SHANGHAI, Dec 5 (SMM) – Operations across Chinese electric arc furnace (EAF) steelmakers have risen to the highest since July, as decent profit margins encouraged mills to move up gear.

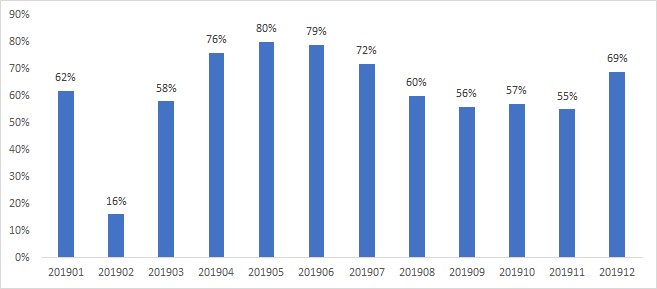

As of December 4, operating rates across EAF steelmakers in China averaged 69%, the highest in five months, showed SMM data. This was up 14 percentage points from the start of November and 4 percentage points from late November.

Chart 1: Operating rates across Chinese EAF steelmakers (Source: SMM)

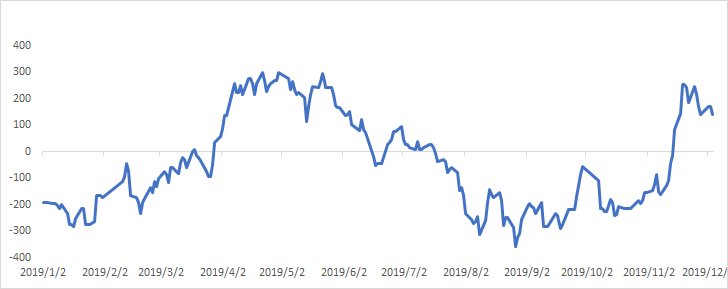

According to SMM calculations, EAF mills saw a profit of 141 yuan/mt on December 4, and the average profit stood at 184 yuan/mt for mid-November to date, up 296 yuan/mt from early November.

With a profit of about 400 yuan/mt, Zhejiang Wantai has ramped up to full capacity, up from 85% a month earlier. Another mill Jingsu Hongtai, located at east China, increased its operating rate from 50% to 75%, and the mill sees a net profit of over 100 yuan/mt.

A weakening market, however, is hurting steelmaker margins. Spot steel prices stemmed the ascent in late November, with rebar price assessed by SMM having shed 146.4 yuan/mt since November 26. EAF steelmaker margins shrank 113 yuan/mt during the same period.

This, coupled with continued tightness in steel scrap supply, is likely to deter EAF steel mills from further ramping up operations.

Chart 2: EAF steelmaker profits (Unit: yuan/mt, source: SMM)

Some mills in south China have slowed down their operations, amid high inventory levels of finished stocks and buyers sidelined from the high selling prices. While profits remain above 400 yuan/mt, Taizhou Baofeng in Zhejiang province slowed to a rate of 70%, from full capacity.

Chongqing Yonghang in the southwest and Heyuan Derun in the south also reported a weakening in demand.

The price spreads between southern and northern markets have widened to 700-800 yuan/mt, prompting northern steelmakers to pour their cargoes in the southern markets, and putting south China spot steel prices under increasing supply pressure. The southern markets have seen a sharp increase in arrivals after operations at some northeastern ports recovered.

Social inventories of rebar and wire rods in Guangzhou of Guangdong province rose 19.31% in the week ended December 4, with stocks of rebar gaining 29.81%, showed SMM data.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![The Most-Traded SHFE Tin Contract Opened Lower and Then Traded Stronger, Spot Market Recovers Amid Downtrend [SMM Tin Midday Review]](https://imgqn.smm.cn/usercenter/WWXJU20251217171753.jpg)