SMM: entering the second half of the year, the mentality of the US auto industry is completely different from that of six months ago, when the epidemic just broke out from China, and analysts are more optimistic that US car sales this year may still exceed 17 million for six consecutive years.

Against the backdrop of a surge in new crown pneumonia cases in the US, it is no longer surprising that US car sales fell sharply in the second quarter of this year.

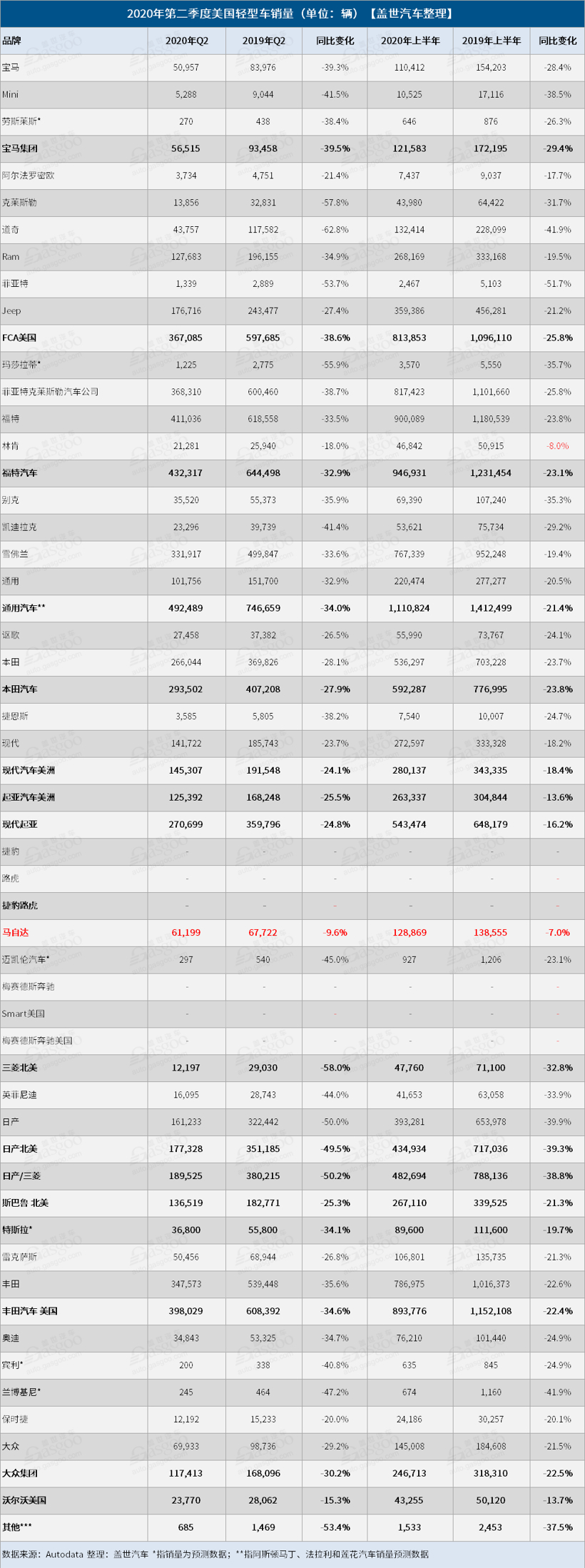

Us light vehicle sales fell between 24 per cent and 30 per cent in June, while overall US car sales fell by about 34 per cent in the second quarter of this year, possibly the worst quarter for automakers this year, according to J.D. Power and Edmunds.

Sales of American car companies: the biggest drop in FCA Tesla sales exceeded expectations

GM's overall sales fell 34% in the second quarter, including a 24% drop in retail sales. Of its four brands, sales of GMC fell slightly, by 32.9 per cent, while Cadillac had the biggest decline, by 41.4 per cent. In terms of models, the Chevrolet Blazer and Trailblazer and Buick encore GX were bright spots, with Blazer sales up 68 per cent year-on-year to 19726, while Trailblazer and Encore GX sales were 6699 and 9256, respectively. In addition, GM says demand for its pickups remains strong.

Ford's second-quarter sales fell 33%, in line with industry expectations, but the decline was smaller than that of FCA and gm. Among them, sales to ordinary consumers fell 14.3% compared with the same period last year, including truck sales down 0.4%, dagger SUV sales down 22%, and car retail sales plummeting 34.7%. Sales of Ford F-Series pickups fell 22.7% in the second quarter due to a decline in fleet volume sales, including government and corporate procurement. In terms of models, with the exception of the explorer SUV and Ranger medium-sized pickup trucks, Ford's sales of each model declined, with the explorer and Ranger up 12.4% and 19.8%, respectively.

Sales of FCA fell 38.6% in the second quarter from a year earlier, while sales of its brands fell more than 21%. Jeff Kommor, the company's US sales director, said retail sales to consumers had been rebounding since April, but bulk orders to governments or companies had been cancelled or delayed. But FCA says sales of its full-size pickups are still good.

Tesla delivered 90650 vehicles in the second quarter, higher than expectations of 74130 and up 2.55 per cent from the first quarter of this year, but down 4.8 per cent from the same period last year.

Japanese and Korean cars: Nissan nearly halves Mazda's outstanding performance

Toyota's sales fell 35% in the second quarter, including a 29% drop in Toyota brand sales and a 10% drop in Lexus brand sales. Honda's sales fell 16% in June and 28% in the second quarter, while its Acura and Honda brands also showed double-digit declines.

Dave Gardner, president of Honda sales, said the company's sales were higher than expected in the second quarter of this year, and the pace of recovery began to accelerate in the second half of the second quarter. "our inventory is a little tight, but our dealers are very flexible in adapting to one of the biggest challenges experienced by the industry."

Nissan's sales plunged 49.5% in the second quarter, with sales of the Nissan brand and Infiniti down 50% and 44%, respectively. However, Nissan said its retail sales exceeded expectations as it continued to reduce rental sales and focused on building a quality and sustainable business.

Hyundai's sales fell 22 per cent in June from a year earlier, the second consecutive month of decline, with retail sales rising for the second consecutive month to 48935 vehicles, while fleet sales plunged 93 per cent, accounting for just 2 per cent of total sales for the month. Sales fell 24 per cent in the second quarter, and Hyundai is reported to be one of only two carmakers to cut discounts last month.

Among other carmakers, Subaru's sales fell 12% in June and 25% in the second quarter. Mitsubishi Motors' sales fell more than all other carmakers by 58% in the second quarter, while Mazda was the best performer, falling just 9.6% in the second quarter.

European cars: Volvo has the smallest decline

Among European carmakers, BMW and Volkswagen both fell more than 30% in the second quarter, while Mercedes-Benz and Jaguar Land Rover have yet to report quarterly sales in the United States. Among luxury brands, sales of BMW brands fell 39.3 percent in the second quarter from a year earlier, Audi brands fell 34.7 percent, Cadillac dropped 41.4 percent, and Maserati had the largest decline, 55.9 percent. Lincoln (down 18%), Acura (- 26.5%), Lexus (- 26.8%), Porsche (- 20%) and Volvo (- 15.3%) showed relatively small declines.

Discount on new cars

In terms of discounts, J.D.Power said the discount in June was close to $4411, an increase of $445 over June 2019. The car discount increased by $459 to $4031, while the average discount for trucks and SUV increased by $407 to $4524. The Detroit Big three are still among the biggest discounts, according to ALG, but Volkswagen and Honda saw the biggest increases in discounts in June, while Ford and Hyundai were the only two companies to reduce discounts.

The challenges ahead are still severe at the beginning of the recovery.

Overall, the relatively optimistic parameter in the United States in June may be the transaction price of new cars. ALG expects the transaction price of new cars in June to be about $36322, up 3.2%, or $1117, from June 2019, but down 0.2%, or $88, from May 2020.

Thomas King, president and chief product officer of J.D.Power 's data and analytics division, said pent-up consumer demand, loosening government restrictions on economic activity and record discounts had helped US car sales rebound. Even in areas hardest hit by the epidemic, such as Detroit, retail sales are catching up with 2019.

But as the government's stimulus package ends and unemployment benefits expire in the coming months, the US unemployment rate will remain high, another test of consumer resilience.

Elaine Buckberg, chief economist at GM, said, "the US economy suffered a severe recession in March, but it has begun to recover gradually after the blockade was gradually relaxed." However, the road to recovery is expected to be tortuous, as the increase in infections in many states may slow down the process of economic restart. "

With the increase in new crown virus cases, especially in the western and southern United States, as well as in big car markets such as Houston, Los Angeles and Florida, dealers and automakers are likely to face new restrictions. this depends on the efforts of local and state governments to contain the virus.

However, car companies have introduced corresponding measures to face all kinds of uncertainties in the future. For example, Ford Motor has launched a loan relief program under which owners who buy new and used cars through loans from Ford's financial department can choose to return their vehicles if they lose their jobs within a year. In addition to Ford, a number of car brands provided varying degrees of customer support services to car owners during the outbreak, including deferred repayment and special financial terms.

Another big challenge for automakers is that as consumers gradually return, car inventories become tight, especially popular pickups, cross-border cars and SUV, trucks such as Ford Explorer and Ram pickups. Some Honda dealers reported that some of their hot models were already in short supply, especially the Civic LX, Civic hatchback and Accord LX. Many dealers expect inventory shortages to affect car sales in July and August.

Click to register: "2020 (Fifth) China International Nickel, Cobalt and Lithium Summit Forum"

Scan the code to sign up for the Ni-Co-Li Summit or apply to join the SMM industry exchange group: