SHANGHAI, Feb 27 (SMM) – Industrial activity levels outside of central China continues to improve as workers return from quarantine periods and logistics pressures eased. However production cuts are still being maintained, especially for zinc and copper, and also nickel though this is also impacted by market forces pressuring NPI smelters in particular. Please see our detailed findings for each metal below.

We will keep you posted on the latest happenings via our website www.metal.com and our social media channels on Linkedin and Twitter.

Please register for our webinars in March as we continue to connect you with the latest happening in the China ferrous and nonferrous metals market.

The next session is happening on Wednesday March 4, 5pm CST, where we present to you a macro update of the resumption of metals industry as China recovers gradually from COVID-19 , with a deep-dive in the copper and zinc domestic markets.

Book your slots here: https://register.gotowebinar.com/register/1611773400789324555

Nonferrous raw materials

Zinc concentrate: Production at domestic zinc mines stabilised this week amid logistics recoveries. Large mines that were using low-grade ore transited to produce with Zn 5-6% ore grade as finished product inventory pressure eased. Smaller mines postponed restarts due to the COVID-19 epidemic as lower profits resulting from continued declines in zinc prices weakened the motivation to restart.

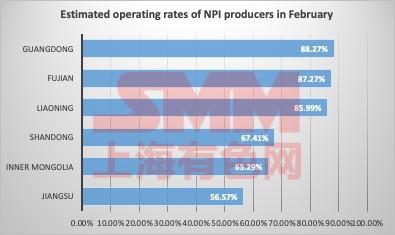

Nickel pig iron (NPI): Most NPI producers in China maintained operations during and after the CNY holiday. Shortage of adjuvant at some NPI plants in Inner Mongolia and Liaoning has eased with the removal of some transportation restrictions, but cargo shipments have not fully normalised, according to the latest SMM survey on February 21. Two NPI producers in Inner Mongolia have halted production and producers in other areas mostly kept their operating rates at low levels, on the back of COVID-19 impact and losses on weak NPI prices. This is estimated to affect overall NPI production in China by 20,000 mt in physical content in February. Supply of Indonesian NPI will also be capped in February as transportation curbs grew inventory pressure at ports. Customs data showed that arrivals of NPI from Indonesia stood at 137,000 mt in January, down 61,000 mt from December. According to SMM data, operating rates of NPI producers in China averaged 69.15% in January, and the rate is expected at 66.68% for February.

Chart 1: Operating rates at NPI producers

Source: SMM, E=estimate

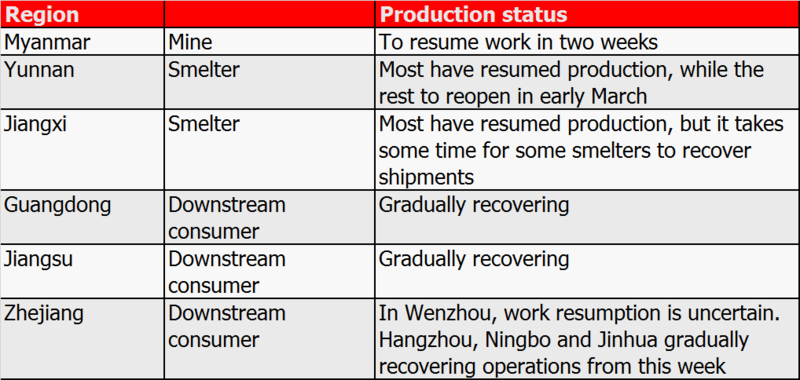

Tin ore: Tin ore dressing plants in Myanmar remain shut as workers remain under quarantine, but are likely to resume in two weeks. Logistics issues continued to affect the transport of tin concentrates.

Nonferrous metals smelting

Copper smelting: Smelters that remained in normal production before logistics issues during the Chinese New Year period kept sulphuric acid inventories from declining. This further lowered sulphuric acid prices after CNY holiday. Swelling sulphuric acid inventories aroused production concerns at smelters, forcing many smelters to lower their output targets for February or undertake maintenance.

Copper output at smelters is expected to decline nearly 40,000 mt in February to 680,000 mt, with operating rates down to 75% from 80% in January. Operating rates in December 2019 stood at 90%.

Table 1: Smelting capacity at copper smelters

Source: SMM

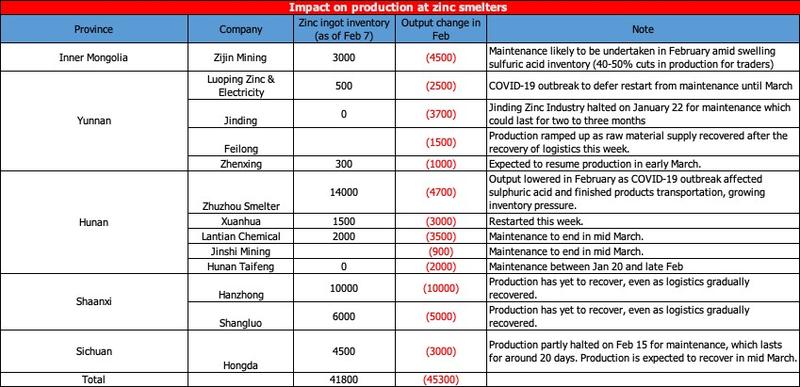

Zinc smelting: Logistics generally recovered this week except for Hubei. That combined with the exemption of freeway toll lowered transportation costs at smelters. Sulphuric acid and finished product inventory pressure alleviated significantly at smelters. As of February 26, finished product inventories at smelters stood at around 120,000 mt. Hunan Xuanhua Zinc Industry completed maintenance and output at Xiangyun Feilong Nonferrous Metals increased thanks to workers returning to work and logistics recovery.

Table 2: Impact on production at zinc smelters

Source: SMM

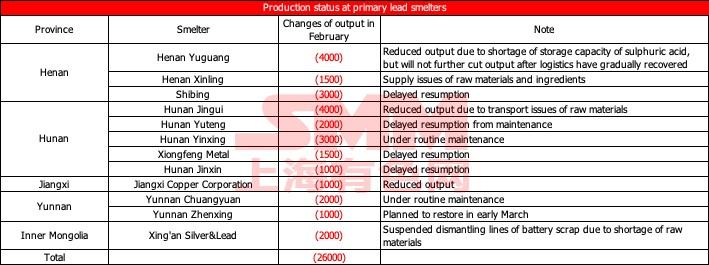

Lead smelting: Logistics have gradually returned to normal this week. High treatment charges for lead concentrate encouraged smelters to produce. Yunnan Zhenxing planned to restore in March. Xiang’an Silver & Lead suspended dismantling lines of battery scrap as some suppliers of battery scrap have not returned to work yet owing to the COVID-19 epidemic.

Table 3: Production status at primary lead smelters

Source: SMM

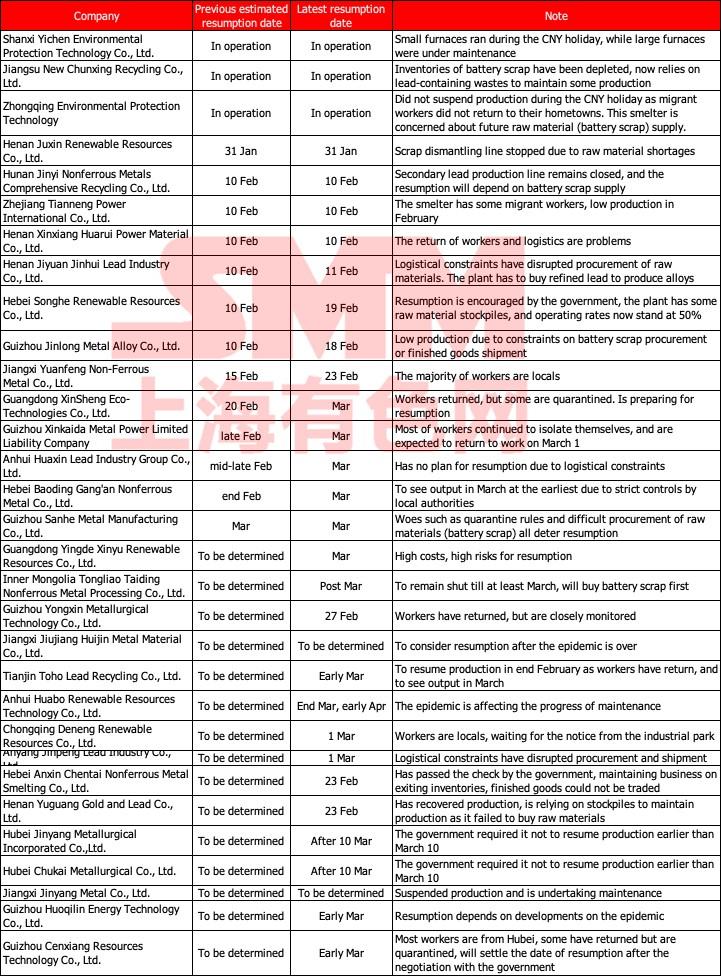

Secondary lead: Many secondary lead smelters in China have yet to resume operations by the last week of February, due to quarantine rules on migrant workers and as transport restrictions lifted costs and squeezed profits.

Following the outbreak of the coronavirus epidemic, over 90% of secondary lead smelters in China suspended operations during the Lunar New Year holiday this year, compared to a proportion of over 50% in previous years.

Quarantine rules on workers who travel back to work have contributed to the slow resumption of secondary lead smelters who have a large proportion of migrant workers. Meanwhile, restrictions on transport, especially across provinces, affected the procurement of the raw material, including battery scrap and deliveries of finished goods, increasing transport costs and squeezing profits at secondary lead smelters. That also deterred smelters from reopening.

Compared to secondary lead smelters, the downstream consumer—lead-acid battery producers in China recovered faster, which led to a smaller-than-expected increase in social inventories of lead ingots.

SMM data showed that the proportion of secondary refined lead production to the total lead ingot supply in China has exceeded 40%, as the secondary lead sector thrived in China in recent years with Beijing pushing an environmentally-friendly economy and having introduced the principles of extended producer responsibility (EPR) for recycling used lead-acid batteries.

A broad recovery across secondary lead smelters is expected in March, according to the latest survey, while uncertainty surrounding battery scrap supply lingers. Battery scrap traders usually reopen five to seven days later than secondary lead smelters, and are likely to remain closed for longer this year.

Table 4: Resumption status at secondary lead smelters

Source: SMM

Nickel smelting: Monthly capacity across nine domestic refined nickel smelters averaged 20,050 mt. In February, output is forecast to stand at 13,160 mt, and 65.64% of smelters are likely to resume operations. Recently, shipments from smelters in Gansu dipped, and the amount of spot nickel cathode shipped to Shanghai also declined. SMM will keep an eye on domestic output of refined nickel.

Nonferrous Processing

Copper

Over 80% of copper downstream processing plants have resumed production amid support from the government. However, actual production is affected by logistics issues and sluggish orders, as smelters incur higher labour costs and are under pressure from the epidemic control.

Logistics issues limited operating rates by affecting raw material supply. Transportation time was extended due to shortage of truck drivers and safety inspections. Insufficient transportation capacity raised transportation costs at smelters. The impact on production was small at plants in Jiangsu and Guangdong that sourced raw materials and sold products within the province or nearby regions.

On orders, deferred restarts in the power and real estate sectors diminished demand for raw materials. Home appliances and automobile makers kept productivity low to prevent backlog of finished product inventories against significant declines in end-user consumption. The spread of COVID-19 in South Korea, Japan, Middle East and the US limited exports, especially in Guangdong.

Production restarts in copper rod, wire and cable sectors are the lowest as the power and real estate sector postponed restarts to March, significantly affecting copper rod, wire and cable orders. Some plants that restarted were shut anew due to the lack of orders. Most of the power projects of the State Grid were suspended. Less than 20% of property companies have restarted, with most of the companies scheduled for restarts in the first half of March.

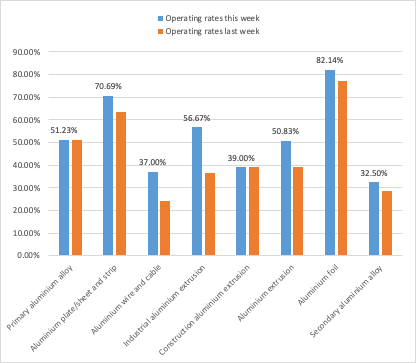

Aluminium

Operating rates at aluminium processors gradually picked up, led by east China and Henan province. Operating rates in other regions increased slower due to the COVID-19 epidemic.

Primary aluminium alloy: Primary aluminium alloy producers maintained stable production due to low operating rates at aluminium wheel producers, even as previous output cuts and recovering transportation lowered their inventories of finished products when compared to early February.

Aluminium plate/sheet and strip: With recovery in transportation and end-user sectors, operating rates at big aluminium plate/sheet and strip producers increased significantly from a week ago to 50-80%, led by Jiangsu, Zhejiang and Shanghai. Resumptions at small and medium-scale producers were slower, with operating rates expected to be below 30% this month as some producers are still waiting for governmental approval to resume. Producers are not optimistic over orders for February and March.

Aluminium extrusion: Overall operating rates at aluminium extrusion producers picked up, but varied by region and producer. Some producers in Jiangxi, Shandong and Guangdong provinces are likely to delay resumptions to early or mid-March due to COVID-19. As most of the migrant workers remained under the 14-day quarantine period, operating rates in Anhui, Shandong, Jiangsu and Fujian provinces increased marginally, while some of the producers do not expect production to return to normal until March. Shipment of raw materials and finished products went back to normal after trans-provincial transport restrictions were lifted last week.

Aluminium foil: Operating rates at aluminium foil producers increased, and are expected to extend the uptrend next week. Production at some producers returned to normal as recovering logistics service eased raw material shortages. Most producers are focusing on working through inventories of finished products.

Secondary aluminium alloy: Operating rates at secondary aluminium alloy producers rose slightly and varied greatly by region. Shanghai, Jiangsu and Zhejiang saw faster resumptions, while Guangdong saw slower resumptions due to delayed return of workers and low production efficiency at end-users. Chongqing postponed resumptions further as the epidemic remained severe there. Some producers suffered from raw material shortages.

Aluminium wire and cable: Large aluminium wire and cable producers resumed from February 10, while small and medium-scale producers resumed slower. Medium-scale and big producers reported stable orders, while small producers reported lesser new orders. Transportation improved amid the government call to resume. With manpower issues still unresolved, production is unlikely to return to normal until the second half of March.

Chart 2: Operating rates of Aluminium processing chain

Source: SMM

Zinc

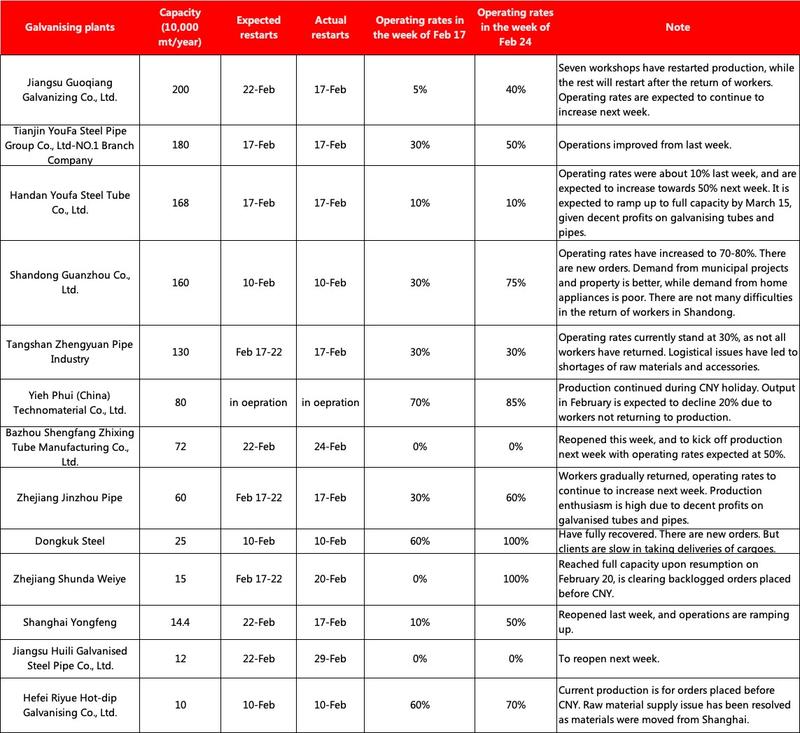

Galvanising: Operations across galvanising plants in China further improved this week, as decent profits on galvanised tubes and plates encouraged plants to ramp up production following the return of workers.

Most of major galvanising plants in China have reopened this week, and the operating rates increased sharply from last week. However, most of small plants in north China remain shut due to manpower issues as workers have yet to return. Workers are likely to return around early March.

Logistical constraints lingered as restrictions on trans-provincial transportation in some areas have yet to be lifted, which affected the supply of raw materials to and shipment of finished goods from galvanising plants.

With end-users yet to recover significantly, galvanising plants failed to see a substantial increase in new orders, with orders from municipal projects accounting for the majority.

Table 5: Operating status of galvanising plants

Source: SMM

Die-casting zinc alloy: Restarts and productivity increased noticeably this week and are expected to continue improving next week. Purchase volumes also increased significantly.

An increased number of producers in south China restarted production, but most of the plants kept operating rates at 30-50%. A few big producers maintained normal production. Producers plan to raise operating rates next week when orders pick up.

More plants in east China resumed production. Restarts rates in Ningbo stand high as logistics recoveries boost purchases, while operating rates remain low. Operating rates are expected to rise in March. Producers postponed restarts further in regions such as Wenzhou where COVID-19 epidemic is severe.

Lead

Lead-acid battery: Most of lead-acid battery producers in China have resumed production. Producers that reopened in the previous two weeks (weeks of February 10 and 17) have ramped up to an operating rate of above 50%, as migrant workers returned following the end of self-quarantine. Major producers have reached rates of 60-70%. The ramp-up of producers that reopened this week (week of February 24) is expected to continue through early March.

Nickel

Stainless steel: Most stainless steel mills in Wuxi have resumed operations, but the Oriental Steel City remained closed. SMM learned that a large stainless steel mill in the east planned to reduce output by 50,000 mt as it operated normally during the Chinese New Year holiday, while downstream consumers delayed resumption, leading to a large backlog of finished product inventories. The mill planned to consume existing inventories first, and then make new production plans according to inventories and downstream demand. Futures prices of cold and hot-rolled stainless steel of Tsingshan Group fell by 300 yuan/mt in February 26, but spot prices have yet to decline. Prices are likely to weaken in the future.

Output of stainless steel is expected to decline 15% from January to 1.72 million mt in February as some mills already reduced output. Some mills said that it depends on downstream resumption as for whether to further cut output in March.

Operating rates at stainless steel sellers and traders in Foshan rose significantly from early February to 75% in the second half of the month. A few traders and retailers are expected to return to work in March. Resumption at end-users (stainless steel processing and products factories) also improved significantly. Logistics have recovered rapidly, but workers need to be quarantined for 14 days before returning to work. End-users planned to receive orders and start production in March. Futures prices of stainless steel for deliveries in March-May showed downward trend due to unbalanced demand and supply and various offers. Besides, rising selling pressure bolstered social inventories and the epidemic affected deliveries and trades, raising cash flow pressure for traders.

Alloy casting sector: Most alloy plants have resumed operations, but delivery date of previous orders and signing of new orders have been delayed due to the epidemic. Operating rates stood at 85% at plants that did not halt production during the Chinese New Year, and stood at 50% at recently-resumed plants. However, plants in Hubei remained shut and may be allowed to restore till after March 10.

Electroplating sector: The electroplating sector was badly hit by the COVID-19 epidemic. Scattered electroplating plants relied heavily on orders, and most of them halt production during the Chinese New Year holiday. Many small plants remained closed, and are likely to restore after March 6.

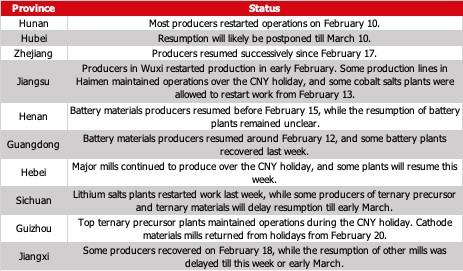

Cobalt/Lithium

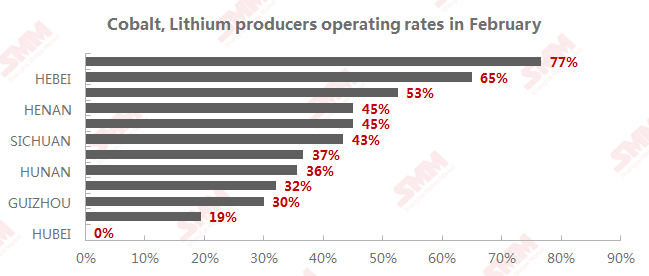

Some producers across the cobalt and lithium chain in Jiangxi, Sichuan and Henan will further delay their resumption till early March, and producers in Hubei, the centre of the COVID-19 outbreak, will remain suspended until further notice, the latest SMM survey showed.

The operating rates for February so far stand at low levels even as some major mills continued to produce during the Chinese New Year holiday and some other producers restarted work as early as February 10. Average operating rates in most provinces/cities outside Hubei are below 50% as of February 26.

Besides the shortage of manpower amid the extended holidays after the virus outbreak, disrupted raw materials supply on logistics restrictions was also a key factor that depressed operating rates.

Table 6: Production status across the new energy industry

Source: SMM

Chart 3: Operating rates of cobalt and lithium producers

Source: SMM

On the back of import curbs, cobalt salts producers that maintained operations over the CNY holiday began to procure raw materials since mid-February, and this lifted prices of cobalt salts and ternary precursor. Some medium-scale and small plants, however, planned to operate at lower rates given insufficient feedstock inventories, sluggish downstream demand and some existing transportation hurdles.

Top producers of cathode materials and batteries reported enough stocks that could guarantee production till the end of the month. Bullish prospects for prices drove some large-scale producers of lithium cobalt oxide (LCO) to lock in orders of cobalt salts and cobalt (II, III) oxide.

Import of intermediate product for hydrometallurgy may recover next week, SMM learned from market participants. But it requires time for smelters to normalise operations, which may see the operating rates this month only at 30-40%.

Tin

Downstream consumers in east and south China are gradually resuming production, which boosted demand for tin ingots this week. Currently, operating rates across the two regions average about 50%. In Zhejiang province, enterprises in Wenzhou remain shut and are uncertain about the resumption date as the region is hit severely by COVID-19, while enterprises in Hangzhou, Ningbo and Jinhua are recovering and about 70% are expected to have reopened by mid-March.

Table 7: Production status across the tin industry

Source: SMM

Further Reading

SMM Webinar Series: COVID-19 Special Update- Focus on Copper and Zinc (Feb 26, 2020)

SMM update: The progress of nonferrous, ferrous metals industry recovery (Feb 26, 2020)

Decent profits encouraged galvanising plants in China to step up operations (Feb 26, 2020)

Spot copper trades weakened on coronavirus fears, thinned enquires at month-end (Feb 26, 2020)

SMM Hot News China Metal Special Report 7-Impact of the coronavirus (COVID-19) outbreak on China metals market (Feb 26, 2020)