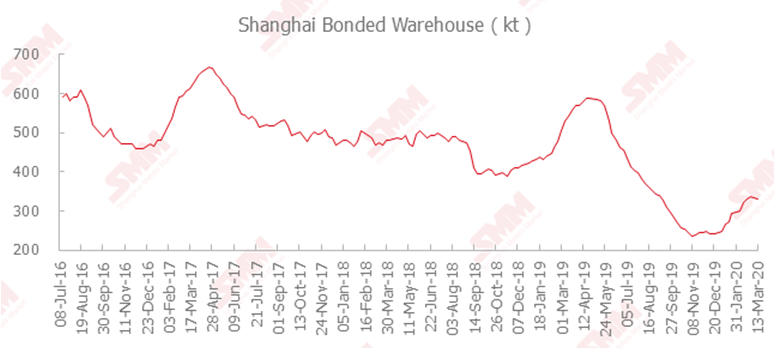

SHANGHAI, Mar 13 (SMM) – Stocks of copper across Shanghai bonded area declined for the second consecutive week as of March 13, as increased import financing activities after the US Federal Reserve’s interest rate cuts triggered outflows of cargoes from the bonded warehouses.

SMM data showed that Shanghai bonded copper stocks decreased 1,800 mt in the week ended March 13 to 332,000 mt, after a decline of 3,500 mt in the previous week. The bonded stocks shrank 5,300 mt over the fortnight as of March 13.

The import financing activities also led to deliveries to SHFE-monitored warehouses amid weak prices of spot copper. Meanwhile, the fast-spreading coronavirus pandemic overseas has delayed the shipments of seaborne copper to China and impacted arrivals at ports.