SHANGHAI, Feb 5 (SMM) – Concerns about high sulphuric acid stocks at Chinese copper, lead and zinc smelters that have been persistent since Q4 2019 have resurfaced as logistics issues emerge following the outbreak of the novel coronavirus.

SMM believes that sulphuric acid inventory pressure was already becoming a structural, profit-related problem for copper smelters prior to the transportation restrictions, though this of course worsens some smelters situation. However a rapid, substantial sulphuric acid inventory accumulation caused by transport restrictions is likely to force lead and zinc smelters in north China to trim production in the near term.

Sulphuric acid inventory pressure began to mount in Q4 2019

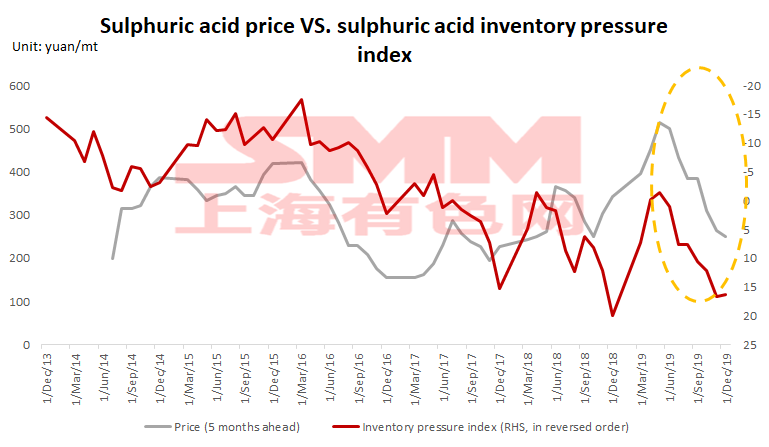

SMM established a sulphuric acid inventory pressure index model based on a quantitative analysis of existing data. The inventory pressure index and prices of sulphuric acid revealed that the ramp-up of new capacity led to a build of sulphuric acid inventory pressure since Q4 2019. (SMM combined sulphuric acid and fertilizer production data to generate the sulphuric acid inventory pressure index, which could fully reflect demand and supply dynamics of the sulphuric acid the market).

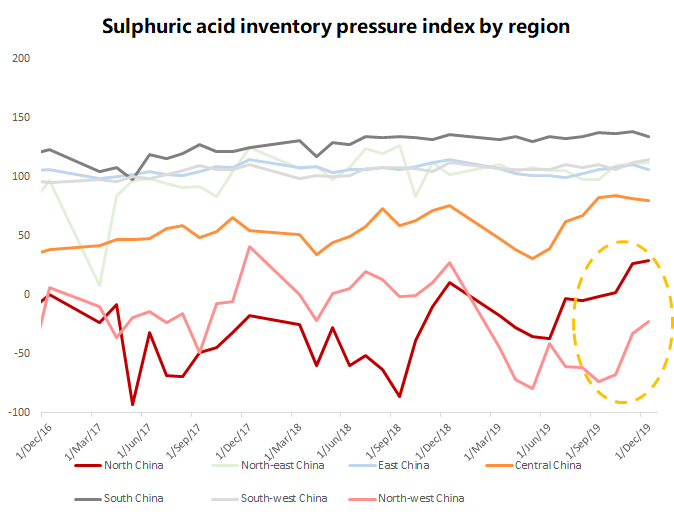

Sulphuric acid inventory pressure prominent in north, northwest China

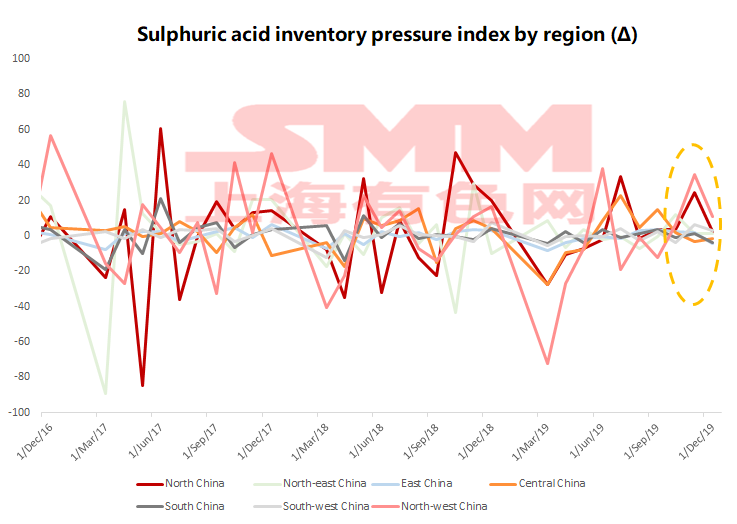

The regional sulphuric acid inventory pressure indices showed that sulphuric acid inventory pressure is mounting significantly in north and northwest China. A sharp increase in the readings indicates that sulphuric acid inventories in that region are growing and the markets are oversupplied, while a positive Δ reading indicates that inventories continue trending higher.

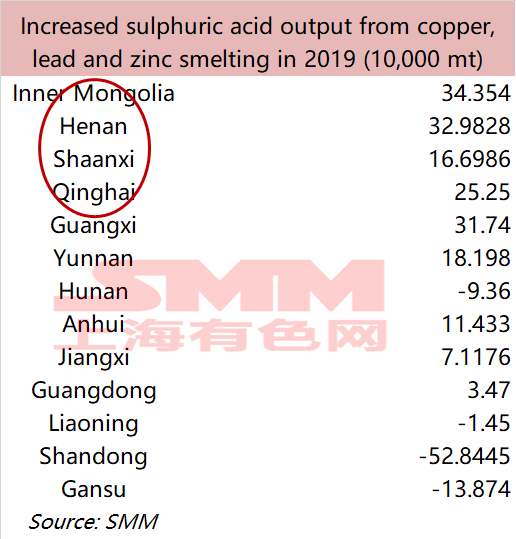

Copper, lead, zinc production increases grew sulphuric acid inventory pressure in northern, western regions

Sulphuric acid production increases last year were mostly seen in north and northwest China, according to SMM data on copper, lead, zinc and sulphuric acid production growth in 2019. That also contributed to higher sulphuric acid inventory pressure in those regions.

Copper, lead, zinc smelters have different “soft bottlenecks” in sulphuric acid stocks

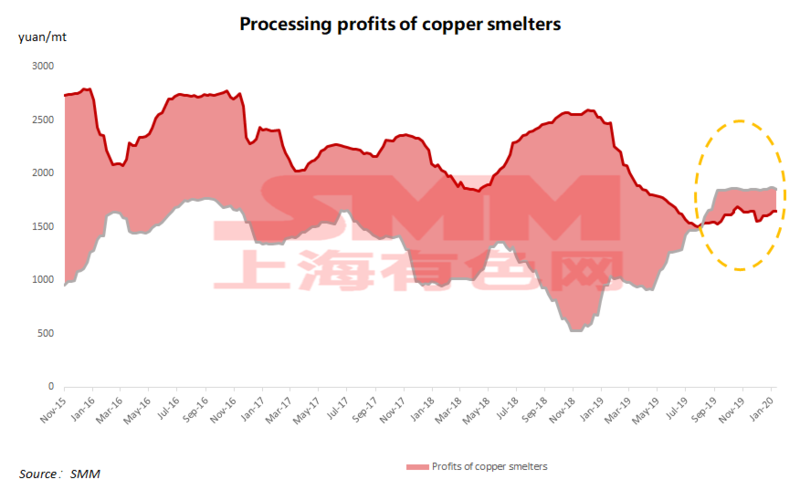

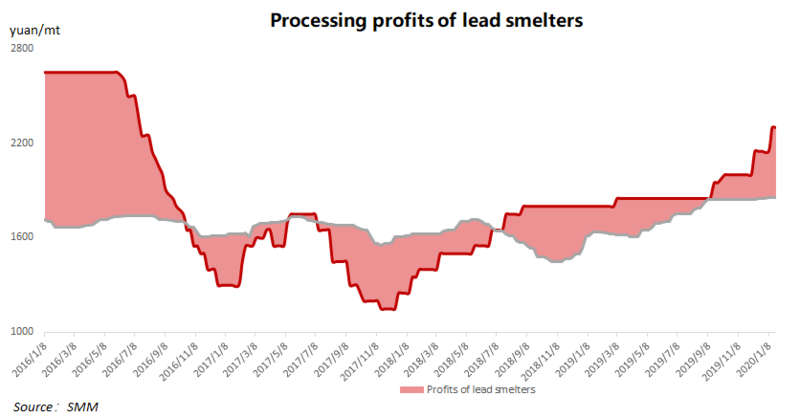

High sulphuric acid stocks will create “soft” or “hard” bottlenecks for smelter production. The so-called soft bottlenecks are actually profit concerns, as sulphuric acid can be sold as long as quotes by smelters are low enough. The essence of a soft bottleneck is whether smelters’ profits from refined metals can counter losses from low sulphuric acid quotes.

According to SMM calculations of profits at copper, lead and zinc smelters, high sulphuric acid stocks are a more vexing problem for copper smelters, who have been frustrated by record-low treatment charges for copper concentrate amid tight mine supply. Medium- and small-scale copper smelters, who are reliant on spot copper concentrate trades that see lower TCs than long-term supply agreements, are very likely to cut production this year if a sulphuric acid supply surplus further widens and pushes smelters to deeper losses.

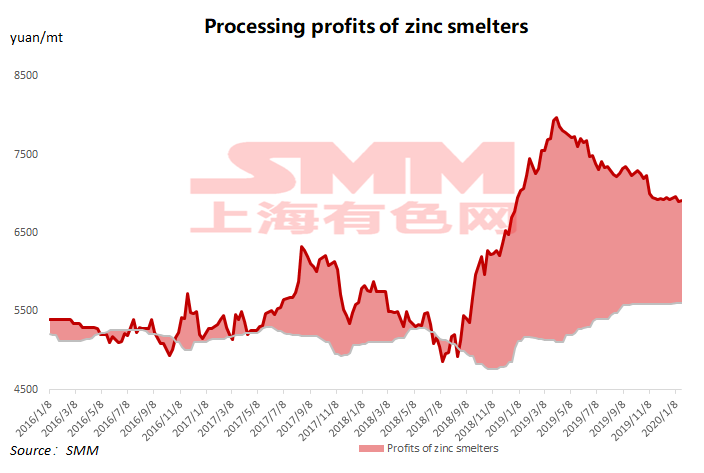

The problem that lead and zinc smelters, who see more decent profits, face on the back of high sulphuric acid stocks is whether they would like to lower their sulphuric acid quotes to discharge cargoes and ensure their production of refined metals. Logistics constraints caused by the recent epidemic outbreak, however, prompt lead and zinc smelters to reassess the problem of high sulphuric acid stocks, which can no longer be eased by cutting sales prices. Chances of production curtailments are growing as the sulphuric acid inventory increase cannot be stopped unless logistics constraints are resolved, and some smelters are running out of storage capacity.

Zinc smelters to be impacted the most by high sulphuric acid stocks amid logistics issues

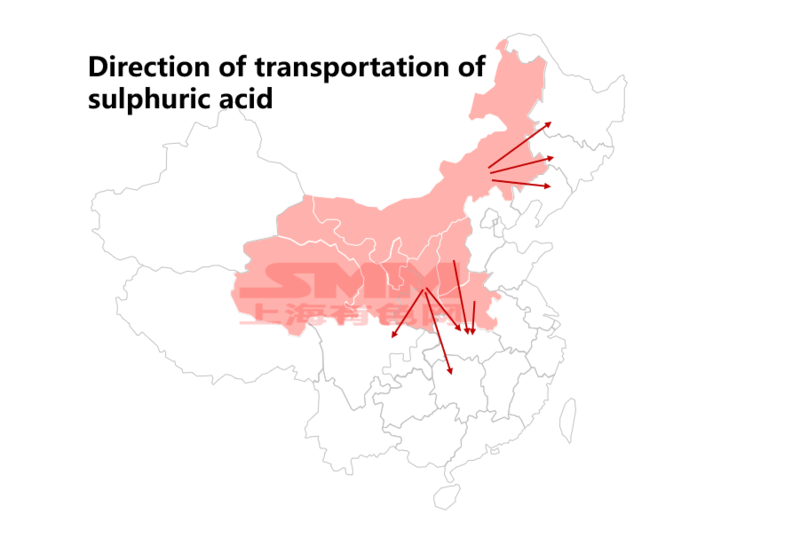

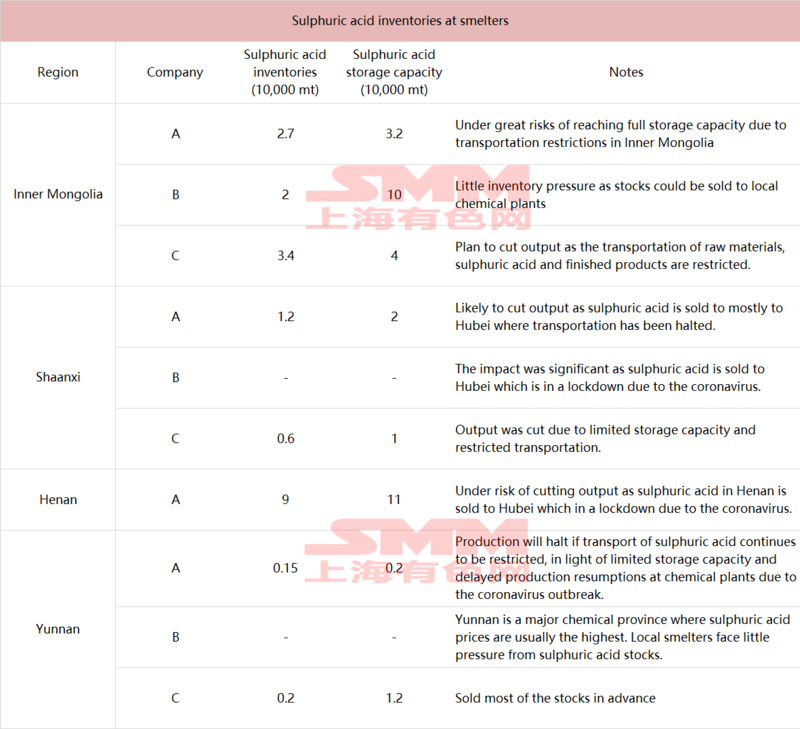

On the backdrop of logistical constraints, zinc smelters are likely to be hit hardest by growing sulphuric acid stocks, as enticing profits have kept them in high gear. Smelters cannot discharge sulphuric acid to ease inventory pressure no matter how low their offers are, as long as logistics constraints linger. SMM data showed that sulphuric acid from northern regions where see high inventories is usually delivered to Hubei and Hunan. Smelters in Shaanxi and Henan told SMM that their sulphuric acid shipments in the direction of Hubei, which has been hit hard by the recent epidemic, used to account for about 90% of the total. With road transport capacity reduced and Hubei under lockdown, inventories of sulphuric acid at smelters continue to trend higher. SMM learned that some zinc smelters have cut their production.

The SMM survey showed that lead and zinc smelters in Shaanxi, Henan and some part of Inner Mongolia are now grappling with a shortage of storage capacity for sulphuric acid. With shipments of not only sulphuric acid but also raw materials affected by logistics issues, smelters in those regions are likely to trim output in the near term if Hubei remains under lockdown.

![Falling Copper Prices Spurred Downstream Buyers to Replenish Inventories; Overall Trading This Week Was Better Than Last Week [SMM South China Spot Copper Cathode Weekly Review]](https://imgqn.smm.cn/usercenter/kvwSZ20251217171710.jpg)

![Most-Traded BC Copper Contract Closed Down 0.16% as Inflation Concerns and High Inventories Weighed on Prices [SMM BC Copper Commentary]](https://imgqn.smm.cn/usercenter/vdbfy20251217171709.jpg)