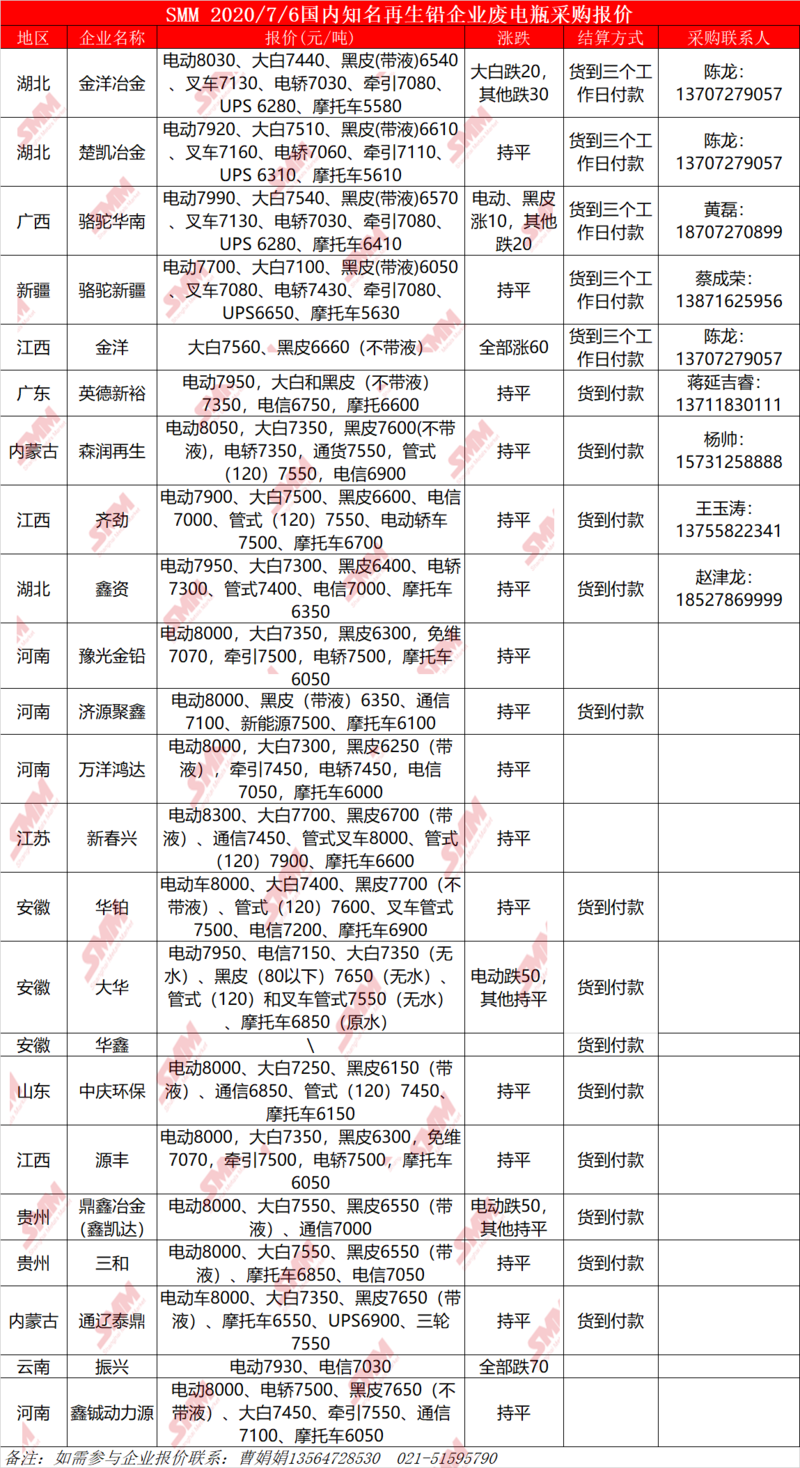

July 6th SMM domestic well-known recycled lead enterprises waste battery procurement quotation

The trend of SMM lead Market on July 6th

The price of Mulun lead is 14850 yuan / ton in Shanghai market, 50 yuan / ton for Shanghai lead 2007 contract, 14850 yuan / ton for copper crown lead in the south of Jiangsu and Zhejiang market, and 50 million yuan / ton for Shanghai lead 2007 contract. Lead concussion consolidation, while recycled lead to maintain a deep discount, the holder of passive shipments, coupled with the current price spread is large, the holder will be more willing to deliver, quotation discount has not changed significantly compared with last week, transactions remain in the doldrums.

Guangdong market Nanhua lead 14725 yuan / ton, for SMM1# lead average price 25 yuan / ton quotation; Henan Jinli 14700 yuan / ton, to SMM1# lead average price flat water quotation (trader); Henan Minshan 15700 yuan / ton, to SMM1# lead average price flat water quotation; Hunan Shuikoushan 14700 yuan / ton, to SMM1# lead average price flat water quotation (trader); Jiang Copper 14700 yuan / ton, to SMM1# lead average price flat water quotation. Jinde 14650 yuan / ton, 50 yuan discount to SMM1# lead price. Anhui Bronze Crown 14600 yuan / ton, 2007 contract discount 50 yuan / ton. Yunnan small factory 14350 million 14400 yuan / ton, the average discount price of SMM1# lead 300 yuan 350 yuan / ton. Lead prices have fallen at a high level, downstream consumption is still in need of procurement, and there is an abundant supply of goods in circulation in the market.

Shanghai lead is slightly consolidated along the daily average line, rising sharply near noon, the price of waste batteries is basically stable, the price of reduced lead is slightly reduced with the lead price, the price of recycled lead including tax is still quoted deeply in water, the purchasing demand in the lower reaches is insufficient, and the market transaction activity is low.

The replacement demand in the car battery market is flat, while as lead prices rise, risk aversion in the industry abates, retailers replenish inventory on demand, while a small number of companies show a slight increase in production.

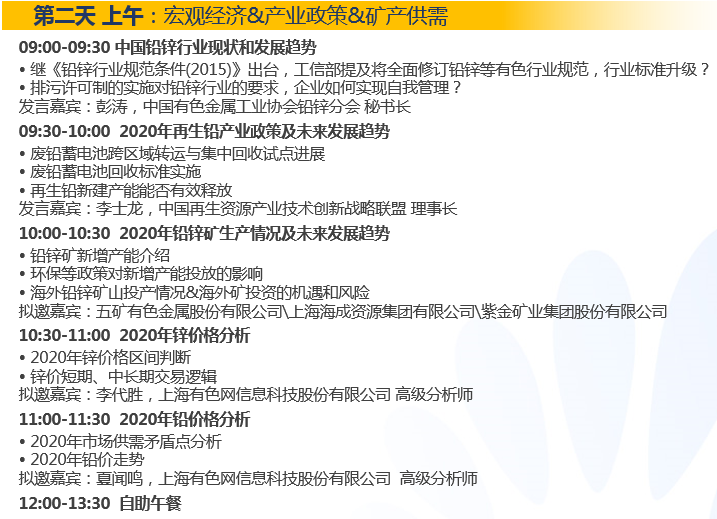

In 2019, global trade disputes escalated, the global economy was under pressure, and central banks began a wave of interest rate cuts. At the same time, the meeting of the political Bureau of the CPC Central Committee stressed that at present and for some time to come, the basic trend of China's economic stability and long-term improvement will remain unchanged, and 2020 will also be the year when China will build a moderately prosperous society in an all-round way and the 13th five-year Plan ends. In this context, the new crown virus is rampant all over the world, and it is worth looking forward to how to achieve steady economic growth.

In terms of the lead market, the newly expanded production capacity of overseas mines has been released one after another from 2019 to 2020, but the overseas epidemic has spread and some overseas mines have been put into production and mines under construction. Where will the lead concentrate go in 2020? At the same time, new expansion projects in China's recycled lead market are springing up everywhere. What is the actual output release in 2020? Whether the cost support is effective or not, the supply of waste batteries has become the focus of the future market; and under the influence of a number of policies (such as the new national standard for electric bicycles, motorcycle purchase tax exemption, etc.), whether the subsequent lead consumption matches, and what is the trend of lead prices in 2020?

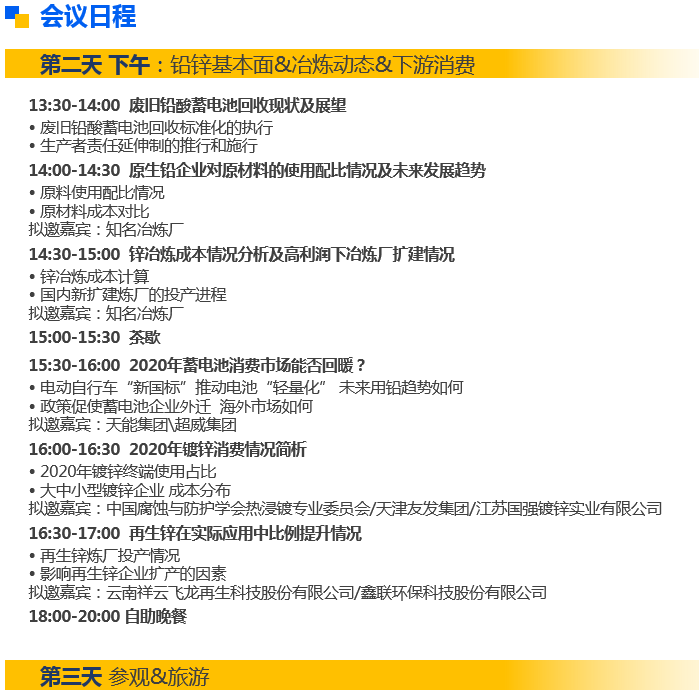

In response to the above topics, SMM will invite industry celebrities, industry professionals, enterprises from the upper and lower reaches of the industrial chain to hold the "2020 (15th) lead and Zinc Summit" in Changsha to jointly discuss the current situation and problems of the industry, as well as the future development prospects, and analyze the fundamentals and the future trend of zinc prices.

Click to sign up for SMM 2020 (15th) lead and Zinc Summit

Scan the QR code in the picture to sign up for the lead-zinc summit and fill in the personal information on the last page. The meeting staff will contact you later!