SHANGHAI, Apr 24 (SMM) – Operating rates across Chinese lead-acid battery producers continued to decline this week, as some plants further scaled back on operations after inventories of finished goods exceeded one month level.

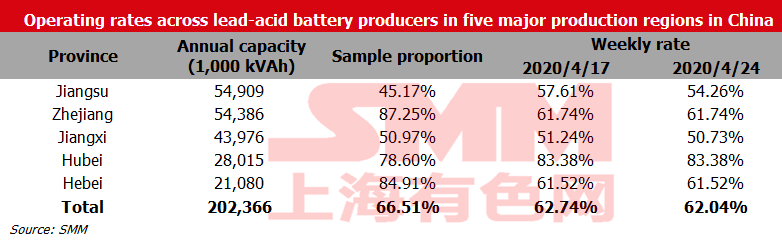

An SMM survey showed that operating rate across lead-acid battery producers in Jiangsu, Zhejiang, Jiangxi, Hubei and Hebei provinces averaged 62.04% in the week ended April 24, down 0.73 percentage point from last week.

Despite sales promotion, stocks at distributors were depleted slowly in a traditional low season for lead-acid batteries, especially those used in electric bikes, slowing deliveries from lead-acid battery producers and lifting their inventories.

Overseas demand for communication and automotive batteries, meanwhile, remains subdued, and some Chinese lead-acid battery producers have decided to take a break of three to five days for the Labour Day holiday.