SMM, July 14:

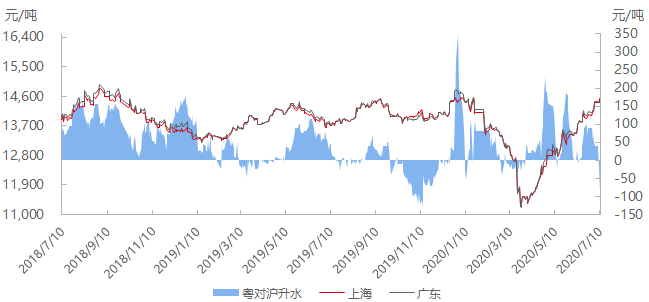

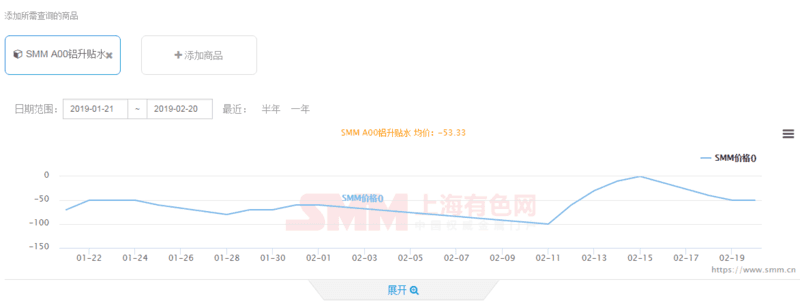

In the morning period, the spot in South China is weak, the market discount quotation is in the majority, and there are not many large purchases. The mainstream transaction price is 14780 Mel 14800 yuan / ton, with a small amount of low price around 14770 yuan / ton. The futures in the secondary period are strong and volatile, and the spot price adjustment is also small. The transaction price is 14780 Mel 14800 yuan / ton, and the rising water turnover is few. The upside-down range of spot prices in Guangdong and Shanghai has narrowed, with a transaction spread of 150 yuan per ton. 07 contract fell sharply, spot to 07 contract discount of about 100 yuan / ton, Shanghai aluminum 07 / 08 difference in the range of 300 RMB500 / ton fluctuated sharply. Imported aluminum ingots continue to be heavily discounted domestic aluminum ingots, public warehouse stocks continue to rise, the supply of goods in circulation in the market is relatively abundant, Shanghai aluminum 07 contract expires tomorrow, the period is now expected to return.

(SMM Tong Lin 0757Mui 85511521)

"Click to view SMM historical price data