SMM7 March 9:

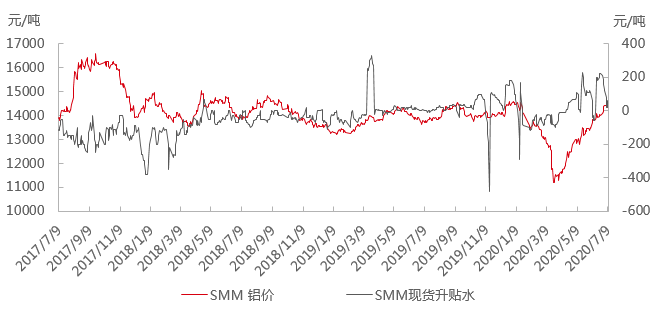

Aluminum concussion uplink before noon. Before noon, the spot price in Shanghai was between 14520 and 14540 yuan / ton, while the price in Wuxi was between 14530 and 14550 yuan / ton, which was nearly 190 yuan / ton higher than yesterday's price. the price in Hangzhou was between 14520 and 14540 yuan / ton, while the price in Hangzhou was between 14520 and 14540 yuan / ton. In the morning, the supply of goods in the market is extremely tight, the number of consignors overwhelmingly exceeds that of shippers, and the price of the holder is firm and the shipment is smooth, but the market is still unsatisfactory because of the shortage of goods. Although a large family normally announces the purchase plan, but from the price point of view, it is expected that the actual transaction is not much. Today, downstream goods are mainly shipped on demand, and the sharp rise in aluminum prices suppresses its willingness to receive goods. The overall transaction in East China is poor today.

(Xu Man 021 muri 51595898)