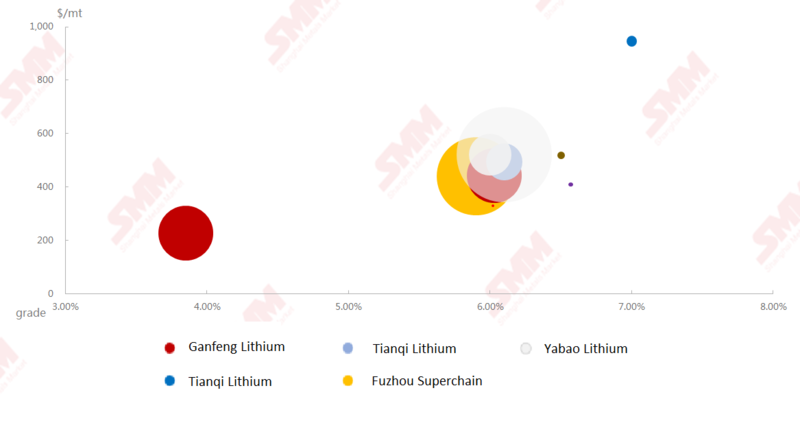

SHANGHAI, Apr 30 (SMM) – China imported about 130,000 mt in physical content of spodumene concentrate in March, with the average import price down 15.8% on the month and down 31% on the year to $456/mt, showed SMM calculations based on the latest customs data.

A greater proportion of spodumene concentrate imports with a lower grade of 4% by major importer Ganfeng Lithium accounted for the reduced average import price.

The amounts of domestic imports used to produce lithium salts stood at 130,000 mt in March, 17.7% higher on the month while 26.7% lower on the year, with the average import price at $453/mt, down 7.7% from a month ago and 31.9% from a year earlier.

No seaborne spodumene raw ore entered China in March.

Last month, Chinese lithium compounds producer Jiangxi Yabao Lithium was the top importer of spodumene concentrate, as it took about 6,800 mt of lithium carbonate equivalent (LCE) from overseas, which was used to produce lithium salts. The average import price stood at $521/mt on a cif basis.

Fuzhou Superchain ranked the second-largest Chinese importer of spodumene concentrate last month, who took 3,800 mt of LCE in March. Import prices for the company averaged $440/mt on a cif basis.

Excluding the import prices from Tianqi, Ganfeng and Yabao, which were agreed in long-term contracts, the prices of spodumene concentrate imports used to produce lithium salts averaged $439.8/mt in March.

China spodumene concentrate import price and grade in March (Source: SMM, China customs)

SMM expects the import prices of spodumene concentrate to fall further and approach $420/mt cif in the months ahead as domestic demand may decline with smelters shifting ore stockpiles into lithium salt finished products inventory.

On the backdrop of weak power battery demand at home and abroad, end-users focused on destocking battery raw materials. This dented orders for battery-grade lithium carbonate and sustained the decline in its prices.

SMM assessed prices of domestic 99.5% battery-grade lithium carbonate at 44,000-45,500 yuan/mt as of April 30, down 1,250 yuan/mt from a week ago and down 2,250 yuan/mt from a month earlier.

Mining companies in Australia may further slow down operations in the second quarter. This, together with the cost pressure on the mining and smelting front, will cap the downsides of prices in the industry.