In this article, copper is still running at a high level in Shanghai, and the epidemic continues to spread to dampen some optimism, but the sustained economic recovery at home and abroad still gives strong support to the upward price of copper. Codelco said it would suspend construction at the El Teniente copper mine to expand production, as concerns about tight copper supplies simmered again, helping to push copper prices higher.

A brief comment on SMM

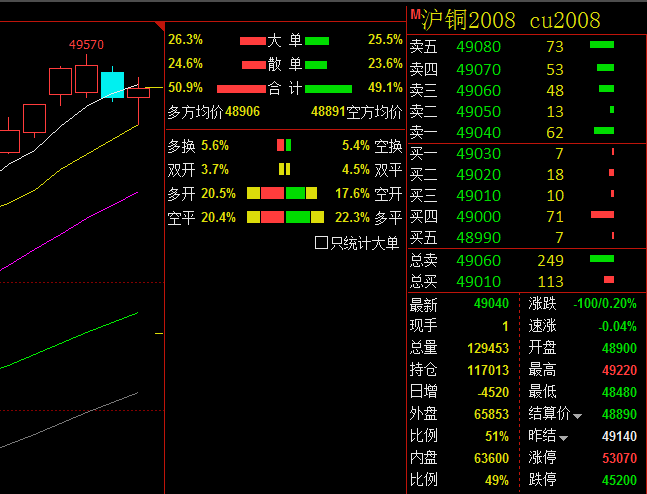

During the day, copper in Shanghai remained at a high level, and the epidemic continued to spread to dampen some optimism, but the sustained economic recovery at home and abroad still gave strong support to the upward price of copper. Codelco said it would suspend construction at the El Teniente copper mine to expand production, as concerns about tight copper supplies simmered again, helping to push copper prices higher. Today, the main copper in Shanghai opened at 48930 yuan / ton in the morning. Copper prices briefly fell after the opening, then fluctuated higher, and the bulls made a profit before midday. Copper prices briefly fell to 48990 yuan / ton, and then rebounded to close at 49050 yuan / ton. In the afternoon trading, Shanghai copper continued the concussion trend, the bulls entered the market to pull copper prices up to the intraday high of 49220 yuan / ton, at this time the bulls gradually reduced their positions, and the market fell again, closing at 49040 yuan / ton at the end of the day, down 49040 yuan / ton, or 0.2%. The intraday 08 contract reduced 4520 positions to 117000 positions, mainly short positions; trading volume decreased 18000 lots to 129000 lots; Shanghai Copper 07 contract reduced 5550 positions to 33000 lots, mainly for short positions. At present, the market still maintains the back structure, and the 07 mur08 contract price difference is maintained at around 70 yuan / ton.

Today, Shanghai copper closed, the upper pressure 5-day moving average, the KDJ curve crosses downward, but the bottom is still supported by the 10-day moving average, waiting for the outer disk guidelines in the evening to test whether the bulls can sustain their efforts to help copper prices gain momentum again.

Spot market

Today, the spot price of electrolytic copper in Shanghai quoted a price of 10 to 40 yuan per ton for that month's contract, 49010 yuan / ton to 49210 yuan / ton for Pingshui copper, and 49020 yuan / ton to 49220 yuan / ton for Shengshui copper. Shanghai copper opened low and went high, followed by A shares based on 49000 yuan / ton in a straight line to 49200 yuan / ton at about 10 o'clock. The morning market holder's quotation is still in the first line of Shengshui 20 yuan / ton, the low price source market response is positive, the inquiry is active, and the flat copper buyer is happy to focus on the rising water 20 yuan / ton, so the quotation is raised to 30 yuan / ton, the price of good copper is 30 yuan / ton, and the popularity is slightly lower than that of flat copper. The downstream just needs to buy, and the supply of wet copper is still loose, and the quotation is reduced from 5040 yuan / ton to 70-60 yuan. Today, it is difficult to have room for price reduction, it is difficult to receive low-price supplies, the market inquiry atmosphere is active, and the market buying interest has significantly improved. As a result, the holders have confidence in Shengshui and are more persistent in their performance, and form a certain degree of support for the further promotion of the market.

Today, the spot price of electrolytic copper in Guangdong Province has risen by 40 per cent to the current month's contract, with the average price unchanged, while the wet copper price has been quoted at a discount of 10 to 10 per cent, with the average price unchanged. The average price of electrolytic copper is 49045 yuan / ton, while that of wet copper is 48985 yuan / ton. Spot market: stocks in Guangdong continued to rise slightly over the weekend, but the increase was much lower than last week, coupled with a certain drop in copper prices today. However, the reception mood of downstream manufacturers is general, it is reported that recently downstream manufacturers have purchased a lot of non-standard and wet copper, resulting in their low willingness to purchase PC boards. Affected by this, the holding price is weak, and today's mainstream transaction price is basically the same as last Friday. That is, 80 yuan / ton for good copper, 50 yuan / ton for flat copper and 0 yuan / ton for wet copper. Overall, today's trading is general, downstream procurement is not active; pay attention to the arrival of goods tomorrow, if you restart the situation of destocking, the future rising water materials will still shock higher.

Yangshan copper

The average price of today's warehouse receipt is $85 / ton, which is $5 / ton lower than last Friday, and the average price of bill of lading is $76 / ton / ton, which is $2.50 / ton lower than last Friday. QP August. LME0-3 has a premium of US $6.50 / ton and an import loss of around 300RMB / ton. LME spot price gradually strengthened, has now changed to the back structure, the domestic back structure narrowed to less than 100 yuan / ton, the price continues to weaken, and the import loss has expanded again.

Today, the demand in the foreign trade market is even lighter, and there are few enquiries. The number of offers from the holder is limited, and most of them maintain the offer last Friday, and the buyer's scruples are weaker than the price, and the domestic trade discount is at a low level. In the face of the current offer, it is prudent to wait and see, and the deal is deadlocked. The number of warehouse receipt offers is limited, and the transaction price has fallen all the way along with the deterioration of the relative price. at present, the transaction of second-card warehouse receipts is around 100 US dollars / ton. On the whole, the wait-and-see mood between buyers and sellers is strong, and the transaction is cold.

At present, the transaction price of fire good copper warehouse receipt is around US $100 / ton, mainstream fire method is US $95 / ton, wet method is 85 yuan / ton, good copper bill of lading is US $87 / ton, mainstream fire bill of lading is US $83 / ton, and wet method is US $76 / ton.

Inventory

Today's LME copper inventory of 197850 tons, a decrease of 8525 tons, or 4.13%, compared with the previous trading day.

"Click to participate in the second China (Yingtan) Copper Industry Summit Forum and the 15th China International Copper Industry chain Summit"

Scan the code to sign up for the summit or apply to join the SMM industry exchange group: