SHANGHAI, Mar 11 (SMM) – All industrial enterprises across China will be allowed to resume operations on March 15, including producers in Hubei, the epicenter of the coronavirus, the latest SMM survey showed. Companies in Hubei are currently in preparation for the recovery.

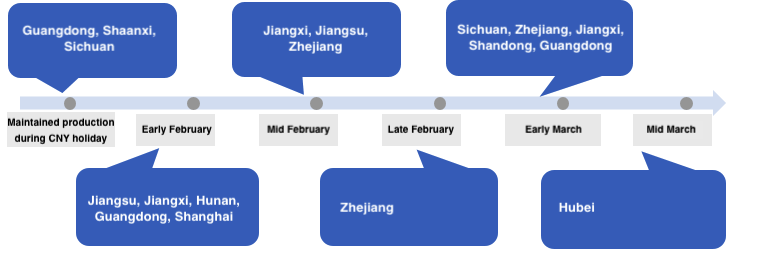

Cobalt salts

Producers of cobalt salts in Guangdong, Jiangxi, Shanghai and Hunan mostly maintained operations or restarted production in early February, given limited impact from the COVID-19. Some plants in Jiangxi, Jiangsu and Zhejiang reopened in the second half of February due to logistics restrictions and shortage of raw materials. Those producers kept operating rates at low levels for February, and have resumed 50-60% of capacity so far. Several cobalt salt producers in Sichuan, Zhejiang, Jiangxi, Shandong and Guangdong recovered production in early March, and are gradually raising operating rates. Producers in Hubei will officially resume operations in mid-March.

The operating rates of Chinese cobalt salts plants are expected to rise to normal levels in March, from only 30-40% in February. As of March 11, the rates stood at 50-60% for most cobalt salts mills.

Lithium salts

Smelters in Jiangxi and Sichuan reduced production in February due to the virus impact. Output in Qinghai, areas that felt a limited impact from the virus, was also lower last month as producers usually schedule output cut on weather issues in winter and some plants scaled back production on elevated inventories.

In February, production of lithium carbonate declined the most in Jiangxi, by 68.1% from a month earlier, SMM assessed. Lithium carbonate production in Qinghai was estimated to fall 17.9% last month, while output in Sichuan shrank only 10% given the continuous production of a major mill over the Chinese New Year holiday.

Smelters in different areas had resumed operations in the second half of February, with the operating rates likely improving markedly in March. SMM expects the average rate to rise to 80% in the second half of March.

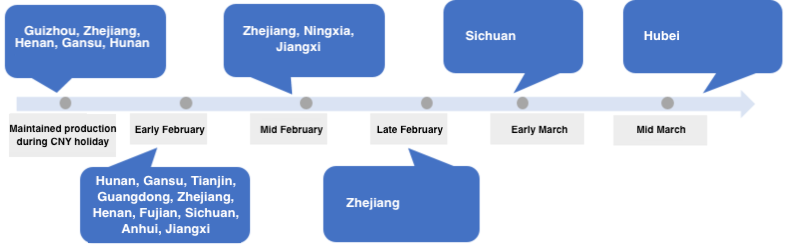

Cobalt (II, III) oxide, ternary precursor

Producers of cobalt (II, III) oxide were limitedly hit by the COVID-19 given a high concentration ratio of the industry. Operating rates of most cobalt (II, III) oxide plants have reached 60-70% as of March 11, and the rate will remain buoyant in March. For most producers of ternary precursor, the operating rates have climbed to 60%, with some major producers lifting rates to 70-80%.

Some producers of cobalt (II, III) oxide and ternary precursor in Guizhou, Zhejiang, Gansu and Hunan maintained operations during the CNY holiday and have lowered their operating rates. Producers in most areas restarted work in early February, and some plants in Zhejiang, Ningxia and Jiangxi only recovered in the second half of February. Producers in Hubei are scheduled to return in mid-March.

SMM research found that inventories of cobalt (II, III) oxide piled up in February due to sluggish purchases by downstream producers of batteries and lithium cobalt oxide (LCO), who operated at low rates last month.

Cathode materials

Operating rates of cathode materials plants were significantly weighed by the delayed resumption of downstream battery producers. A handful of cathode materials mills in Henan, Guizhou and Shandong continued their operations during the CNY holiday, while producers in most provinces and cities returned from holidays in early February, and focused on fulfilling pre-holiday orders. As of March 11, more than 90% of the cathode materials producers in China have restarted operations.

As of March 11, operating rates of most cathode materials plants have recovered to 50-60% with the rates at major mills rising to 70-80%, compared to an overall rate below 40% in February. Some producers of lithium manganese oxide (LMO) and LCO reported higher operating rates of 70%, while producers of ternary materials and lithium iron phosphate (LFP) mostly kept their rates at 60%. SMM expects overall operating rates to normalise between late-March and April.

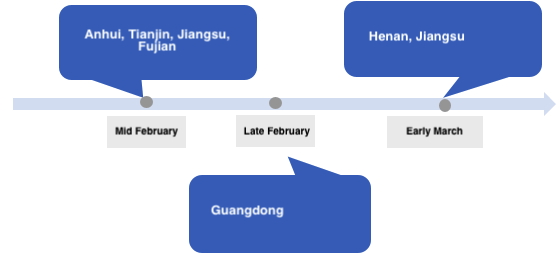

Battery

Battery mills and carmakers, except for major producers such as Tesla, maintained low operating rates last month as the epidemic dampened consumption and resulted in sharp declines in production of new energy vehicles and batteries. Battery mills in Anhui, Tianjin, Jiangsu, Fujian and Guangdong resumed operations successively in the second half of February. About 60% of battery makers in China have reopened as of March 11, with the operating rates also climbing. Producers of consumer batteries resumed at a faster pace compared to power battery mills, and have started to restock raw materials.