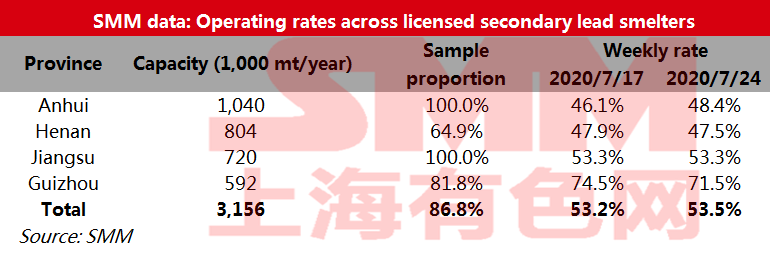

SHANGHAI, Jul 24 (SMM) – Operating rates across licensed smelters of secondary lead in Jiangsu, Anhui, Henan and Guizhou averaged 53.5% in the week ended July 24, up 0.3 percentage point from the previous week, showed an SMM survey.

The average rate in Anhui climbed 2.3 percentage points to 48.4%, as capacity ramped up at Anhui Dahua after debugging of equipment.

The rate in Jiangsu held largely unchanged from a week ago at 53.3% as continued tight supply of battery scrap prevented smelters from raising output. Local smelters mostly maintained normal operations.

The average operating rate in Henan came in at 47.5%, down 0.4 percentage point on the week. This was due to a decline in output at Henan Yuguang amid a shortage of battery scrap, which offsetted the resumption of production lines at Henan Jinli.

Guizhou Cenxiang scaled back production as it shut down for several days this week, leading to a drop of 3 percentage points in the average operating rate in Guizhou, to 71.5%.

Lead prices hovered at low levels and supply of battery scrap remained tight with elevated prices this week. This weighed on profits at secondary lead smelters and may depress their near-term production. Secondary lead smelters operating rates are expected to retreat next week as some smelters have planned for output cut next week, SMM learned.