(Added a chart of battery makers)

SHANGHAI, Feb 17 (SMM) – China’s production of new energy vehicles dropped in the first month of 2020, as producers shut or trimmed output due to the Lunar New Year holiday and continued market weakness.

About 48,000 NEVs produced in China obtained qualification certificates last month, down 52.3% from a year ago, according to SMM data. Passenger vehicles accounted for 43,000 units, or 88%, while 2,700 were buses, taking up 5.6%. The rest 3,100 were special vehicles, accounting for 6.4% of the total.

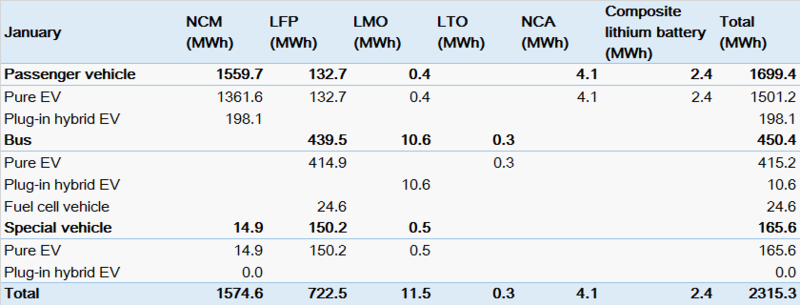

SMM data also revealed that 2.3GWh of power batteries were installed in January, down 53.5% year on year.

As the market remained lacklustre since the second half of last year, most of electric vehicle battery producers in China began their Lunar New Year holiday in early or middle of January, while some leading companies kept some of their production lines running.

A high statistical base also contributed to the sharp year-over-year decline in NEV production, as producers ramped up production in the same month of 2019, in anticipation of a cut in subsidies.

Chinese EV and battery producers were in low gear since the second half of 2019, as sales took a hit after the government sharply scaled back NEV subsidies. That, together with the coronavirus epidemic outbreak, is set to substantially subdue NEV production earlier this year, before the market recovers later in the year.

In terms of battery types, capacity of installed ternary batteries was 1.58GWh in January, accounting for 68.2% of the total installed EV batteries, while lithium iron phosphate batteries accounted for 31.2% or 0.72GWh, according to SMM data.

About 1.5GWh was installed in PVs, which primarily use NCM batteries, while buses and special vehicles favour LFP batteries. About 0.45GWh of batteries was installed in busses last month, while 0.17GWh was for special vehicles.

Source: SMM

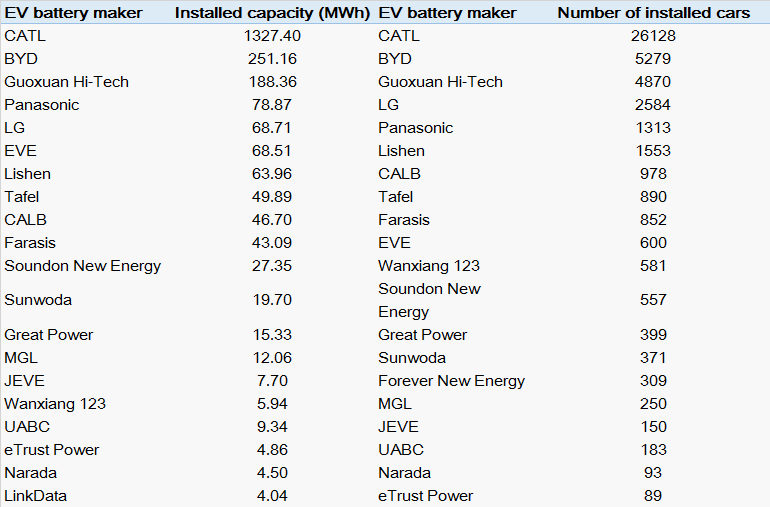

In January, CATL, BYD and Guoxuan High-tech remained the top three battery makers in the Chinese market, and CATL maintained its first position with a 57.3% market share. The beginning of battery supply from South Korea’s LG and Japan’s Panasonic to Tesla, meanwhile, took the two battery makers to the fourth and fifth places.

The EV battery market concentration improved further last month, with CR10 at 94%, CR5 at 82.2% and CR3 at 76.3%.

Source: SMM

The latest SMM survey showed that most of battery makers in China have delayed their resumption by one to two weeks amid the epidemic outbreak. Factories in the top two EV battery producing hubs of south China’s Guangdong and east China’s Jiangsu, are required to remain shut until they get the approval from authorities. Workers, meanwhile, are required to isolate themselves for 14 days after they return from holidays.

SMM expects the broad recovery of Chinese EV battery makers to be at the end of February, with operating rates for the month remaining low.

China’s Association of Automobile Manufacturers (CAAM) said last week the virus will deliver a “huge shock” to the car industry, causing a worse impact than the SARS epidemic did in 2003. Demand for cars and will falter sharply in the near term, but is likely to see a brief consumption boom after the epidemic is over. The painful start to the year, however, is casting a shadow over the full-year performance for the Chinese industry in 2020.