4.23 Summary of Bronze Morning meeting

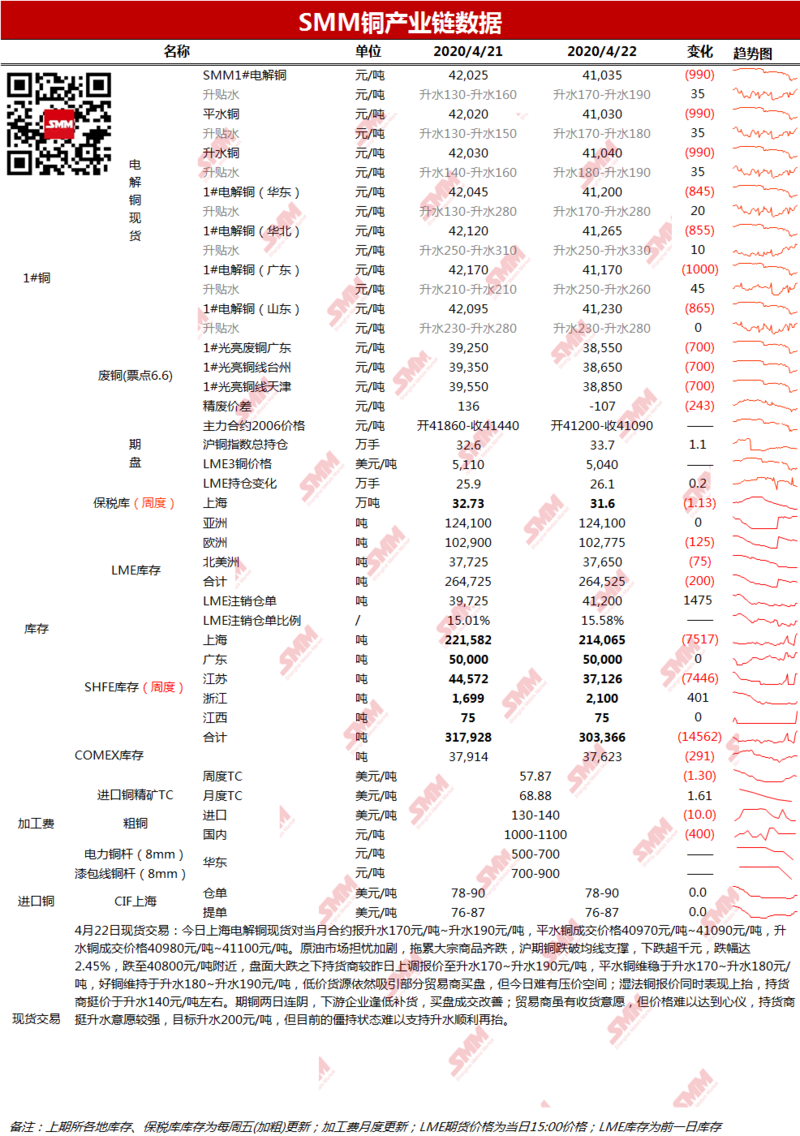

[4.23 SMM Bronze Morning meeting minutes] Macro aspect: 1) EIA reported that excluding strategic reserves, commercial crude oil stocks increased by 15.022 million barrels to 518.6 million barrels, an increase of 3 percent, the highest since May 2017. domestic crude oil production in the United States fell by 100000 barrels per day last week to 12.2 million barrels per day. 2) U.S. Treasury Secretary Noochin: will provide $2.6 trillion in direct support to the economy and can increase it by another $4 trillion through the Federal Reserve. The Trump administration is studying different plans to support U. S. oil producers. Oil prices are expected to be at $30 a barrel in August. According to foreign media, the European Commission has drafted a new draft budget, which the European Commission expects to spend 2 trillion euros to try to bridge the differences in recent weeks. The document shows that the European Commission may set up a targeted recovery fund of 300 billion euros. Fundamentals: 1) (Antofagasta), a Chilean miner of copper concentrates, said on Wednesday that it had cut its capital spending plan for 2020 and cut its copper production target as a result of the new crown pneumonia outbreak. The company said it expected copper production to be at the low end of its forecast range of 72.5-755000 tonnes this year. [Lido] 2) the price difference of scrap copper yesterday was-107 yuan / ton, calculated at 6.3%. Copper prices fell again yesterday, fine waste spread re-entered the inverted range, although downstream manufacturers can continue to receive goods, but the price is not high, and traders are willing to ship, in order to maintain liquidity. On the whole, the scrap copper trading industry has been relatively depressed this year, with profits and trade volume shrinking sharply. [Lido] 3) Import copper yesterday foreign trade market inquiry enthusiasm is not reduced, but the transaction situation is slightly weaker than yesterday, mainly because the supply of goods is tight. Import prices continue to improve, stimulate actual demand, and financing demand is getting stronger, the buyer actively inquire for goods. Warehouse receipt prices remain high, due to the shortage of goods, some traders quoted up, there are a small number of wet warehouse receipts high prices. Some traders are in a mood to cherish the sale. At present, the quotation of the far month bill of lading is uneven. 4) stocks in LME fell by 200 tons to 264525 tons on April 22, and copper warehouse receipt stocks in the previous period decreased by 7841 tons to 143897 tons. [neutral] 5) spot East China: on the spot side, after a continuous pullback of copper prices in the past two days, the transaction of buying improved; the holder has a strong willingness to raise water, with a target of 200 yuan / ton, but the current stalemate is difficult to support the smooth re-lifting of rising water. South China: Guangdong electrolytic copper spot contract rose 250 to 260 yesterday. In the spot market, the tight supply of electrolytic copper in Guangdong has not been effectively alleviated, holders continue to offer shipments, flat copper and good copper prices have risen, and there is almost no price difference between the two. Although the rising water continues to rise, it has not stopped the desire to buy downstream, especially the decline in copper prices today, and even took the initiative to increase the volume of purchases downstream. Overall, Guangdong electric copper market is in short supply, the future rising water is expected to continue to rise. Copper price and forecast: last night, Lun copper closed at $5108.5 / ton, up 1.63%, trading volume 15000 hands, position increased 293 to 261000 hands. Last night, copper stopped falling and rebounded, shaking up and back to the 5100 level, rising $5137 / ton in intraday trading. Us oil rose nearly 40 per cent at one point yesterday as tensions between the US and Iran escalated and US oil rose nearly 40 per cent after hitting more than a 20-year low. It also breathed the recent pullback in copper prices from the crude oil crash and investors betting that governments around the world would introduce further stimulus measures to boost copper prices in the three major US stock indexes. From the copper fundamentals, the supply side tension still has a strong support below the copper price, copper prices are expected to continue to game around the 5100 level today. Today's copper is expected to be 5120-5180 US dollars / ton, Shanghai copper 41800-42300 yuan / ton. It is estimated that the water will rise by 170-200 yuan per ton today.