The main reason for the negative return of copper in Shanghai is that the number of people applying for unemployment benefits from the United States to the week of July 4 announced last night fell for the 14th consecutive week, but the number is still more than one million, and it has been high for 16 consecutive weeks, and the number of unemployed has remained high. Investor optimism has cooled; In addition, tensions between China and the United States have further escalated, and global investors are worried that another deterioration in trade relations between the two countries will damage the economy, putting pressure on copper prices. Fundamentally, the epidemic in South America has not been effectively alleviated, the copper strike in Chile continues to ferment, workers are voting on whether to accept the final wage agreement or strike, and the market tension on copper supply has not been effectively alleviated, supporting copper prices are still high.

A brief comment on SMM

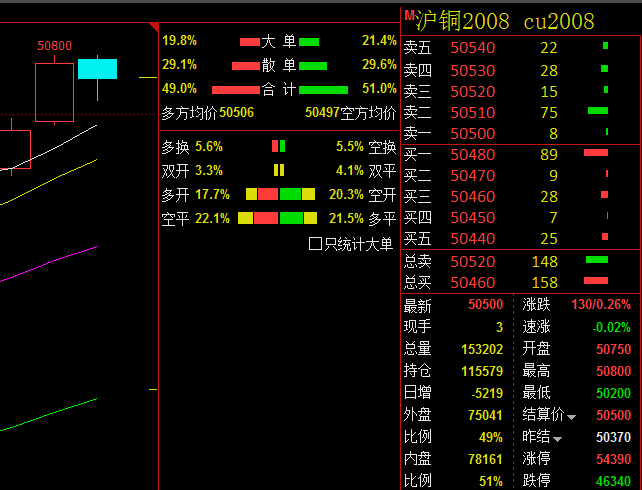

The negative results for copper in Shanghai were mainly due to the 14th consecutive week of decline in the number of jobless claims announced last night in the United States to the week of July 4, but the number is still more than one million, and the number of unemployed has remained high for 16 consecutive weeks. investor optimism has cooled somewhat; in addition, tensions between China and the United States have further escalated, global investors are worried about the deterioration of trade relations between the two countries and damage the economy, and the macro situation is cold to put pressure on copper prices. Fundamentally, the epidemic in South America has not been effectively alleviated, the copper strike in Chile continues to ferment, workers are voting on whether to accept the final wage agreement or strike, and the market tension on copper supply has not been effectively alleviated, supporting copper prices are still high. Today, the main force of Shanghai copper opened at 50470 yuan / ton in the morning, and the copper price rose rapidly after the opening, but with the decline of many flat into the market, after a short adjustment, the copper price rose from the position of 50420 yuan / ton, rising all the way, climbing a daily high of 50660 yuan / ton, and closed at 50600 yuan / ton in midday trading. Opening in the afternoon, the market fell rapidly, exploring the intraday low of 50290 yuan / ton. at this time, the bears made a profit and the copper price rebounded upwards, and finally closed at 50500 yuan, up 130 yuan / ton, up 0.26%. The intraday 08 contract reduced 5219 positions to 116000 positions, mainly by long positions; trading volume increased by 9000 lots to 153000 lots; and Shanghai Copper 07 contracts reduced positions by 6055 lots to 13000 lots, mainly by long positions.

Today, Shanghai copper negative, KDJ opening convergence, but the bottom is still far away from multiple moving averages, the technical side of copper prices still have room to rise. Wait for the outer disk guidelines at night to test whether the bulls can continue to make efforts to support copper prices to continue to rise.

Spot market

Today, the spot price of electrolytic copper in Shanghai is quoted at a discount of 10 yuan / ton to 20 yuan / ton, flat copper price of 50560 yuan / ton to 50650 yuan / ton, and copper price of 50570 yuan / ton to 50660 yuan / ton. Copper futures in Shanghai remained high and fluctuated at 50600 yuan / ton. Approaching the delivery cycle, speculators prefer low-cost sources of goods, the morning market quoted 10 ~ 30 yuan / ton, the market is not attractive. Speculators take advantage of the opportunity to lower the price, and the quotation is reduced to 10 yuan / ton, and there is still room to enlarge the price. Around 10: 00, the flat copper price can be reduced to 10 yuan / ton at a discount, while the price of good copper is limited to 10 yuan / ton to 20 yuan / ton. Downstream bargain buying, wet copper than yesterday slightly narrowed to 80 ~ 60 yuan / ton discount. The market continues to show the characteristics of strong and weak in the period, and the fear of heights continues to ferment, restraining market consumption, but with the approaching delivery period, the base margin continues to narrow, which limits the room for expansion under the discount to a certain extent, but the supply of goods in the market is still loose. It is also difficult to lift the water again.

Today, the spot price of electrolytic copper in Guangdong province is quoted as a rise of 160 won 190 for that month's contract, with an average price increase of 55 yuan per ton, while wet copper is quoted at 100 to 110 yuan per ton, with an average price increase of 50 yuan per ton. The average price of electrolytic copper is 50730 yuan / ton, while that of wet copper is 50660 yuan / ton. Spot market: inventory continues to decline, the holder is firm price willingness, in early trading is flat copper once reported at 170max 180 yuan / ton, but near the weekend and shipments significantly increased, rising water dropped, intraday reported 140gamma 150 yuan / ton, some imported copper is reported to 120 yuan / ton; However, some holders suddenly raised their prices to 170 yuan / ton, but there were not many underwater buyers in Gaosheng, and finally the market returned to 150 RMB 160 yuan / ton. On the whole, the Guangdong market quotation is chaotic today, there are bullish bearish and rising water, but the excessive rising water suppresses the trading sentiment of the market. We believe that the recent tight supply in Guangdong is the main reason for the market divergency. looking forward to next week, we do not expect a large number of goods to arrive before delivery, and the rising water in the first half of next week may remain at a high level, making it difficult to plummet.

Yangshan copper

Today's warehouse receipt is quoted at US $85 per ton, the average price is unchanged from the previous day, and the bill of lading is quoted at US $77 per ton, the average price is unchanged from the previous day, QP August. LME0-3 rising water is 0.35 US dollars / ton, and the import loss is around 200yuan / ton.

After a brief rebound in market activity yesterday, today's foreign trade market returned to a cold state, demand weakened again, and transactions were limited. In the case of simultaneous rise in internal and external copper prices, the actual demand downstream has also been suppressed, in the face of traders with higher quotations, low willingness to receive goods. At present, at the end of July, the price of the second brand bill of lading in Hong Kong is around US $90 / ton, the mainstream fire method is about US $85 / ton, and the wet offer is US $80 / ton. Warehouse receipt prices remain high, and the mainstream fire offer is still around $100 / ton, with few transactions.

At present, the transaction price of fire good copper warehouse receipt is around US $100 / ton, mainstream fire method is US $95 / ton, wet method is 85 yuan / ton, good copper bill of lading is US $88 / ton, mainstream fire bill of lading is US $83 / ton, and wet method is US $77 / ton.

Inventory

Today's LME copper inventory of 181075 tons, a decrease of 4125 tons, or 2.23%, compared with the previous trading day.

"Click to participate in the second China (Yingtan) Copper Industry Summit Forum and the 15th China International Copper Industry chain Summit"

Scan the code to sign up for the summit or apply to join the SMM industry exchange group: