SHANGHAI, Mar 19 (SMM) – Reduced demand and bearish sentiment triggered by the coronavirus outbreak have depressed prices of cobalt sulphate, a major raw material of ternary batteries, since early March. SMM sees further downward potential in the near-term prices, before the resumption of end-users demand and stepped-up operations of automakers support prices in the second half of April as COVID-19 becomes more contained in China.

SMM expects cobalt sulphate prices to extend declines to 46,000-47,000 yuan/mt by end-March as demand from motive power battery sector may remain subdued this month. Downstream consumption in April will likely improve markedly from March, which may see cobalt sulphate prices stemming declines in the second half of April.

As of March 19, spot prices of domestic cobalt sulphate stood at 48,000-51,000 yuan/mt, down 1,500 yuan/mt from the previous day and down 8,000 yuan/mt from a high level in early March, SMM assessments showed.

According to SMM calculations, the cost price of cobalt sulphate is about 46,000 yuan/mt. Current downbeat demand may drive cobalt salt producers to sell at costs in the short term, but there is also a chance that prices will be lifted in May if escalations in the COVID0-19 development disrupt raw materials supply in late-April. Most cobalt salt plants in China have stored feedstock inventories that could meet demand until the second half of April.

As of March 11, about 90% of automakers in China have restarted operations, with the rate of resumption for workers rising to 77%, showed a survey from the China Association of Automobile Manufacturers (CAAM). However, plunges in NEV sales over the past two months added to inventory pressure at distributors and capped the rebound in operating rates. SMM expects operations at carmakers to return to normal levels in the first half of April.

A delay in downstream demand recovery also constrained operations of motive power battery plants. Producers of ternary materials and precursors were compelled to reduce offers and slowed purchases of feedstock.

Demand from the consumer battery market, meanwhile, revived at a faster pace and underpinned the demand for cobalt salts. But some consumer battery producers purchased cheap recycled products of cobalt sulphate as their requirement for the feedstock quality is looser than that of motive power battery plants.

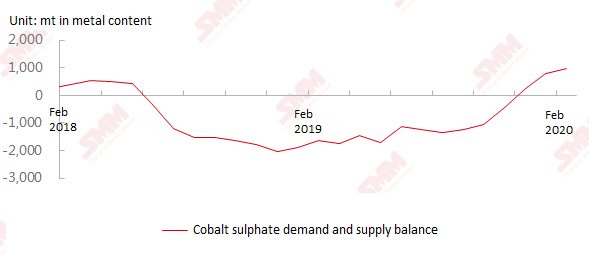

SMM data indicates that inventories of cobalt sulphate in China rose a net 206 mt in metal content in February. The stocks had increased an accumulative 984 mt in metal content since 2018.

China cobalt sulphate demand and supply balance (source: SMM)

Overall consumption of cobalt sulphate in China is assessed at 1,500 mt in metal content last month, with demand from ternary precursor sector standing at 1,000 mt in metal content, down 68.8% on the month and down 62.5% on the year. SMM expects consumption of cobalt sulphate from the precursor sector to recover in March with the return of end-users demand.

On the supply front, China produced 1,800 mt in metal content of cobalt sulphate in February, 40.3% lower on the month and 47.6% lower on the year. The impact of COVID-19 pandemic on production was less significant than that on the demand, which led to a continued buildup in cobalt sulphate inventories.

SMM expects domestic cobalt sulphate output to rebound 113.5% on the month in March to 3,900 mt in metal content, 1% lower from a year earlier, as cobalt salt plants restarted operations this month.