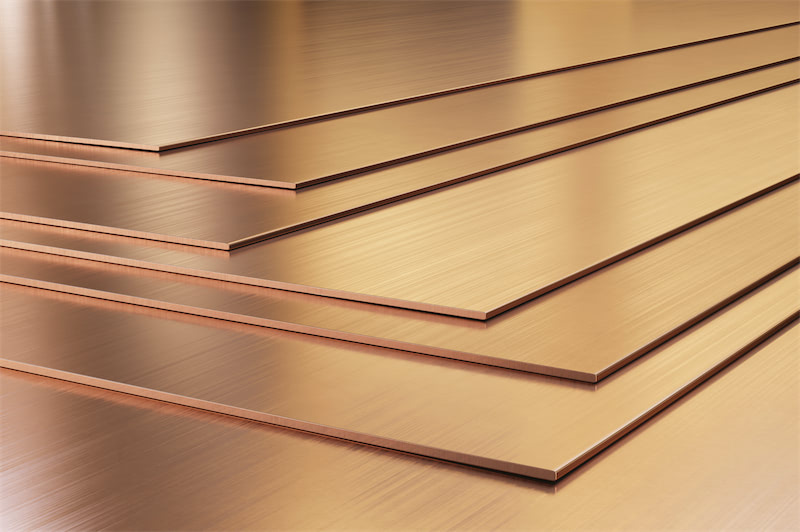

Copper

China’s copper cathode output shrank in July as some smelters conducted maintenance to deal with shortage of copper concentrate.

SMM data showed that China’s copper cathode output stood at 749,500 mt in July, down 1.28% on month and 0.75% on year. Output totalled 5.18 million mt in the first seven months of 2020, up 3.05% from the same period last year.

On the other hand, copper cathode output is expected to rise in August as supply of supply of blister copper made of copper scrap has increased and seaborne blister copper arrived at ports.

SMM expects domestic copper cathode output to rise 5.92% from July and 3.41% from a year earlier to 793,900 mt in August, and total output in the first eight months to increase 3.1% on year to 5.98 million mt.

Alumina

China’s alumina output stood at 5.91 million mt in July. This included 5.7 million mt of metallurgical-grade alumina, with the daily output up 0.29% on the month and 0.04% on the year to 183,800 mt. Output of metallurgical-grade alumina in the first seven months of the year totalled 38.34 million mt, 6.54% lower on the year. Luoyang Wanji, SPIC Aluminium & Power Investment and Chongqing Bosai restored some capacities, while flexible production at Chinalco affected some output.

As of early August, the operating capacity of metallurgical-grade alumina stood at 67.15 million mt/year. SMM sees output of metallurgical-grade alumina at 5.72 million mt in August, with the daily output maintaining at around 184,700 mt. Falling alumina prices and tight supply of domestic bauxite are likely to deter plants in Shanxi and Henan from recovering. In addition, some alumina plants reduced output.

Aluminium

China’s primary aluminium output rose 1.83% year on year to 3.12 million mt in July (31 days), showed an SMM survey. As of the end of July, there was 41.41 million mt among 41.23 million mt per year of existing primary aluminium capacity in operation, while operating rates across Chinese primary aluminium producers inched up 0.5 percentage point to 89.5% as high margins encouraged newly commissioned and resumed capacities to ramp up.

During the first seven months of 2020, China’s primary aluminium output increased 2.76% year on year to 21.13 million mt, while consumption rose 1.8% to 21.18 million mt. More new capacities in Yunnan and Inner Mongolia will be commissioned in August, increasing the annual operating capacity to about 36.97 million mt.

China’s production of primary aluminium is expected to increase 4.5% to 3.14 million mt in August (31 days) from a year earlier. The month-on-month increase in actual consumption is likely to slow to 3.18% in August.

Nickel

China produced 14,600 mt of refined nickel in July, down 3.05% or 460 mt from June, but up 15.73% from a year earlier.

Output across Gansu smelters stood flat on month, but rose 30% from the same period last year. No maintenance plans have been heard by far amid stable production environment and moderate shipments.

July output in Liaoning and Tianjin held largely unchanged from June as local smelters kept normal production.

July output across smelters in Xinjiang fell 37% month on month as part of the output will be classified into August statistics and some lines shifted to electro oxidation slots production.

Output in Shandong declined 16.67% as smelters reduced operating capacity to ease pressure.

SMM expects China’s refined nickel output to rise to 14,800 mt in August as production lines have recovered and part of July output will be classified into August statistics. The COVID-19 outbreak in Xinjiang will affect local transportation of raw materials.

Nickel pig iron (NPI)

China’s NPI output fell 3% from June and 14.74% from a year earlier to 43,200 mt (Ni content) in July. This included 36,000 mt (Ni content) of high-grade NPI, down 3.87% on month, and 7,200 mt (Ni content) of low-grade NPI, up 1.56% month on month. Maintenance at some NPI plants led to the decline in high-grade NPI output. Some integrated steel makers increased output of #200 stainless steel, contributing to the rise in low-grade NPI output.

SMM expects China’s NPI output to rebound 1.9% on month to 44,100 mt (Ni content) in August as some plants will return to normal production from maintenance. High-grade NPI output is likely to increase 2.16% to 36,800 mt (Ni content), and low-grade NPI output to inch up 0.56% to 7,300 mt (Ni content) in August, both on a monthly basis.

Demand for NPI increased as stainless steel output expanded, but the rise in NPI imports from Indonesia failed to accelerate as Indonesian stainless steel makers also raised output. Tighter domestic NPI supply may buoy NPI prices, which is likely to limit the decline in third-quarter NPI output in China.

Nickel sulphate

China produced 52,300 mt of nickel sulphate in July, or 11,500 mt in nickel content, up 16.35% from June and 2.8% from a year ago. This included 45,200 mt of battery-grade nickel sulphate and 7,100 mt of electroplating-grade nickel sulphate. As orders from downstream users improved, some nickel salts plants resumed operations and some raised output slightly.

SMM expects nickel sulphate output to rise 4.49% on month to 12,000 mt (Ni content) in August as some producers will slightly raise output as inventories have declined for three straight months.

Zinc

China’s refined zinc output increased in July as some smelters which had trimmed output due to shortage of zinc concentrate raised production and some smelters recovered from maintenance.

SMM data showed that China’s refined zinc output stood at 492,800 mt in July, rising 27,400 or 5.9% on month and 0.44% on year. Output totalled 3.36 million mt in the first seven months of this year, up 3.95% from the same period last year.

SMM expects refined zinc output to expand 1,200 mt to 494,000 mt in August. Domestic refined zinc smelters kept raw material stocks that could guarantee production for about 28 days in August. Rising treatment charges (TCs) for domestic zinc concentrate and higher zinc prices buoyed smelters’ profits, which encouraged them to raise output. Meanwhile, smelters in Inner Mongolia and Henan planned to start routine maintenance.

Lead

China’s primary lead output ended its four-month increases and fell by more than 10,000 mt in July as primary lead smelters, including Yunnan Chihong, Jiangxi Copper, Hunan Shuikoushan and Jingui, undertook routine maintenance. Besides, equipment breakdown across some smelters in Henan, Jiangxi and Yunnan further weighed on July output.

SMM data showed that China produced 259,000 mt of primary lead in July, down 3.82% from June, but up 17.3% from a year ago. For January-July, output increased 3.31% from the same period last year.

SMM expects China’s primary lead output to expand to 273,000 mt in August. Lead prices rose in August, with the most-traded SHFE 2009 lead contract touching 15,850 yuan/mt. Improved profits encouraged smelters to produce. Henan Yuguang completed upgrading of production lines, and Yunnan Chihong and Hunan Shuikoushan recovered from maintenance.

Tin

China’s refined tin output fell MoM in July as a large-scale smelter in Yunnan suspended production for maintenance.

SMM data showed that China produced 10,057 mt of refined tin in July, down 19.48% from June. Recovery of mines and maintenance at the large-scale smelter eased tight supply of tin ore. Improved consumption and rising feedstock supply prompted other smelters to increase output.

SMM learned that Myanmar has effectively contained Covid-19 at home and is expected to reopen its border till the end of August, which will ease the tight supply of tin ore. Demand is unlikely to rise significantly in August, a traditional low consumption season.

Refined tin output is likely to rebound to 12,000 mt in August, SMM estimates.