SMM1, January 8: January 3, the U. S. military used air strikes to kill Iran's "Al-Quds Brigade" commander Sulaimani. The Black Swan has since taken off as a result of the turmoil in global capital markets and the strengthening of safe haven assets. In Iran, there has been wave after wave of statements of retaliation, and US President Donald Trump has warned that if Iran attacks any US personnel or targets, the US "may respond quickly in a disproportionate manner". For a time, the international community is increasingly worried about the outbreak of large-scale conflict between the United States and Iraq, and the capital markets are also panicking.

Tensions between the United States and Iraq have intensified. In the early morning of January 8, Iran launched two waves of attacks on US military bases in Iraq. As soon as the news of the air raid came out, it quickly disrupted global financial markets, and stock markets began a collective decline. U. S. stocks plummeted at the start of trading before narrowing their losses. By the end of the day, the Dow was down nearly 120 points, while NASDAQ and S & P 500 were down 0.03% and 0.28%, respectively.

Iran's Islamic Revolutionary Guard Corps issued a statement announcing that the attack on the Assad Air Force Base in Iraq was for Sulaima Bao, commander of the Revolutionary Guard's Al-Quds Brigade, who was killed by US air strikes on the 3rd. The statement also urged the United States to withdraw its troops from Iraq as soon as possible, otherwise Iran will launch more attacks. Allies of the United States, such as Kuwait, Bahrain, Saudi Arabia, Jordan and Israel, will also be under attack by Iran. The White House immediately issued a statement saying that the United States has been informed of reports of attacks on US military bases in Iraq and is closely monitoring the development of the situation. "the president has been briefed and is closely monitoring the situation and consulting with his national security team," the statement said. "

International crude oil prices in Asia rose sharply at the start of the day, surging nearly 5 per cent at one point to $65.65 a barrel from $62.70 a barrel, the highest level since April last year. The main contract for the futures of crude oil fell more than 1% from yesterday night and rose by a straight line to a maximum of more than 4% at the start of trading this morning.

Heightened risk aversion has also sent gold prices soaring, rising above $1600 an ounce for the first time since 2013 when Asian markets opened this morning. The main contract of gold futures rose as high as 264.44 yuan / g, the highest since September last year.

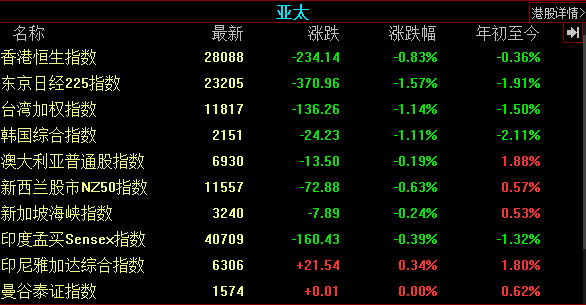

On the other hand, Asia-Pacific stocks also opened lower this morning, with the Nikkei 225 index down more than 1%, the lowest drop extended to more than 2.5%, and still down 1.91% as of press time. South Korea's KOSPI index opened low and fell 1.16%. The Hang Seng index fell below the 28000-point integer mark at the start of trading, narrowing its decline slightly as of press release, but still down 1.04 per cent. China's oil and gas holdings rose nearly 13 per cent, rising nearly 150 per cent in just eight trading days since the end of last year, led by oil and gold stocks such as Sinopec Energy and Dragon Resources. Chuangli Holdings, which improves financial and securities services, tumbled more than 60 per cent in intraday trading.

In the A-share market, the gold plate opened more than 3%, a new high in more than a year and a half, Chifeng gold led the rise, has closed 9 yang. Zijin Mining, which has recently risen nearly 70% from its low, was loosened in profit trading yesterday and fell 3.91% against the market. But in order to avoid international political risks, it cost more than Rmb100m to go northward yesterday, buying 22.93 million shares in Zijin Mining, with a market capitalisation of Rmb1.655 billion. Although the three major stock indexes fell more in the afternoon, 721 stocks rose and 112 stocks rose more than 5%. 2980 stocks fell, with 110 stocks down more than 5 per cent. After the attack on US military bases, there was no significant outflow of funds northward, and the funds were not pessimistic.

A number of organizations have also expressed their views on the "Black Swan" incident.

Citic Securities said that the "well-off cow" rehearsal continued, before the Spring Festival A shares still have action energy, all kinds of funds under the rapid relay plate rotation speed. The performance enters the intensive disclosure period, the Middle East geographical risk deteriorates rapidly, the risk will weaken the action energy, the market trend overheating possibility is not big. Structurally, the growth plate is about to enter a strict performance test period, the logic of the cycle plate can not be falsified in the short term, and the value plate is favored by all kinds of funds. Taking into account valuation, risk and capital preferences, the final capital consensus and market style will fall on value. In terms of configuration, it is still recommended to adhere to the value as the main position, and the cycle still has an offensive effect in the short term.

Huatai Securities said that from the perspective of calendar effect and macro data gap period, the "red envelope market" may continue until before the Spring Festival, throughout the year, the index upward space may be greater than the downward space. In rhythm, it is suggested that we should continue to grasp the red envelope market before the Spring Festival, but we should pay attention to the risk of fermentation of short-term geopolitical problems and the three points of pressure in February after the festival. In terms of configuration, under the condition of short-term trading volume and abundant liquidity, the boom + undervaluation strategy resonates, but in the medium term, the economy is still better, and we continue to pay attention to building materials (glass is more cost-effective), household appliances (small household appliances are more cost-effective), automobiles, construction and other industry opportunities + electrified new, mechanical stocks. The camera continues to lay out the opportunities for the three "big years" (upper and middle reaches of electric cars, electronics and cloud computing) after structural inflation is reduced in the first quarter of next year.

Anxin Securities believes that important geopolitical events have taken place in the Middle East, the US-Iraq conflict has brought new uncertainty, oil prices are expected to rise, and expectations of chemical and commodity prices will be boosted in the short term, and inflationary pressures brought about by "lard resonance" will not be ruled out in the future.

"Click to sign up:" 2020 (Fifth) China International Nickel Cobalt Lithium Summit Forum "

To sign up for the Nickel Cobalt Lithium Summit or apply for entry into the SMM New Energy vehicle / Cobalt Lithium Industry Exchange Group, please scan the QR code below:

Please note: sign up for the Nickel Cobalt Lithium Summit / apply for SMM New Energy vehicles / Cobalt Lithium Industry Exchange Group