4.13 Summary of Bronze Morning meeting

[4.13 SMM Bronze Morning Association Summary] Macro aspect: 1) according to the preliminary statistics of March 2020, the stock of social financing at the end of March was 262.24 trillion yuan, an increase of 11.5 percent over the same period last year. Of this total, the balance of RMB loans issued to the real economy was 158.82 trillion yuan, an increase of 12.7 percent over the same period last year, of which the balance of RMB loans to the real economy was 158.82 trillion yuan, an increase of 12.7 percent over the same period last year. 2) after twists and turns in the OPEC+ negotiations, a historic agreement was finally reached, which would reduce production by 9.7 million barrels per day, slightly lower than the 10 million barrels originally planned. The draft statement expects global oil production cuts to take effect from May 1 and will cut crude oil production by more than 20 million barrels a day in 2020, OPEC+ said. The US consumer price index (CPI) fell by the most monthly rate in more than five years in March, with the core CPI interest rate at 2.1% a year in the late March quarter, up from 2.5%. CPI is likely to fall further in the future as the new crown epidemic suppresses demand for some goods and services and offsets price increases caused by supply chain disruptions. [bearish]

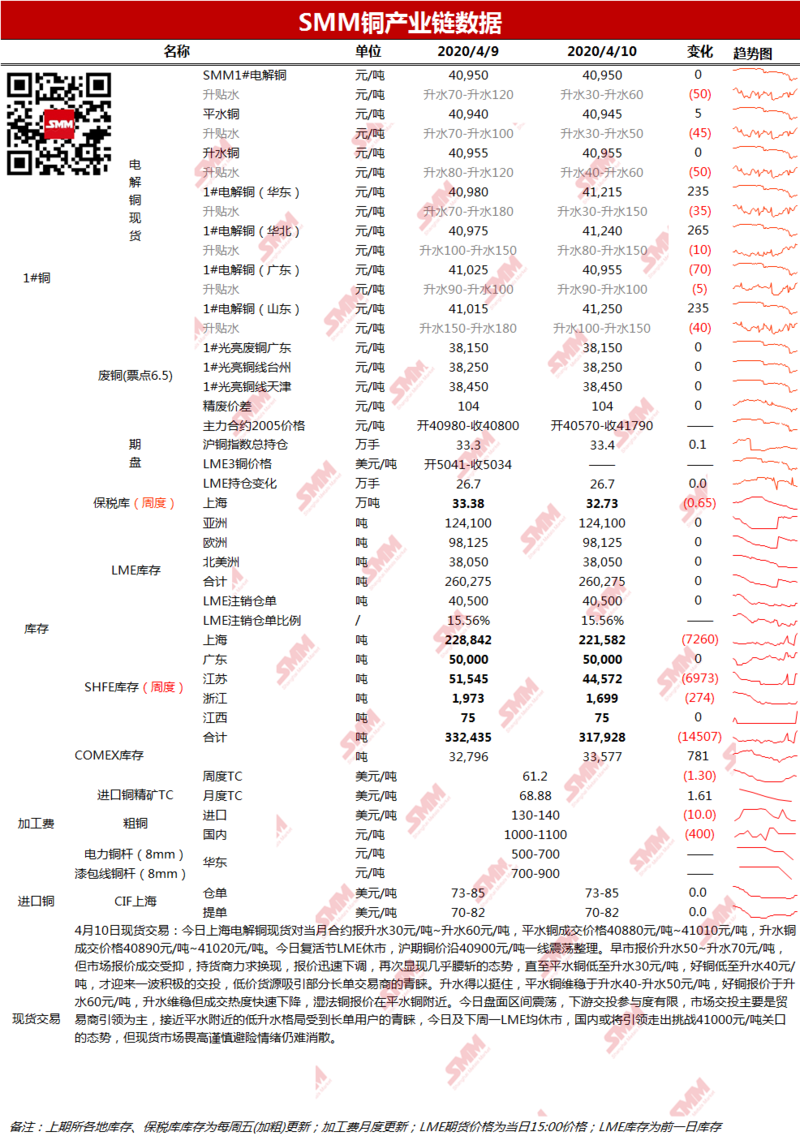

Fundamentals: 1) Copper concentrate as of Friday, the SMM copper concentrate index (week) was $61.20 / tonne, down $1.30 / tonne from the previous month. As a result of the impact of the new crown virus, South Africa has imposed a strict blockade, leading the country's miners to start transferring copper exports from its ports to other ports in Africa, particularly in Dar es Salaam. South African authorities initially said the port would only operate necessities during the three-week national blockade, which began on March 27. On Friday, the Ministry of Transport said the port remained open for all types of cargo. [Lido] 2) the price difference between scrap copper and scrap copper was 104 yuan / ton last Friday, with a vote point of 6.6%. The sharp rise in copper prices in the afternoon may increase traders' willingness to profit from shipments, but the rebound has not yet covered the cost of hoarding for traders a year ago, scrap copper circulation will still not increase significantly, need to continue to wait for copper prices to pick up. [Lido] 3) the market for imported copper was more desolate on Friday than it was yesterday. Both buyers and sellers are less active because LME is closed on Friday and the market lacks a ratio guide. The seller said it was difficult to quote, but remained bullish on spot prices in the short term, with some holders maintaining yesterday's offer. On the other hand, at present, there is still a gap between the quotation and the buyer's psychological expectations, the overall demand is weak, and the market is in a stalemate. At present, market transactions are concentrated in bills of lading at the end of April and early May, and far-monthly orders are affected by the delay of shipment by overseas smelters and uncertain shipping dates. Inventories were closed at LME on Friday; copper stocks in the previous period were down 14507 tons to 317928 tons from the previous month; and copper stocks in the bonded area were down 6500 tons to 327300 tons from the previous month. Spot East China: in the spot market, the rising water fell rapidly last week, from 130-160 yuan / ton at the beginning of the week to 30-60 yuan / ton on Friday. High copper prices and high water make it difficult to carry out market trading, holders are increasingly willing to exchange cash, buyers are still afraid of high risk aversion, and most of the trading shows a stalemate and fatigue within the week. South China: Guangdong electrolytic copper spot contract rose 90% to 100% on Friday. In the spot market, stimulated by the fact that Guangdong went to the warehouse, where stocks have fallen to 74400 tons compared with the same period last year, Guangdong's rising water did not fall with the fall in Shanghai, and trading prices remained basically at yesterday's levels; wet copper prices rose slightly due to tight supply. In addition, as delivery approaches, warehouse receipt demand has been reduced than before, some of the choice of re-delivery, which will ease the pressure on supply. Overall, consumption in Guangdong has been good recently, and it is difficult to see a sharp decline in rising water.

Copper price and forecast: last Friday night plate closed for the Easter holiday, the inner plate also continued to close. Copper prices rebounded last week, mainly due to the gradual release of liquidity from central bank stimulus policies, superimposed copper supply side interference frequent transmission, led to a large rebound in copper prices. On the other hand, the copper operating rate has rebounded significantly from the previous month, and domestic inventories are in a storage state, which is also good for copper prices last week, and it is expected that copper prices will be supported by fundamentals in the short term. Today, the outer plate continues to stop trading, Shanghai copper is expected to 41500-42000 yuan / ton.