SHANGHAI, Mar 20 (SMM) – Social inventories of lead ingots in China fell sharply this week, as downstream buyers turned to the spot market after plunging lead prices prompted smelters to hold back on sales.

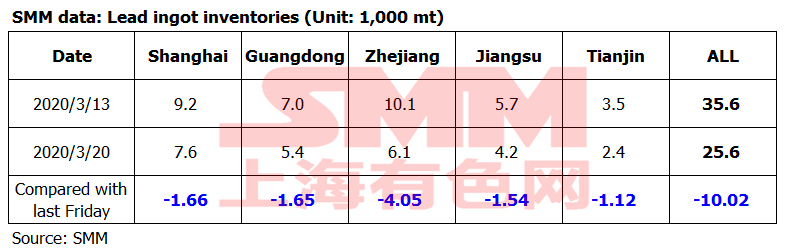

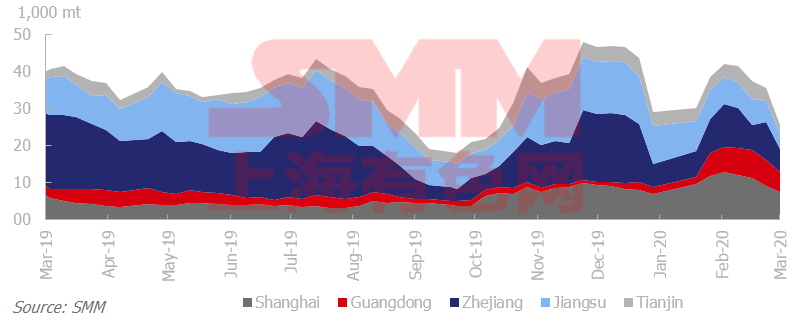

SMM data showed that lead social stocks across Shanghai, Guangdong, Zhejiang, Jiangsu and Tianjin decreased more than 10,000 mt in the week ended March 20 to 25,600 mt, much larger than a decline of 1,900 mt mt in the previous week.

Lead prices dived by close to 1,000 yuan/mt this week, as the coronavirus pandemic fears battered global markets. That prompted primary and secondary lead smelters to hold back on sales and to suspend sales in the second half of the week.

Meanwhile, downstream consumer—lead-acid battery producers ramped up production and had to turn to the spot market to source raw material, leading to this week’s sharp decline in lead social inventories.

With the month drawing to a close, some battery producers will see their long-term lead supply contracts coming to an end, suggesting a potential increase in demand for spot cargoes. Social inventories of lead ingots in China are likely to continue to trend lower next week, if smelters keep sales suspended.

![Overseas Geopolitical Risks Escalate LME Lead Overall Center of Operation Shifts Downward [SMM Lead Morning Brief]](https://imgqn.smm.cn/usercenter/guTSZ20251217171722.jpg)

![Lead Ingot Destocking Boosts Lead Prices While Geopolitical Risks Persist [SMM Lead Morning Meeting Summary]](https://imgqn.smm.cn/usercenter/xVUpr20251217171722.jpg)